The well-known technology fund Ark Capital, which became one of the most profitable exchange products in the U.S. market in 2021, gave its forecast for the digital asset industry, in particular for Bitcoin and Ethereum.

The crypto market is becoming more and more mature - a good sign

Ark's analysis shows that the majority of bitcoin investors have matured and are holding assets for long-term gain rather than short-term speculative gains. The analysis is based on network data such as long-term holder base and total cost basis.

Both metrics provided remain at an all-time high. The second long-term holder base is the basis of Ark's claim that the bitcoin market is moving from speculative to long-term. So, it can be considered "maturing."

In addition to network data, Ark also looks at bitcoin market data. This is a transfer value metric both on an absolute basis and on a price-adjusted basis. As the report suggests, Bitcoin has taken its share of the market as a settlement network.

BTC transaction volume increased by 120% in 2021 to reach $12 trillion. As the adoption of cryptocurrency continues, users are starting to use it for both money transfers and regular transfers. Various cryptocurrencies allow customers to transfer large amounts abroad with significantly lower fees compared to conventional bank transfers.

Institutional capital returns to the market

There is also evidence that during the previous week, the institutional flows of cryptocurrencies have become positive. The inflow into investment cryptocurrency assets amounted to $14 million. BTC and multi-asset investment products led the way in this process.

The value of global crypto assets under management (AUM) has remained above $50 billion over the previous week. However, that number has fallen to its lowest since August 2021. In November last year, the AUM of the cryptocurrency showed a historical maximum: the bar was taken at $86 billion.

In a weekly report, CoinShares noted:

"Bitcoin saw inflows totaling US$14m last week, having suffered outflows of US$317m, representing 1% of AUM, in the prior 5 weeks. Of the Altcoins, Cardano, Polkadot, and Solana saw inflows totaling US$1.5m, US$1.5m, and US$1.4m, respectively. Investors continue to add multi-asset (coin) investment products to positions with US$8m last week."

The outflow of institutional cryptocurrency began to decline in the second week of January 2022. The recent surge in inflows indicates that positive market sentiment has returned, which means there is a chance for a recovery.

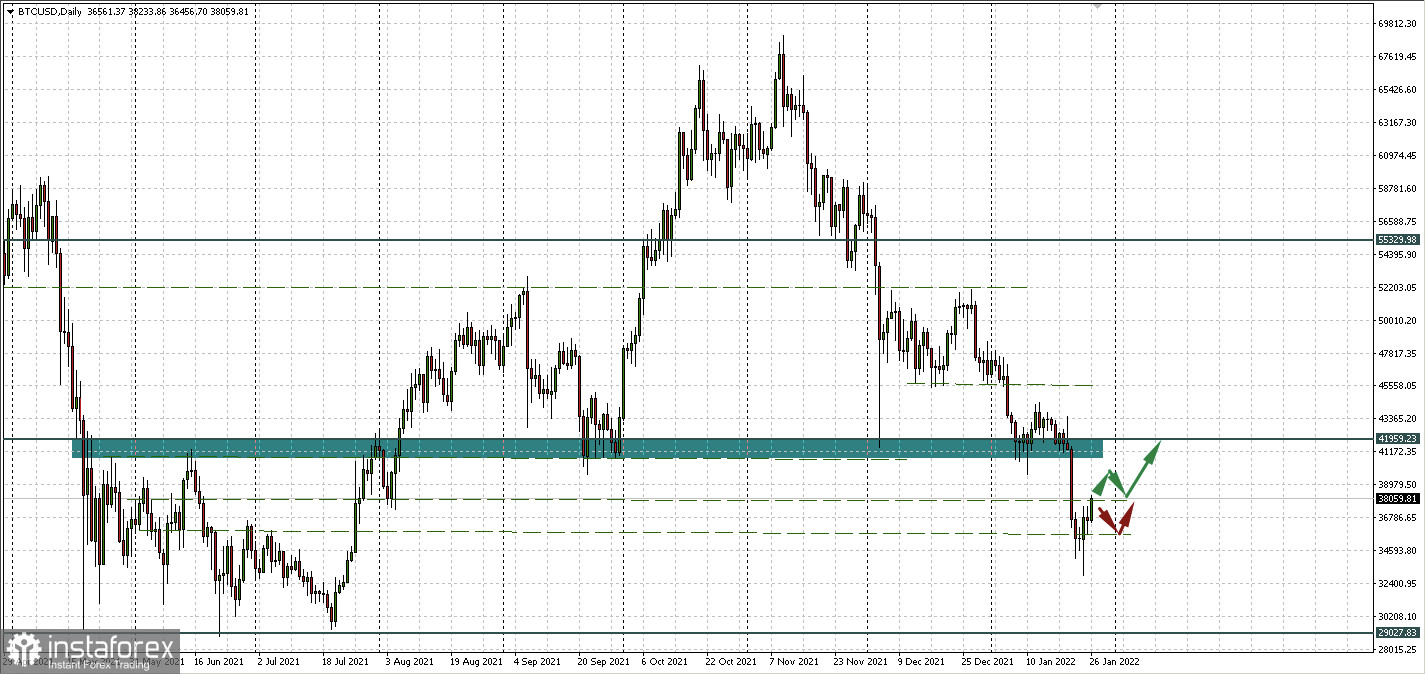

In the meantime, Bitcoin has reached the sideways resistance of 35,915.72 - 37,903.51. If it is possible to break through the upper border with consolidation above, there will be hope for a recovery to the area of $40,000 per coin. Otherwise, we may see consolidation in this narrow corridor.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română