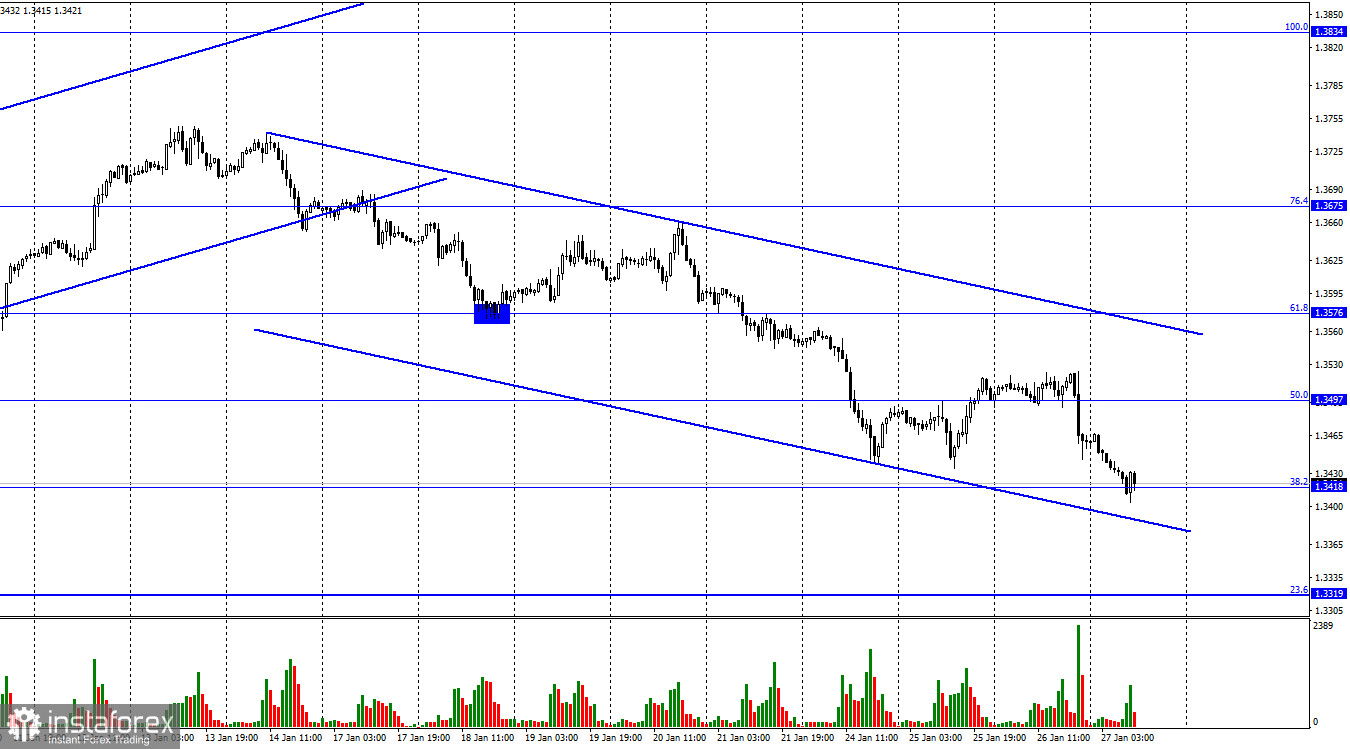

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the US currency yesterday, consolidating under the corrective level of 50.0% (1.3497) and falling to the Fibo level of 38.2% (1.3418). I note that after the announcement of the results of the Fed meeting, the euro and the pound fell by about 100 points down, that is, the same. The rebound of the pair's rate from the level of 38.2% will allow us to expect a reversal in favor of the British and some growth in the direction of the Fibo level of 50.0%. Closing quotes below the 38.2% level will work in favor of a further fall in the direction of the next Fibo level of 23.6% (1.3319). The downward trend corridor continues to characterize the mood of traders as "bearish". The information background had the same effect on the pound/dollar pair yesterday as on the euro/dollar pair. The evening news from the Fed caused new purchases of the US currency. And quite deservedly, since the American central bank has made it clear that it intends to fight inflation and is ready to raise the rate as many times as necessary.

However, this event has already been left behind, and now we need to focus on the US GDP report for the fourth quarter, which will be released in a few hours. Jerome Powell said yesterday that he was pleased with the pace of economic growth, despite the new wave of the pandemic caused by the omicron strain. In just a few hours, we'll find out if the US economy is growing as well as Powell says. Traders expect GDP to grow by 5.5% q/q after growing by 2.3% in the third quarter. If the value of the indicator is below 5.5%, then dollar buyers may be a little disappointed and start taking profits on their positions. This moment may just coincide with the rebound from the level of 1.3418. If it turns out that the US economy grew stronger than expected in the 4th quarter, then the fall of the pound/dollar pair may continue, which will mean a new growth of the US currency. Next, traders will wait for the meeting of the Bank of England, which, according to some forecasts, may also raise the rate.

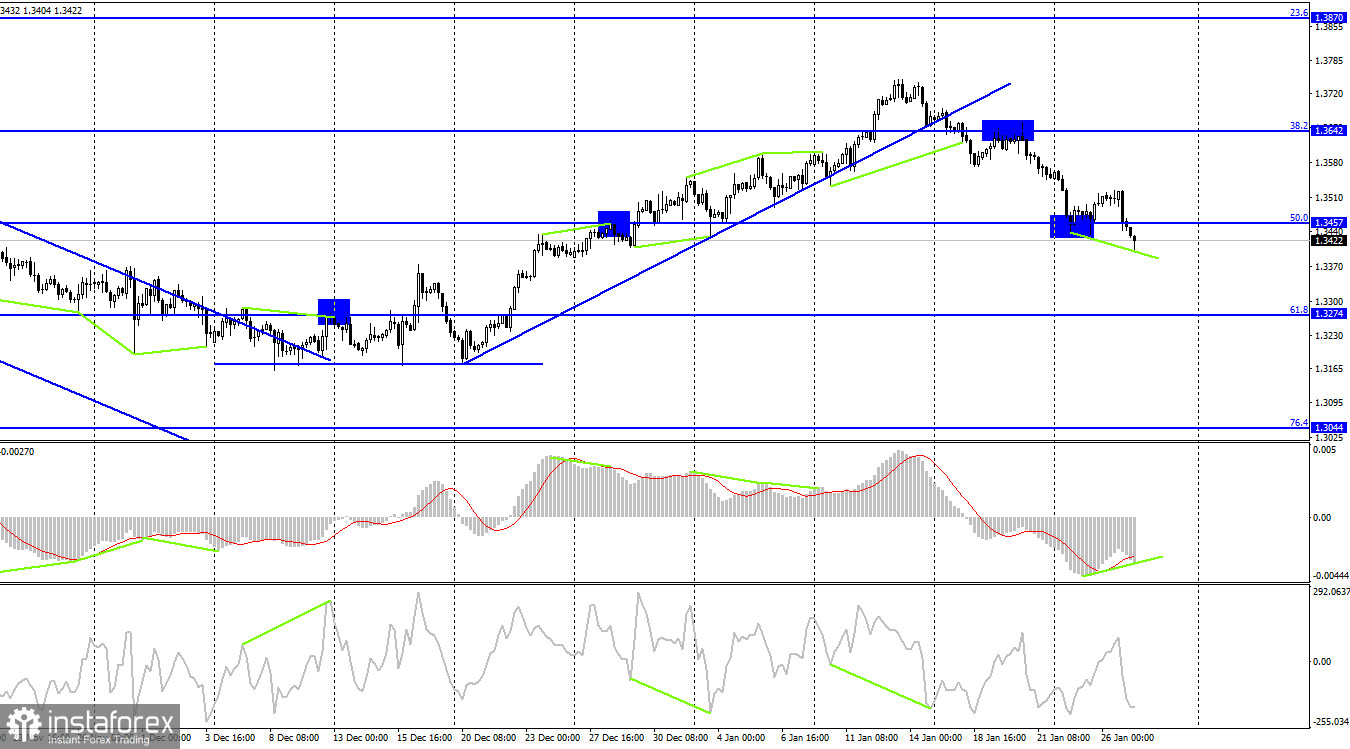

On the 4-hour chart, the pair performed a new reversal in favor of the US currency and anchored under the corrective level of 50.0% (1.3457). Thus, the process of falling quotes can now be continued in the direction of the next Fibo level of 61.8% (1.3274). The emerging bullish divergence allows us to count on some growth, but first, it must be formed. If there are strong reports in the US today, then the dollar will continue to grow rather than the pair will begin to adjust.

News calendar for the USA and the UK:

US - change in GDP volume for the quarter (13:30 UTC).

US - change in the volume of orders for long-term goods (13:30 UTC).

US - number of initial applications for unemployment benefits (13:30 UTC).

On Thursday, the calendar of economic events in the UK is empty again, and important reports on GDP and orders for long-term goods will be released in the US. Both of these reports can also greatly affect the mood of traders today.

GBP/USD forecast and recommendations to traders:

I recommended selling the pound if there is a close below the 1.3497 level on the hourly chart, with targets of 1.3418 and 1.3319. The first goal has been worked out, if it is passed, then we remain in sales with the second goal. I do not recommend buying the pound yet, since the pair may be at the beginning of a new trend "down", and the descending trend corridor on the hourly chart characterizes the mood of traders as "bearish".

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română