Today we wait for the Fed's decision on the interest rate. Plus, the crude oil inventories, which will be released at 15:30 UTC. All these important events can finally strengthen the bulls to complete the formation of wave XX.

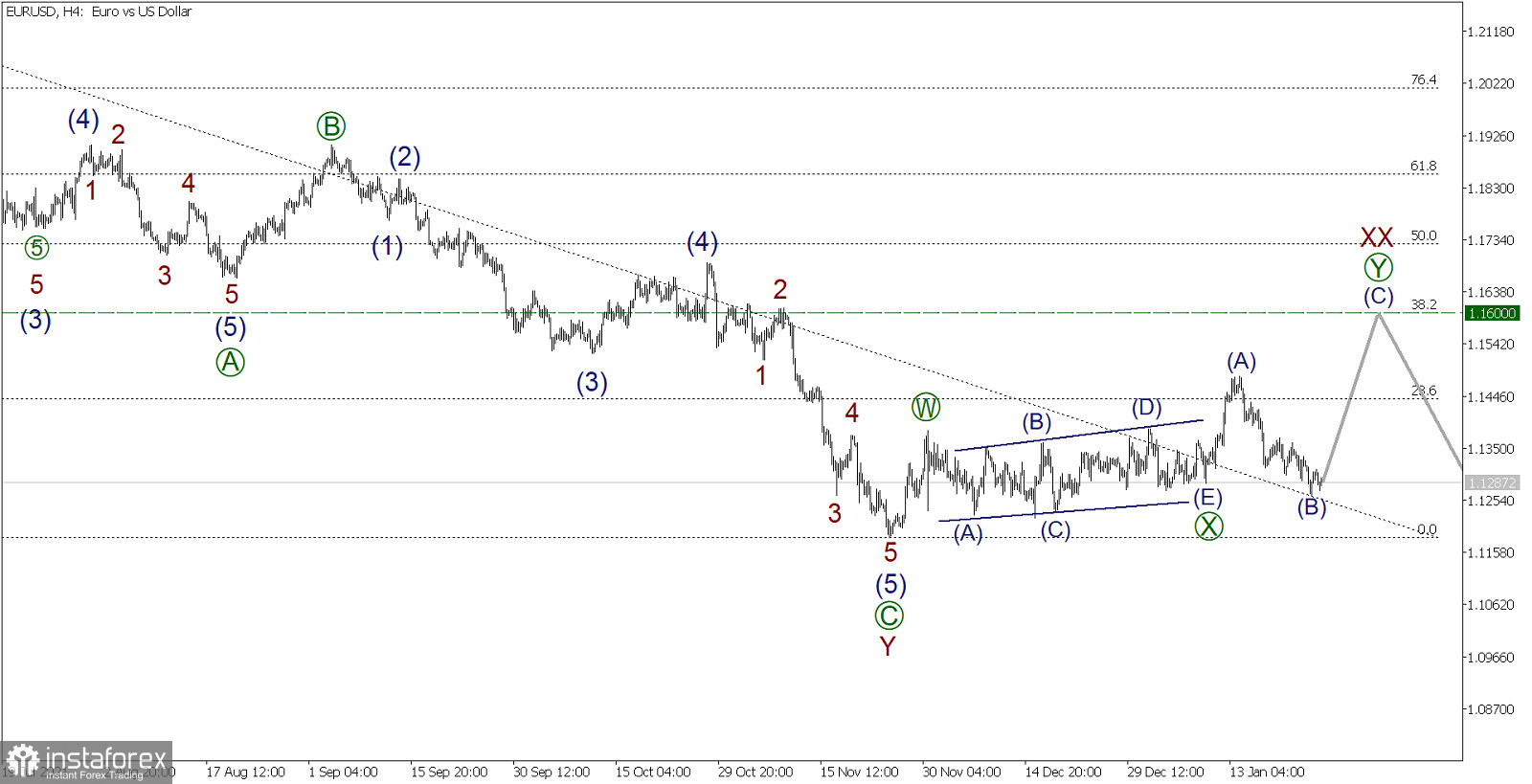

EURUSD, H4:

According to the Elliott theory, we see a global corrective trend that is moving in a downward direction. Perhaps this trend is taking the form of a triple zigzag W-X-Y-XX-Z.

On the 4-hour timeframe, we see that the decline in the current wave Y was completed, followed by the rise of the market in wave XX.

The internal structure of wave XX hints at a double zigzag [W]-[X]-[Y], where the link wave [X] is an inclined triangle. Now a bullish actionary wave [Y] is under development, which can be a standard zigzag (A)-(B)-(C).

The final impulse wave (C) is needed to complete the above zigzag. (There is a possibility that wave (C) will take the form of a finite diagonal).

The cost of quotes may rise to the level of 1.1600. At this level, the size of wave XX will be 38.2% on Fibonacci lines from wave Y.

Trading recommendation:

Buy 1.1277, Take profit 1.1600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română