EUR/USD

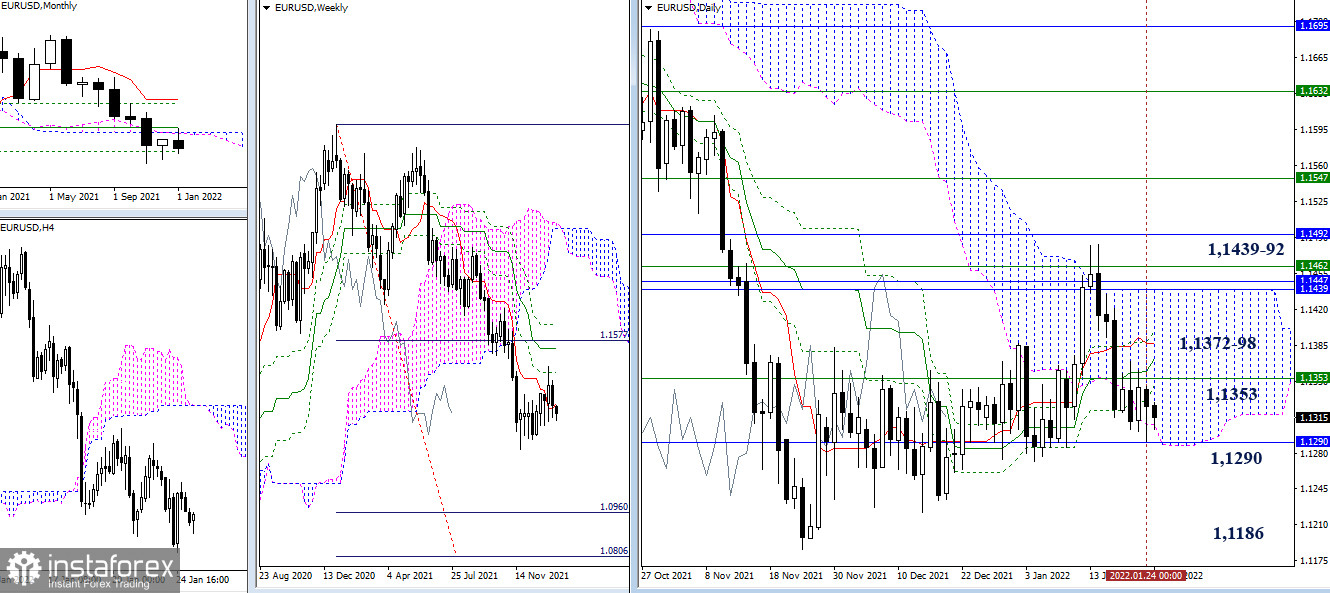

Noticeable changes did not occur over the past day. The euro still remains within the influence and attraction zone of important levels 1.1353 - 1.1290 (weekly short-term trend + the final level of the monthly cross). The pivot points also retain their value and location at the moment. For the bears, the next important border is 1.1186 (minimum extreme), and for the bulls, the daily cross (1.1372 - 1.1387 - 1.1398) and the 1.1439-92 area (monthly levels + weekly Fibo Kijun + upper limit of the daily cloud) are important.

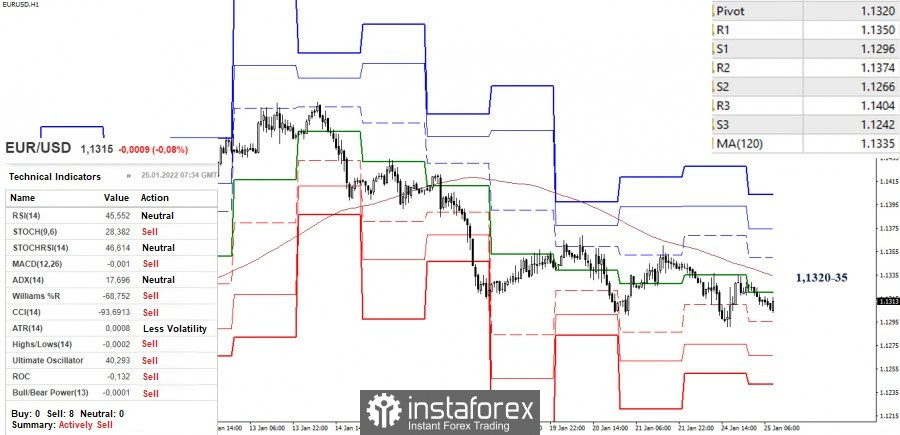

The advantages in the smaller timeframes are currently on the bearish side. The downward pivot points continue to serve as support for the classic pivot levels (1.1296 - 1.1266 - 1.1242). Today, the key levels responsible for the balances are located in the area of 1.1320 - 1.1335 (central pivot level + weekly long-term trend). In case of consolidation above and reversal of the MA, it is better to re-evaluate the overall situation. On the hourly chart, the resistances for the classic pivot levels (1.1350 - 1.1374 - 1.1404) can be considered.

GBP/USD

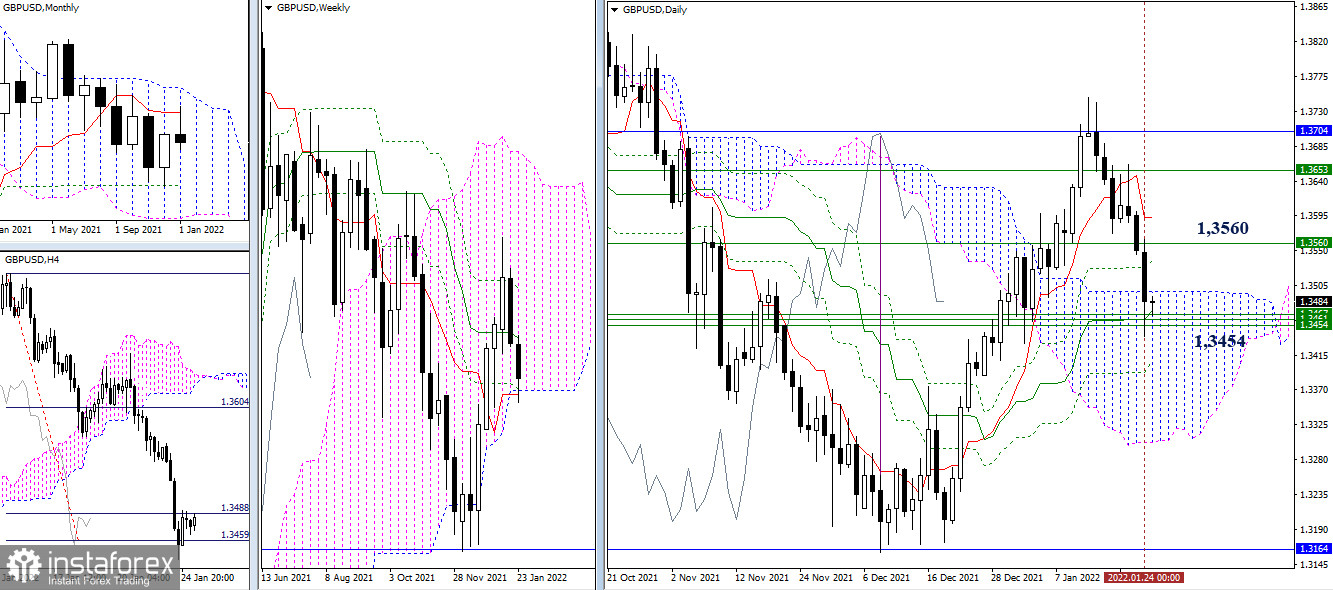

The bears continued to decline to the area of several targets at once (1.3454). There is a daily medium-term trend, three weekly levels at once, and a target to break through the H4 cloud. Such a large accumulation of levels can provoke a slowdown or the formation of a rebound. The levels passed earlier, led by the weekly medium-term trend (1.3560), will now act as resistances. The breakdown of 1.3454 and confirmation of the result in the weekly chart (consolidation in a bearish zone relative to the weekly cloud) will indicate new bearish prospects.

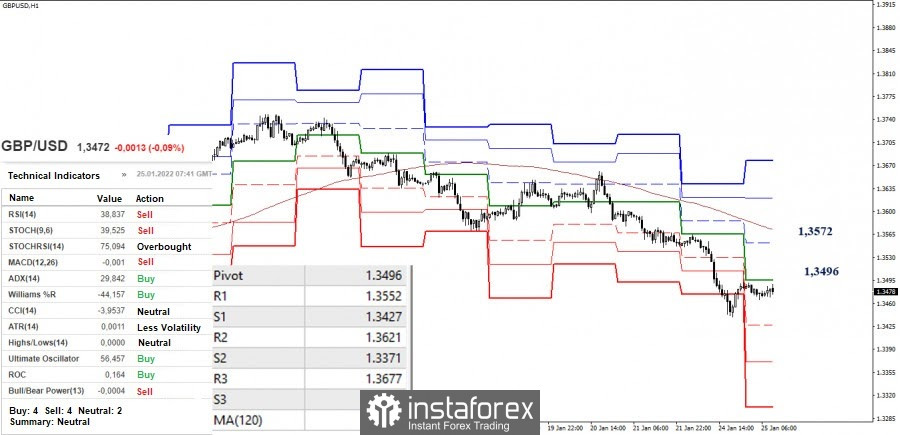

Currently, the pair in the smaller timeframes is in the zone of the upward correction, but the main advantage continues to be on the bearish side. Leaving the correction zone and restoring the downward trend will return the relevance to the support of the classic pivot levels (1.3427 - 1.3371 - 1.3302). The next task for the development of an upward correction now is to break through the resistance of the central pivot level (1.3496). The main level to change the current balance of power is set at 1.3572 (long-term weekly trend) today.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română