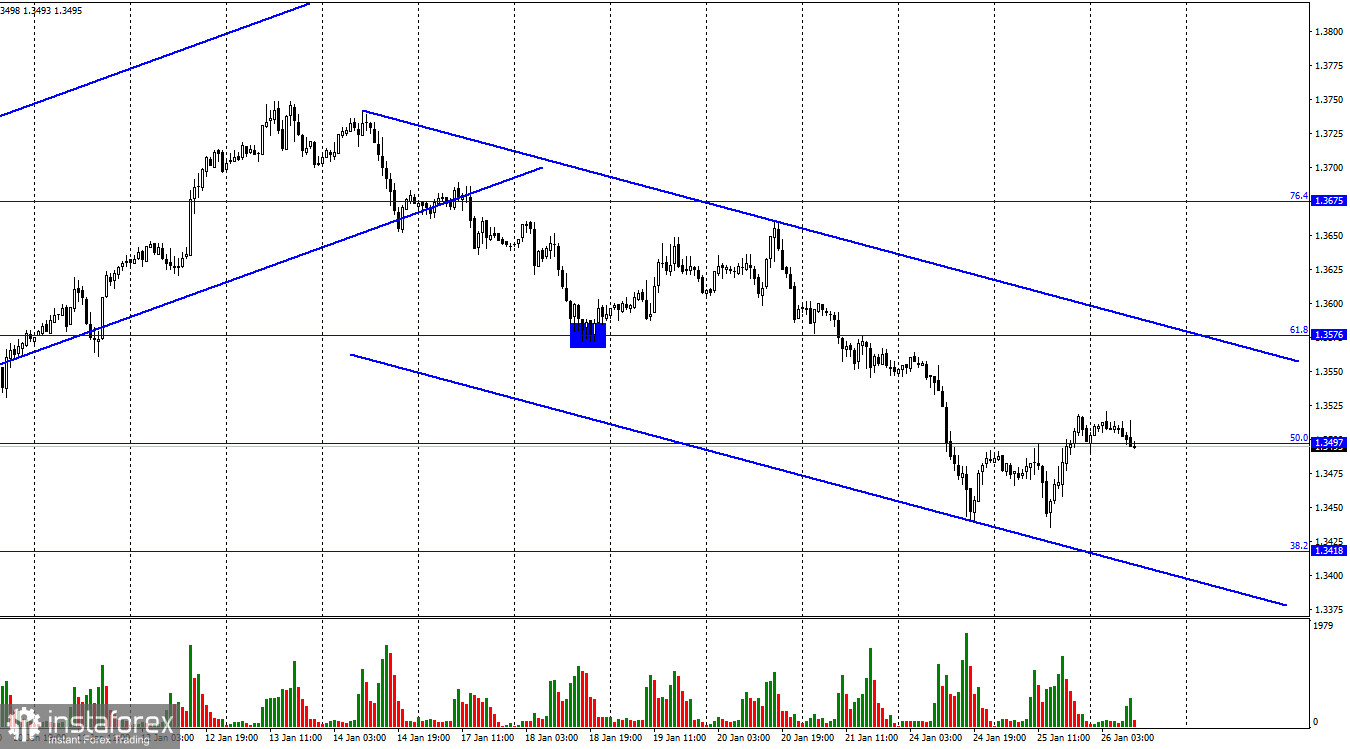

According to the hourly chart, the GBP/USD pair performed a new fall yesterday in the direction of the corrective level of 38.2% (1.3418), but in the afternoon, it turned in favor of the British and closed above the corrective level of 50.0% (1.3497). Thus, the growth process could be continued in the direction of the Fibo level of 61.8% (1.3576), but the probability of a resumption of the fall is too high today. On the 4-hour chart, the pair performed a rebound from the level of 1.3457, which led to the pair's growth. However, the results of the FOMC meeting today may lead to new purchases of the US currency and, as a result, to the fall of the pound/dollar pair. There is no other information background for today in the calendar. At the same time, the International Monetary Fund warns that the Fed's decision to raise interest rates could cost countries with high levels of debt (especially in US dollars and especially low-income countries) dearly. It is unlikely that the FOMC will take into account the state of the economies of countries with high debt obligations in determining monetary policy.

The US economy will also slow down as interest rates rise. However, it is no longer economic growth and the recovery of the labor market that is in the first place in terms of importance for the Fed. Inflation has exceeded 7%, and there is no reason to expect that it will at least begin to slow down. No one is talking about reducing inflation now at all. The fact that the Fed has already reduced the volume of buying bonds on the open market twice has not brought any positive effect. Today, the interest rate is also unlikely to be raised, which means that inflation will be able to continue to rise in February and March, exactly until the next Fed meeting, at which an interest rate increase will be announced with a 95% probability. In such conditions, the US dollar remains in a very favorable position, since even the IMF expects the growth of the US currency. And most likely, this is exactly what will happen to the dollar for most of 2022, if the Fed does not abandon its plan.

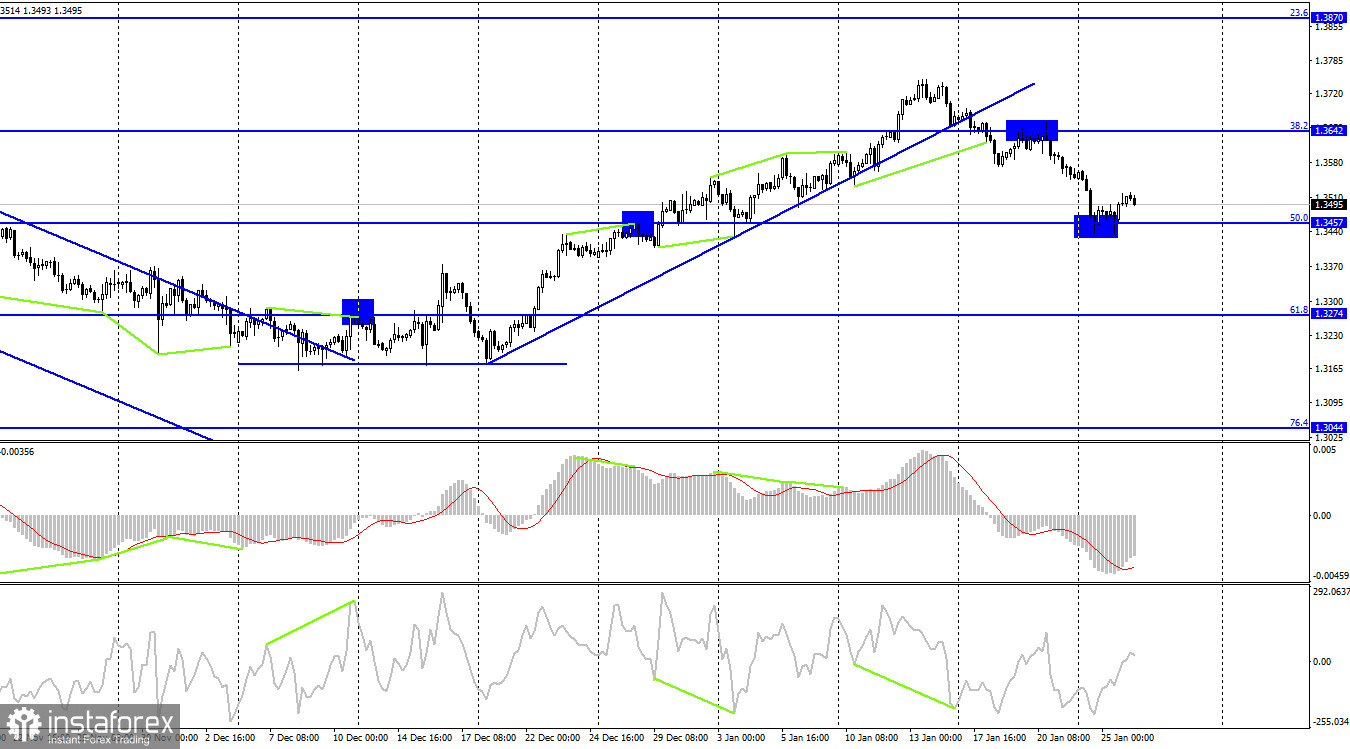

On the 4-hour chart, the pair performed a drop to the corrective level of 50.0% (1.3457), a rebound from it, and a reversal in favor of the EU currency. Thus, the growth process may continue for some time in the direction of the corrective level of 38.2% (1.3642). Fixing quotes below the level of 50.0% will work in favor of the US currency and the resumption of the fall in the direction of the Fibo level of 61.8% (1.3274). Emerging divergences are not observed in any indicator today.

News calendar for the USA and the UK:

US - FOMC decision on the main interest rate (19:00 UTC).

US - accompanying FOMC statement (19:00 UTC).

US - FOMC press conference (19:30 UTC).

On Wednesday, the calendar of economic events in the UK is empty, and the results of the FOMC meeting will be summed up in the US, which is the most important and only event of today. The influence of the information background, therefore, will be extremely strong tonight.

GBP/USD forecast and recommendations to traders:

I recommend selling the pound if there is a close below the 1.3497 level on the hourly chart with targets of 1.3418 and 1.3319. I do not recommend buying the British yet, since the pair may be at the beginning of a new downward trend, and the descending trend corridor on the hourly chart characterizes the mood of traders as "bearish".

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română