In my personal opinion, the pound/franc pair is quite interesting and volatile. However, at the same time, it is quite technical. I propose today, on the last day of weekly trading, to pay attention to this instrument and briefly consider the technical picture that is observed on the weekly and daily charts of GBP/CHF.

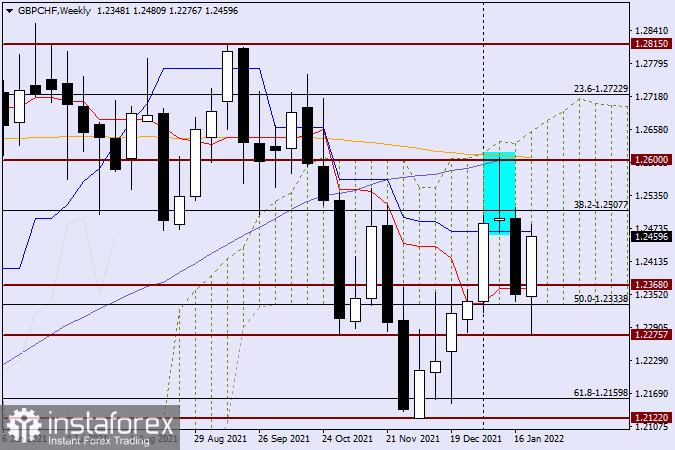

Weekly

On the weekly timeframe, we see that after the growth of 1.1596-1.3070, by which the Fibonacci grid is stretched, GBP/CHF made a deep correction to the level of 61.8 Fibo. In general, I would like to note once again that the pound is a big fan of making deep corrections, thereby misleading traders that the trend is changing. So in this case, it is from the 61.8 Fibo level that the pair is trying to turn back towards growth, and so far it has succeeded. At the auction of the current five-day period, bears on this trading instrument tried to bring the price down from the weekly Ichimoku indicator cloud. What they eventually got is visible in this timeframe. There is a long shadow at the bottom, and the body is filled with a bullish color. In my opinion, there is little chance that the picture will change in the time remaining before the closing of weekly trading. Most likely, the pound/franc will end the trading of the current five-day period with an increase.

Here it is worth paying attention to the blue Kijun line of the Ichimoku indicator, which runs near the strong technical level of 1.2470. As you can see, so far attempts to go above this barrier are failing, but if the bulls for GBP/CHF have enough strength to raise the rate above the Kijun and close the trades above this line, it will go into their piggy bank. If this does not happen, then there will be no catastrophe. The very fact that after coming down from the cloud, the players had enough strength to radically change the situation, indicates a strong demand for the "Briton". Finally, the bullish sentiment for this pair will be announced by the breakdown of the strong technical level of 1.2600 and the absorption by the growth of the reversal candle model "Tombstone", which is highlighted on the chart. The situation is complicated by the fact that there is also a 200 exponential moving average near 1.2600, which can provide additional and very strong resistance to attempts to break through 1.2600.

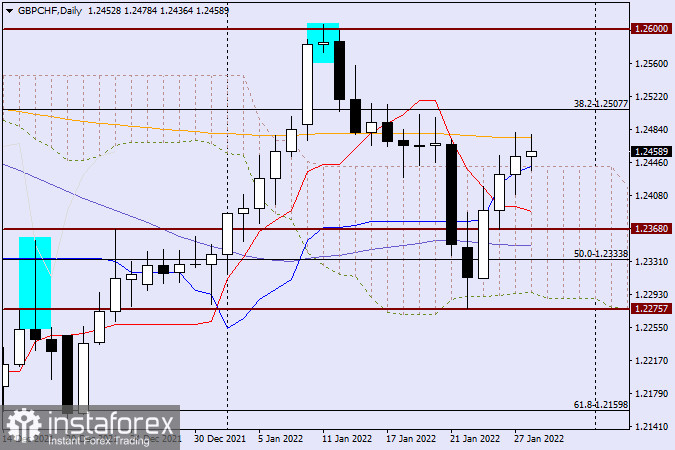

Daily

On the daily chart, we see that yesterday the pair went up from the Ichimoku indicator cloud, but after meeting strong resistance in the form of the same 200 EMA, it bounced back. Today's attempts to break above the orange 200 exponentials have not yet brought results. In the event of a breakdown of 200 EMA and consolidation over this moving, I recommend looking at purchases on a rollback to it. Otherwise, after the appearance of a bearish candle under 200 EMA, the quote may return to the limits of the Ichimoku cloud with a subsequent decline. In this case, it will be time to open short positions. And the last. Since today is Friday and weekly trading closes, this forecast (including weekends) will be valid for five days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română