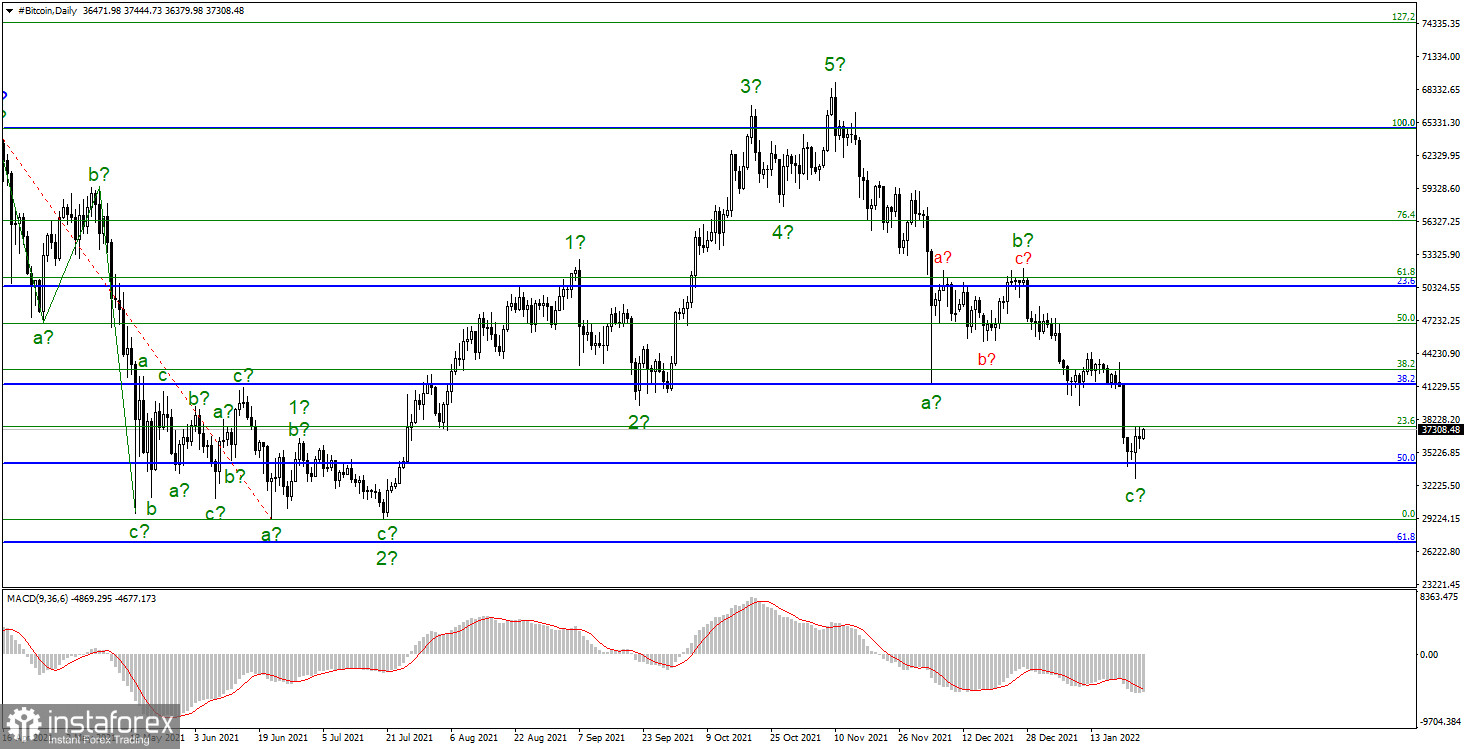

Over the past week, Bitcoin has done exactly what was expected from it. It can be recalled that we keep on waiting for the cryptocurrency to continue to decline this month, since the fundamental background for it remained very weak, and the wave counting suggested the further formation of a downward wave c. Now, it needs to hope that the entire downward section of the trend will turn out to be three waves and not five waves. In the first case, it will be able to count on the end of the decline near $34,322, which it failed to break through just the other day, or near $29,068, which is equal to the low of last summer. If the current wave counting does not take on a more complicated form, then Bitcoin has a good chance to stop declining.

However, the news background and the market mood is more important for it and for the entire cryptocurrency. For a long time, many analysts and experts assured that long-term investors would buy all available bitcoins on the way to $40,000. But it can be seen that the instrument has already fallen to $34,000. If the Fed raises the rate tomorrow, or even just continues to curtail the QE program, this could further reduce the demand for the world's first cryptocurrency. Bitcoin began its downward move when it became clear that the Fed was taking action. At the moment, the situation is very tense all over the world. The US stock market is falling, the entire cryptocurrency market is declining, and the US dollar is rising across the entire spectrum of the market. Such actions of market participants can only mean that they have begun to withdraw their money from those assets that are the riskiest. Accordingly, capital is currently being transferred to protective assets, despite global high inflation.

It is inflation that can ultimately save Bitcoin from a new decline by 80-90%. It is worth noting that every upward trend ended with Bitcoin falling by 80-90%. It can be assumed that something similar could happen this time as well. However, high inflation may once again force market participants to invest their money in instruments that can provide the highest growth and profit. And Bitcoin is definitely one of them. Moreover, market participants will need to solve a dilemma for themselves: either follow the Fed's actions to tighten monetary policy in 2022, or look only at inflation, which will lead to the depreciation of capital invested in protective assets.

The new downward section of the trend with the descending wave c continue to form. An unsuccessful attempt to break through the level of $34,238, which corresponds to 50.0% on the upper Fibonacci grid, suggests that quotes are leaving the lows reached. However, it is not about the completion of the downward trend and its wave c. This wave can further form with targets located near $29,117 and $26,991, which equates to 0.0% and 61.8% Fibonacci. However, some kind of corrective wave in the composition of c can be built. This is because there are no internal corrective waves visible inside wave a, which means there may not be any inside wave c. Moreover, the entire section of the trend can take an impulse, that is, a five-wave form. In this case, the current decline will relate to wave 3, not C. And then, there will have to be a fifth wave, which can take the cryptocurrency far below the level of $30,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română