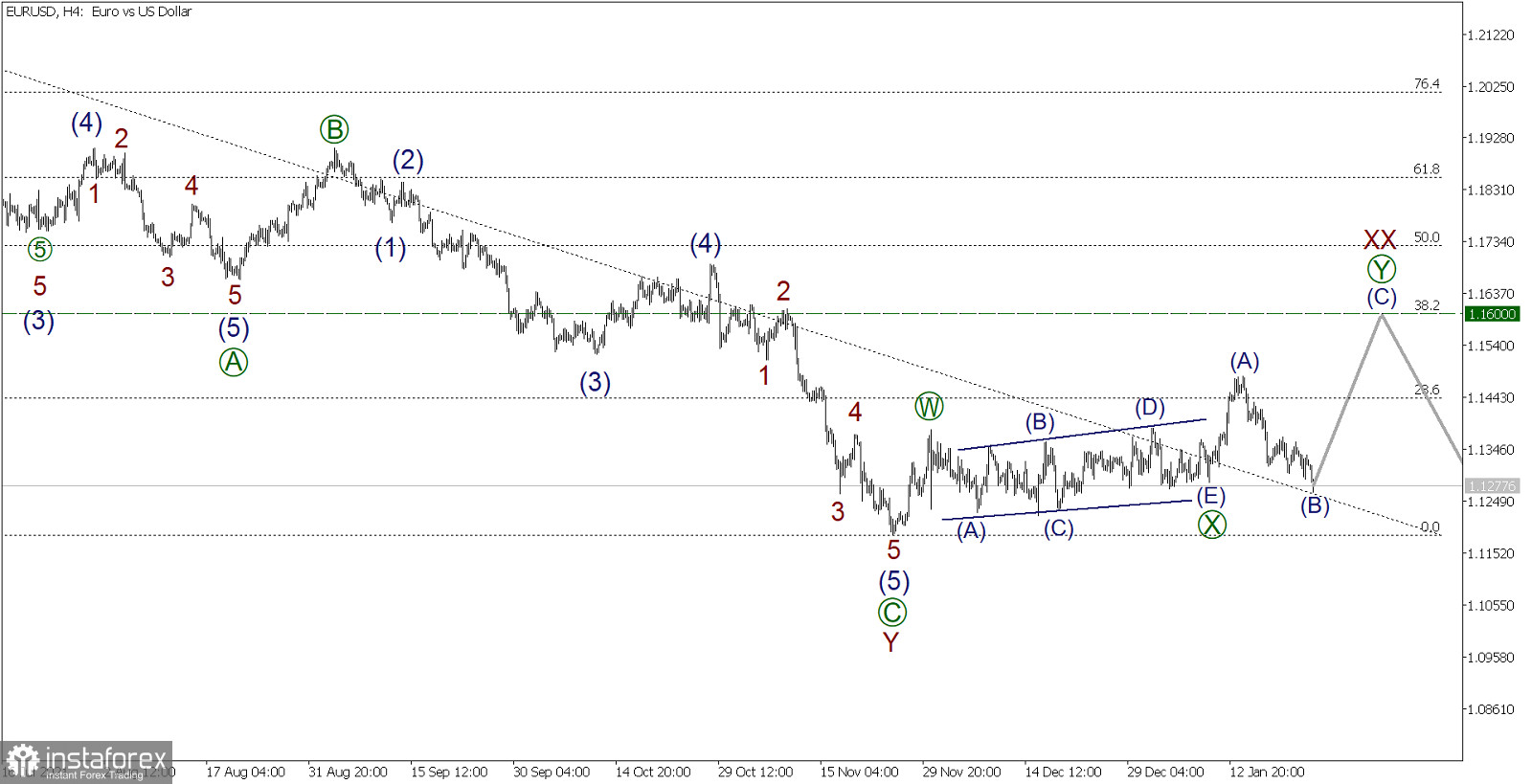

EURUSD, H4:

The EURUSD currency pair forms a corrective pattern - a triple zigzag W-X-Y-XX-Z. After the end of the downward movement of the market, the current wave Y was completed, which took the form of a simple zigzag.

After the completion of wave Y, a zigzag wave [W] and a horizontal linking wave [X] were formed in the form of an inclined triangle. These sub-waves are the constituents of the linking wave XX, which can take the form of a double combination [W]-[X]-[Y].

There is a possibility that sub-waves (A)-(B), impulse and correction were formed. Thus, in order to complete the active wave [Y], it is necessary to wait for the development of the final impulse wave (C). The end of the upward movement can be expected at the level of 1.1600. At this price level, the size of wave XX will be 38.2% of the Fibonacci lines from wave Y.

Today's U.S. Consumer Confidence report could increase the chances of the bulls and help boost the Eurodollar.

In the current situation, it is possible to consider longs from the current level in order to take profit at the level of 1.1600.

Trading recommendation:

Buy 1.1277, take profit 1.1600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română