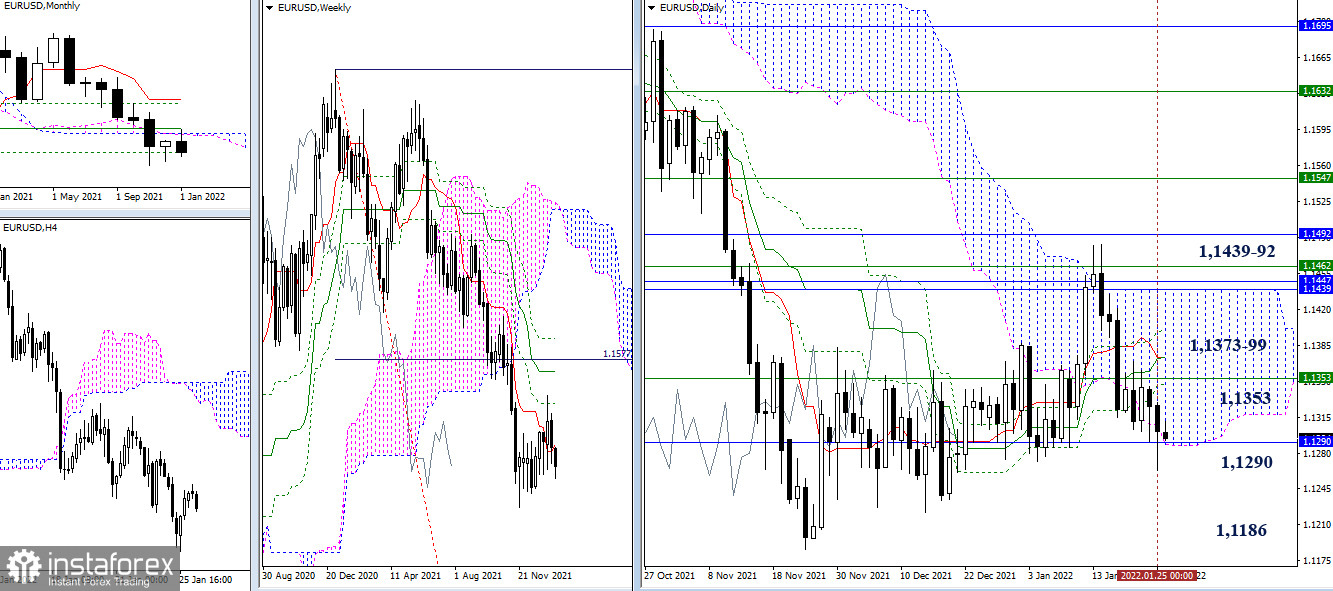

EUR/USD

The situation continues to remain within the designated borders. Yesterday, the support level of 1.1290 was tested, but traders managed to close above this, only putting away the long lower shadow of the daily candle beyond it. As a result, it can be stated that the influence and attraction zone of important levels 1.1353 - 1.1290 (weekly short-term trend + final level of the monthly cross + daily levels) retains its value. To move beyond its borders, it will be important for the bears to restore the downward weekly trend (1.1186), while for its opponent, they need to break through the accumulation of levels in the area of 1.1439-92 (monthly levels + weekly Fibo Kijun + upper limit of the daily cloud) in order for new prospects to appear.

The bears retain their main advantage in the smaller timeframes. However, the current situation is such that the pair is in the correction zone and is testing the strength of the key levels at 1.1298 (central pivot level) and 1.1324 (weekly long-term trend). A consolidation above and reversal of the moving average can change the current balance of forces. If growth continues, the upward pivot points set at 1.1332 0 1.1364 - 1.1398 (classic pivot levels) will be considered. On the contrary, the downward pivot points can now be noted at 1.1266 - 1.1232 - 1.1200 (classic pivot levels).

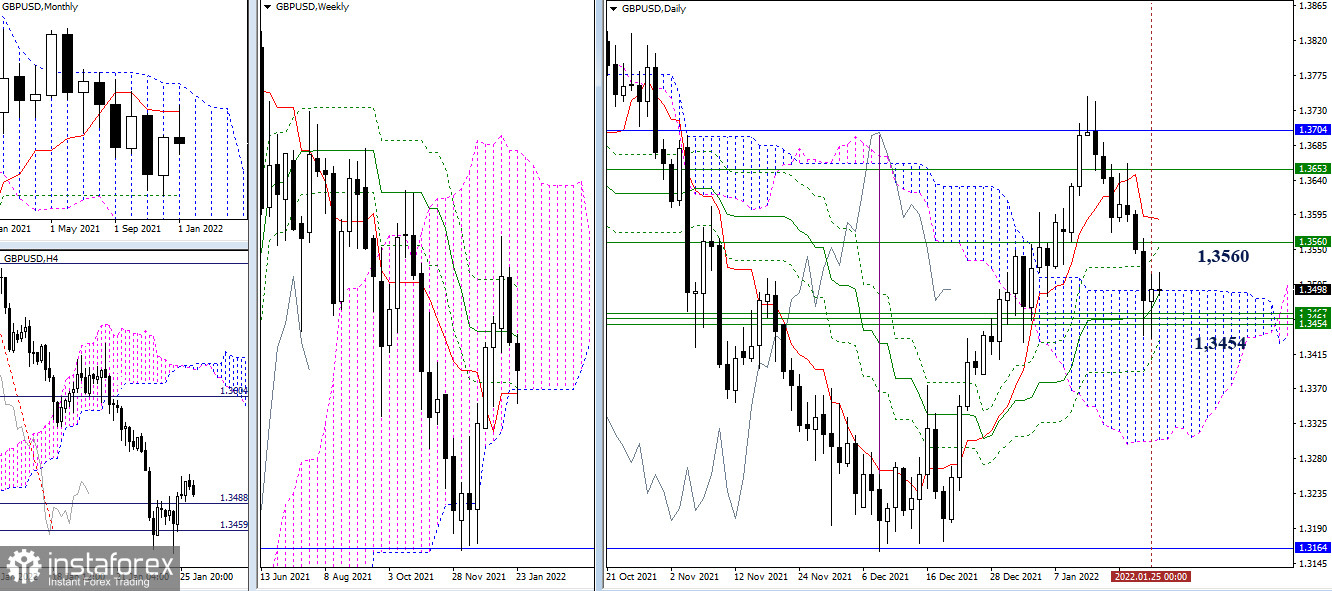

GBP/USD

Meeting with the accumulation of weekly support levels at the turn of 1.3454 ended with the formation of a daily rebound. Now, the upper limit of the daily cloud (1.3497) has the main influence and attraction. If the bulls manage to further rise and consolidate in the bullish zone, relative to the daily cloud, a more bullish mood can be expected. The nearest pivot points here can be noted at 1.3560 (weekly short-term trend) and 1.3588 (daily short-term trend), but the most significant resistance here is the 1.3653 (weekly Fibo Kijun) - 1.3704 (monthly Tenkan) zone. But if the bulls fail to confirm and implement the rebound from the encountered supports (1.3454), they will be forced to return to them and test their strength again.

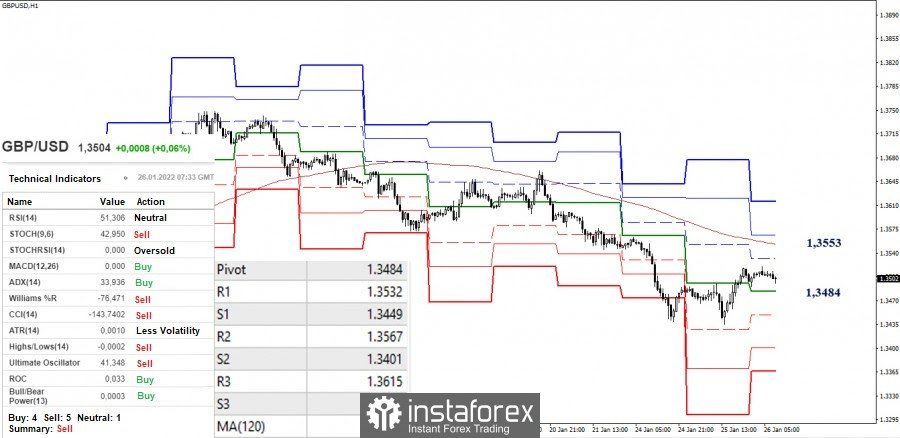

The pair is in the correction zone of the smaller timeframes. The bears lost the first significant level of 1.3484 (central pivot level). As a result, all attention is now focused on 1.3553 (weekly long-term trend). The breakdown of the level of 1.3553 can affect the current balance of power. Other pivot points in this timeframe can be noted at 1.3449 - 1.3401 - 1.3366 (support) and 1.3567 - 1.3615 (resistance).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română