Despite the completely empty macroeconomic calendar, the single European currency showed good activity yesterday. It is connected exclusively with today's meeting of the Federal Open Market Committee. At first, the media continued to spread rumors about the possibility of an increase in the refinancing rate already following the results of today's meeting. Which fueled interest in the US currency. But at the opening of the US trading session, the mood changed dramatically, as the nature of the published materials became diametrically opposite. March began to be announced much more often as the month of the first increase in the refinancing rate. And with regard to the January meeting, they talked only about preparing the markets and specifying the timing of the start of tightening monetary policy. Apparently, this is exactly how it will be.

One of the main problems of the Federal Reserve is a bubble in stock markets. The fact is that if interest rates are raised right now, then the markets will collapse. They need time to prepare. In principle, it is clear that the markets are really preparing, but the process is far from over. So the Fed is unlikely to risk raising the rate right now. Most likely, the central bank will once again announce that the first increase will take place in spring, without specifying when exactly. After all, two meetings will be held in spring. One in March and the other in April. Thereby giving the markets time to prepare, and themselves room for maneuver. If the markets do not meet by the beginning of March, the rate hike will be postponed until April. Nevertheless, immediately before the meeting, speculation will surely begin and the dollar will rise in price. And after that, the US currency will begin to lose its position significantly.

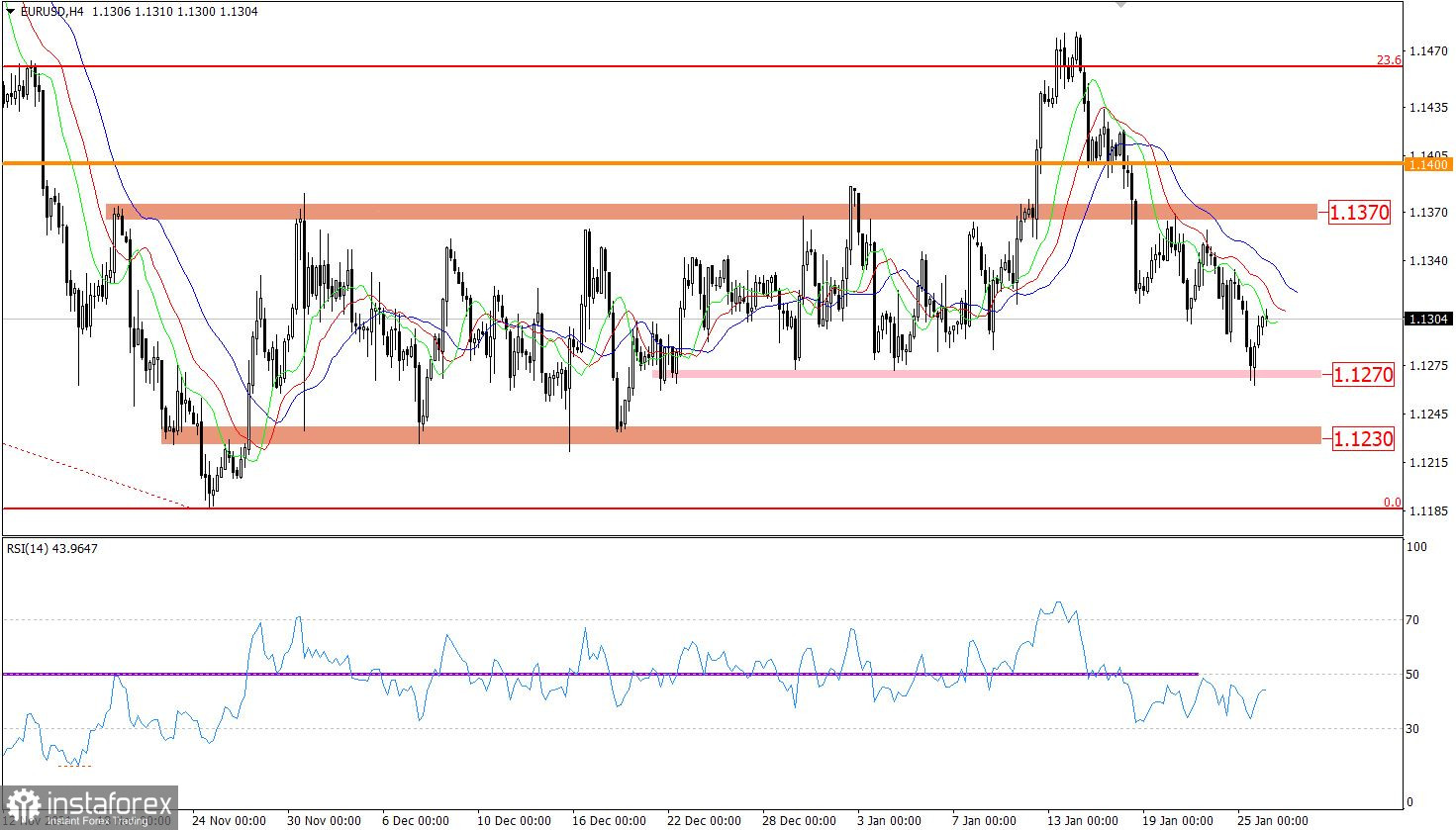

The EURUSD currency pair during the downward movement reached the first support point of 1.1270. This move led to a reduction in the volume of short positions and, as a result, a technical rollback. Despite short-term price changes, the mood of traders is downward, this is indicated by a large-scale movement on January 14, where the euro exchange rate lost more than 200 points in value.

The RSI technical instrument is moving in the 30/50 area in the four-hour and daily periods, which indicates the prevailing interest in short positions.

The Alligator indicator (D1) has completed the stage of intertwining between the MA moving lines in a downward direction, thus confirming the signal about the completion of the corrective move.

On the daily chart, there is a phased process of recovery of dollar positions, which increases the chances of bears to prolong the downward trend from June 2021.

Expectations and prospects:

We can assume a temporary price fluctuation within the current rollback, but speculative hype could already be possible in the market during the US trading session. So, in case of a downward scenario, the second pivot point is located around the value of 1.1230, this is the lower boundary of the previously completed flat. The upward scenario considers price fluctuations within 1.1270/1.1370, where the second value is the upper limit of the previously mentioned flat.

A complex indicator analysis gives a buy signal based on the short-term and intraday periods due to the price rollback. Technical indicators in the medium term are focused on a downtrend, giving a sell signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română