To open long positions on GBP/USD, you need:

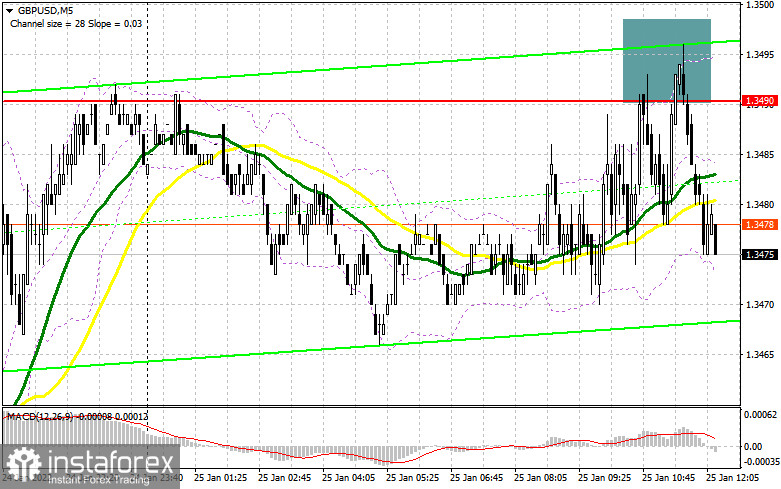

In my morning forecast, I paid attention to the level of 1.3490 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. The buyers of the pound failed to offer anything above the level of 1.3490 and several unsuccessful attempts to consolidate above this range led to the formation of excellent signals for the sale of the pound. At the time of writing, the pair has already fallen by more than 35 points from the entry point - this is more than the entire intraday volatility observed in the first half of the day. From a technical point of view, there have been only minor changes with the nearest support levels. And what were the entry points for the euro this morning?

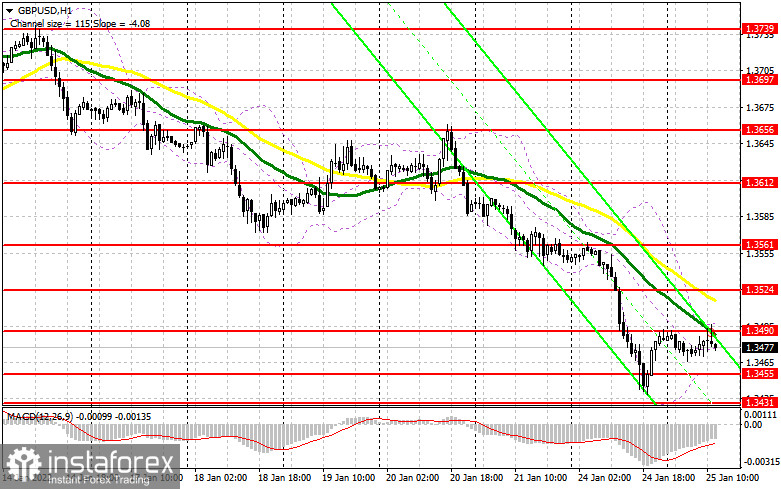

During the American session, the focus will certainly be on the data on the US economy. The primary task of buyers is to protect the 1.3455 level, to which the pair is rapidly falling at the time of writing. Only the formation of a false breakdown there, together with weak data on the US consumer confidence indicator and the Richmond manufacturing index, will allow forming a signal to buy GBP/USD against the downward trend observed since January 14. The emerging divergence on the MACD indicator also allows us to count on an upward reversal of the pound. If such a scenario is implemented, the bulls will aim for a repeat test and a breakout of the resistance of 1.3490, which they failed to do in the first half of the day. Moving averages that limit the upward potential of the pair pass above this level. The breakdown and test of 1.3490 from top to bottom forms an additional entry point and will strengthen the position of buyers with continued growth and updating of the highs: 1.3524 and 1.3561. A more distant target will be the 1.3612 area, where I recommend fixing the profits. Under the scenario of a decline in the pound during the US session and strong US data, the lack of activity at 1.3455 will be a direct hint of a wait-and-see position. It is best to postpone purchases to the level of 1.3431. Only the formation of a false breakdown there will give an entry point based on a small upward correction. You can buy GBP/USD immediately on a rebound from 1.3409, or even lower - from a minimum of 1.3389, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

Bears continue to control the market and the proof of this is the unsuccessful growth of the pound above 1.3490. While trading will be conducted below this range, you can count on more active sales of the pair. Despite the bearish nature of the market, the primary task remains to protect the 1.3490 range, as going beyond it can lead to the formation of a bullish correction. Strong data on the US consumer confidence indicator will surely lead to a test and a breakdown of the 1.3455 support. A breakdown and reverse test of this range from the bottom up will hit buyers' stop orders, which will dump GBP/USD to the next support of 1.3431 and open a direct road to the lows: 1.3409 and 1.3389, where I recommend fixing the profits. If the pair grows during the American session and sellers are weak at 1.3490, it is best to postpone sales to a larger resistance of 1.3524. I also advise you to open short positions there only in case of a false breakdown. You can sell GBP/USD immediately for a rebound from the maximum of 1.3561, or even higher - from the area of 1.3612, counting on the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for January 18 recorded an increase in long positions and a reduction in short positions - which indicates the continued preservation of the attractiveness of the pound after the Bank of England raised interest rates at the end of last year. Expectations have increased quite seriously that at its next meeting, the regulator may again resort to another increase in interest rates by 0.25 points, which will only strengthen the pound's position. However, the observed fundamental picture creates many more serious moments that limit the upward potential. First of all, we are talking about inflation, which is "eating up" everything that the UK labor market can offer at the moment with cosmic speed. Despite high wages and falling unemployment, high inflation leaves nothing from household incomes, and high prices for energy and other services make their well-being even lower than the level that was observed during the coronavirus pandemic. If you look at the overall picture, the prospects for the British pound look pretty good, and the observed downward correction makes it more attractive. In any case, the Bank of England's decision to raise interest rates further this year will push the pound to new highs. It is worth recalling that this week everyone is waiting for the results of the meeting of the open market committee, at which a decision on monetary policy will be made. Some traders expect that the US central bank may decide to raise interest rates already during the January meeting, without postponing this issue until March. A reduction in the Fed's balance sheet will also be announced. The COT report for January 18 indicated that long non-commercial positions increased from the level of 30,506 to the level of 39,760, while short non-commercial positions decreased from the level of 59,672 to the level of 40,007. This led to a change in the negative non-commercial net position from -29,166 to -247. The weekly closing price rose from 1.3579 to 1.3647.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 daily moving averages, which indicates a further decline in the pound trend.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the average border of the indicator in the area of 1.3490 will act as resistance. A break of the lower limit in the area of 1.3455 will lead to a new wave of decline in the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română