Long positions on EUR/USD:

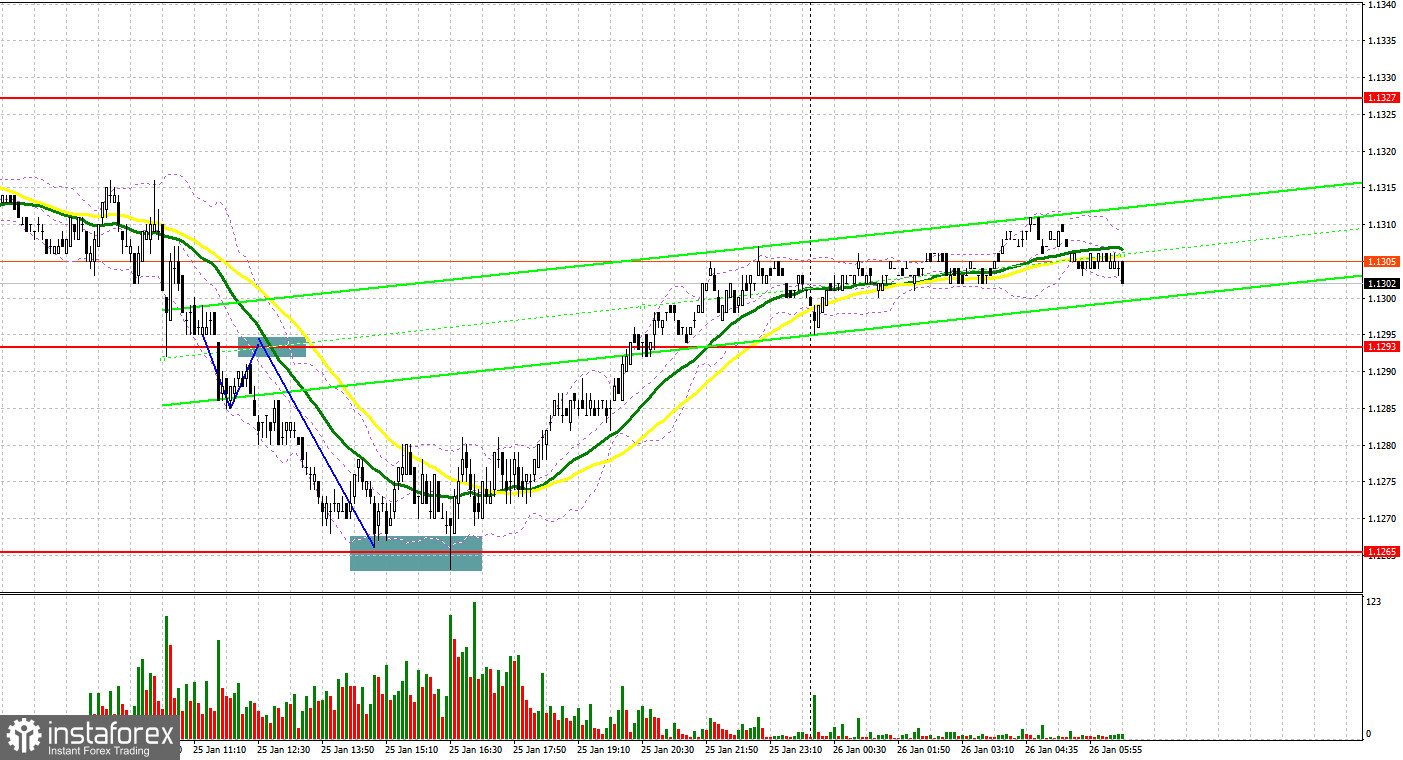

Several entry points were formed yesterday. Let's switch to the M5 chart and analyze them. In my previous morning review, I said you could consider entering the market from 1.1293. Ifo Current Conditions, Business Climate, and Expectations for Germany came out mixed yesterday, thus failing to provide support for the euro. Although bulls tried to act at 1.1327. A breakout of this level took place without a retest from bottom to top (blue lines on the chart), and no short entry point was formed. In the second half of the day, several false breakouts at 1.1265 generated a signal to open long positions. The price grew by 40 pips as a result.

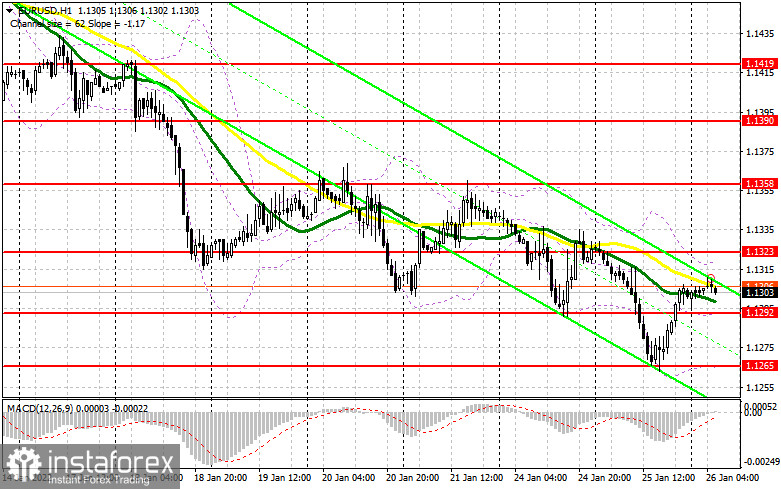

If not for today's meeting of the Federal Reserve, we could think of an impending market reversal. EUR buyers have been actively buying back lows lately. Given the empty macroeconomic calendar, market participants will solely focus on the Federal Reserve's policy decision. Therefore, volatility is likely to be low in the first half of the day. The primary goal for today will be to protect support at 1.1292. Yesterday, bulls managed to return the quote to this level after a sharp drop in the North American session. A false breakout at this level will produce a signal to buy the euro. However, a more noticeable correction is likely to occur only after Powell's press conference. Another important goal is to break through 1.1323, the upper limit of the intraday channel. A retest of this range from top to bottom could generate an additional signal to buy the instrument. If so, the targets are seen at 1.1358 and 1.1390, where you should consider locking in profits. A more distant target is seen at 1.1419. If the price goes down in the European session and there is a lack of bullish activity at 1.1292, pressure on the euro is likely to mount. In such a case, you could open long positions there if only the quote bounces off 1.1224 and 1.1208, which, in turn, could be possible after studying the outcome of the Fed meeting, allowing an upward correction of 20-25 pips intraday.

Short positions on EUR/USD:

Bears are still in control over the market although they were locking in profits on short positions yesterday ahead of the Fed meeting. The fact that bears updated the swing low indicates the continuation of the downtrend in the short term. The primary goal will be to protect resistance at 1.1323 in the first half of the day. Since the instrument trades near the moving averages, it is hard to predict the pair's future movement without any fundamentals. Pressure on the price will mount in case of a false breakout at 1.1323. If so, the first sell entry point will be formed with the target at 1.1292. A breakout and a test of this level from bottom to top will generate an additional signal to sell the instrument. In such a case, the targets are seen at the lows of 1.1265 and 1.1245. A more distant target is seen at 1.1224, where you could consider locking in profits. However, the price will reach this target only if there is a mass sell-off of risk assets triggered by talks of possible rate hikes by the Federal Reserve. If the euro goes up and there is a lack of bearish activity at 1.1323, do not rush to enter the market. It would be wise to open short positions if there is a false breakout at 1.1358. You could sell EUR/USD on a rebound to 1.1390 and even 1.1419, allowing a 15-20 pips downward correction intraday.

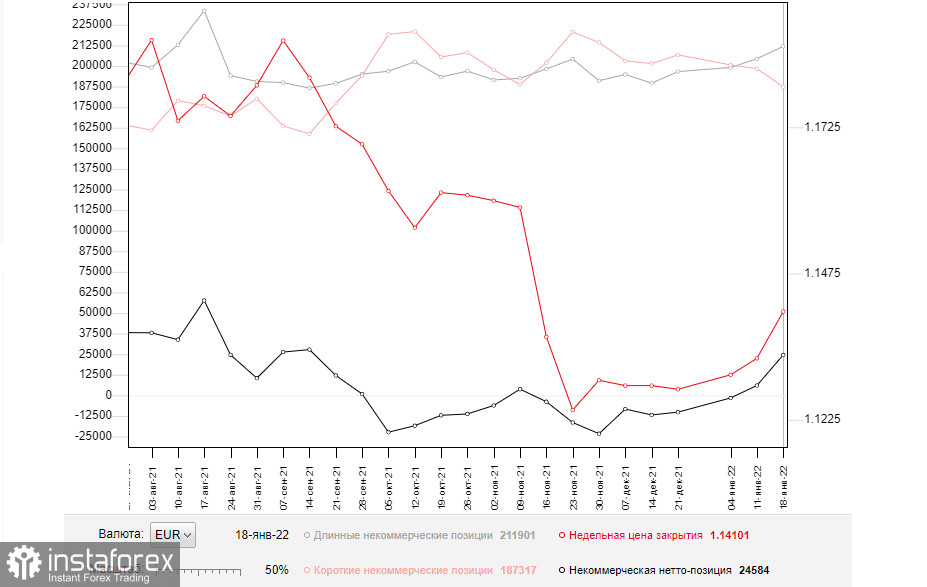

The COT report as of January 18 logged a rise in long positions and a decrease in short ones, leading to an increase in the positive delta. Generally speaking, the euro is still in demand despite the expected changes in the monetary policy of the Federal Reserve. The deeper the correction, the higher the demand. The Federal Reserve will announce its policy decision today. Some traders expect the central bank to raise the interest rate already in January. A shrink in the regulator's balance sheet will also be announced. A lot now depends on Chairman Powell's rhetoric. If he expresses concerns about US inflation, demand for the US dollar will most likely only increase. As many as 4 rate hikes are expected this year. Some major market players suggest there will be even 5 of them. The ECB is planning to end its PEPP already in March. At the same time, the regulator is not ready to take further actions aimed at tightening its policy, which limits the upward potential of risky assets. The COT report revealed an increase in long non-commercial positions to 211,901 from 204,361 and a fall in short non-commercial positions to 187,317 versus 198,356. Traders continue to increase long positions on EUR/USD, hoping for an uptrend. The positive non-commercial net position rose to 24,584 from 6,005. The weekly closing price grew to 1.1410 versus 1.1330 a week earlier.

Indicator signals:

Moving averages

Trading is carried out in the area of the 30-day and 50-day moving averages, indicating uncertainty over the future direction of the pair.

Note: The period and prices of moving averages are viewed by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands

Demand for the instrument will increase in case of a breakout of the upper band at 1.1320. Otherwise, if the quote goes down, the pair could find support at 1.1265, the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română