Last year, the old whales (long-term large bitcoin holders) may have reduced their positions a bit. However, as the latest data shows, the demand for the main cryptocurrency shows no signs of disappearing, despite the price drop.

Some panic sell, others actively buy

While the market is experiencing panic selling, bitcoin whales are accumulating spare BTC, as evidenced by the falling balances on the exchanges.

Bitcoin is buying up aggressively near $30,000 as bidders begin to soak up liquidity from short sellers. Bitcoin is clearly attractive at current levels.

Data from the network monitoring resource CryptoQuant shows that since the end of December, bitcoin exchanges have again begun to lose their coin reserves.

After a period of traders sending BTC to exchanges, perhaps to sell or rid themselves of further losses, there is now more overall outflow than inflow.

Between December 7 and 28, 2021, BTC reserves on 21 major platforms controlled by CryptoQuant increased from 2.396 million to 2.428 million BTC.

After that, the long-term downward trend resumed, with 2.366 million BTC accumulated on exchanges as of Monday, despite the fact that the spot price was at a six-month low.

Meanwhile, the old whales, despite some impatience in recent years, are still able to provoke a reversal in the price trend, according to CryptoQuant CEO Ki Young Ju.

"It seems they have been sold $BTC to new players at the tops or bottoms," he said in a series of tweets on the subject, noting that institutional investors have likely been the main buyers since 2020.

Whales begin to redeem the bottom

It is now well known that the trend of the exchange balance now coincides with tangible demand in the network from large investors.

As noted by CC15Capital's Twitter account this week, the run to $33,000 was accompanied by multimillion-dollar BTC buy-ins, in particular from one wallet.

Since August, the account has accumulated more than $1 billion worth of bitcoin from an initial balance of zero.

This phenomenon also comes against the backdrop of a strong determination by long-term holders not to sell. As reported by Cointelegraph, coins that have not moved for a year or more now make up 60% of the total supply of bitcoins.

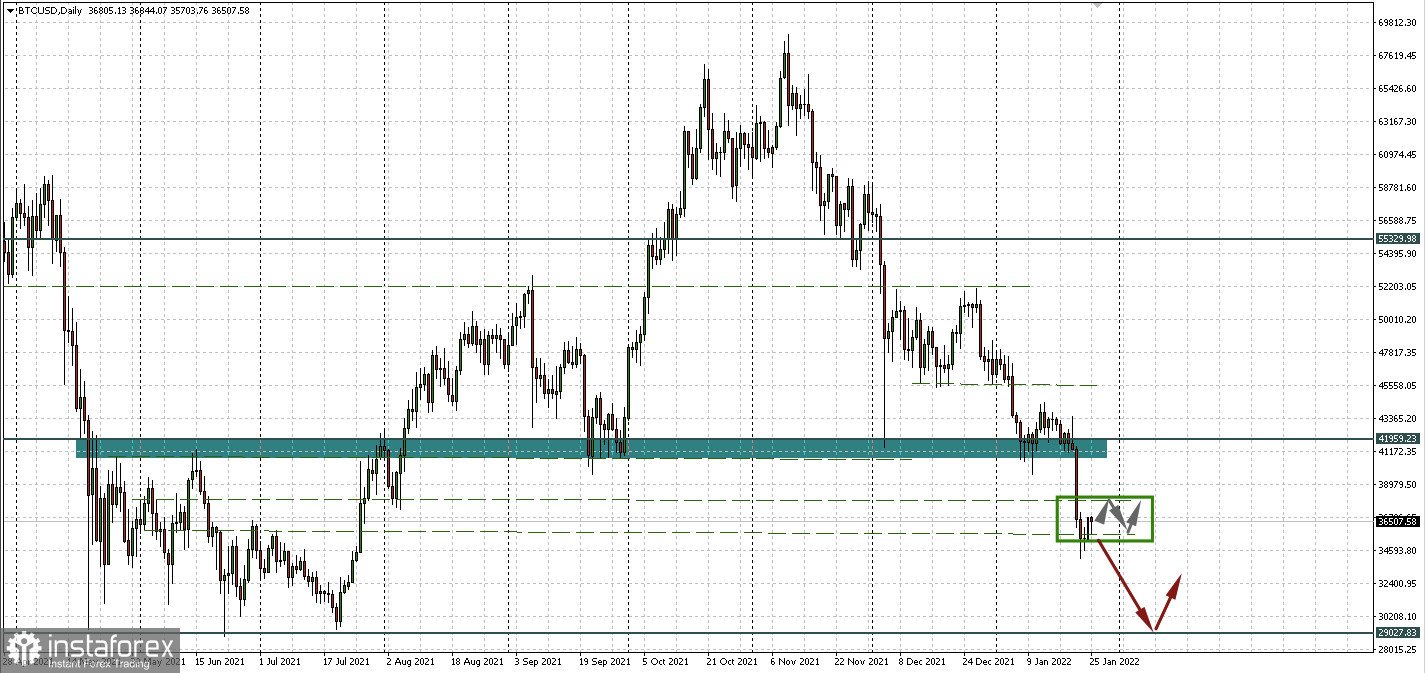

On Monday, Bitcoin managed to stay in the 36,000–38,000 zone, leaving a long shadow of a false breakout. So far, the best scenario is seen in the consolidation of the main cryptocurrency in this range.

But even the fact that bitcoin whales entered the market to replenish reserves at a discount does not exclude the fall of the main cryptocurrency to the support of 29,027.83. And from there, an upward reversal looks more likely, because the price for the purchase will be more profitable.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română