Investors in the cryptocurrency market have lost all hope of restoring quotes in the past two weeks. However, hope appeared when no one believed in it anymore. This phrase fully reflects the current situation in the cryptocurrency market. Bitcoin followed the local SPX and NASDAQ bullish momentum and hit $37.5k. Following BTC, the altcoin market also showed a slight increase, which resulted in the growth of the total capitalization of cryptocurrencies by 7% to $1.69 trillion.

Thanks to the rebound of the main digital assets, the question has again appeared on the agenda: is it worth waiting for a trend reversal or will Bitcoin drag the entire market into a bear den? Experts from Switzerland's largest bank UBS gave an answer without waiting for the question. According to analysts, Bitcoin and the cryptocurrency market are moving towards a "crypto winter " that could last several years.

The fate of Bitcoin is in the hands of the Fed

Bank representatives voiced a key factor contributing to the further fall of Bitcoin. It lies in the position of the Fed and the increase in interest rates, due to which the first cryptocurrency will become less attractive to institutional investors. This statement is debatable as the value of Bitcoin is not limited to being an alternative to gold and fiat. In the next two days, the Fed will give a detailed commentary on digital assets, and the market reaction to this will be the key to understanding further processes in the crypto market.

Indeed, the rise of BTC in the last bull cycle of 2020-2021 was tied to government stimulus programs. Given the catastrophic rise in inflation, the Fed decides to shut down the printing press and raise rates. JPMorgan and Goldman Sachs experts believe that the Fed will raise interest rates at least twice in 2022 in order to effectively counter inflation. These decisions will be painfully received by the cryptocurrency market and bitcoin.

Bitcoin is close to a trend reversal

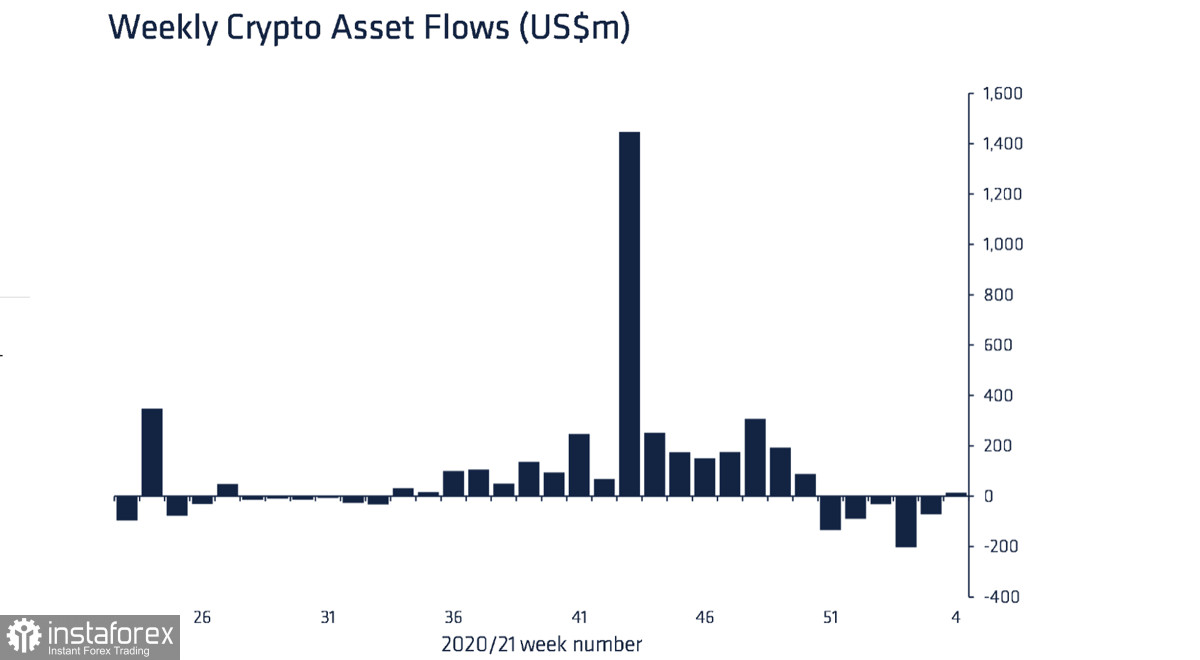

Despite the pessimistic statements, Bitcoin holds a key support zone at around $33k. Moreover, for the first time in six weeks, there is an influx of funds into cryptocurrency funds, which can also be a signal of a "thaw." Major players in the stock markets are returning, and the first among them was Rothschild Investment, which bought more shares of the Grayscale Bitcoin trust. The third largest BTC wallet is also on the alert and has acquired 160 coins today alone

All these factors indicate a possible reversal in the price of the bitcoin. The key support zone has held out, major players are returning to the market, and the overall capitalization is growing. Bitcoin is approaching the point of no return, which will be the Fed meeting. Growth of major indices ahead of Powell's speech speaks of the optimistic mood of the market.

If expectations are confirmed and the cryptocurrency breaks through the important resistance level of $35.5k, then this will become a signal for the entire market and start a cycle of accumulation and recovery. Otherwise, we should expect a breakdown of the long-term support line at $33k. In the event of a decline, the next key area of resistance will be the yearly low at $28.7k. Its breakdown will mark the onset of winter in the cryptocurrency market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română