Many crypto companies continue raising funds despite seeing a huge dip in the market recently. For example, FTX and its US affiliate obtained $800 million in January, while Fireblocks and Blockdaemon raised $550 million and $155 million, respectively. CB Insights said it seems that this year will be a blockbuster year for crypto startups.

The recently-observed decline in the crypto market made investors worried about their funds, and the term "crypto winter" began to be heard again. The last time that such an event occurred was late 2017 and early 2018, when Bitcoin fell 80% from its then all-time high. "If we enter a 'crypto winter', it will have nothing to do with the bear market that we have seen before," said Konstantin Richter, CEO and founder of Blockdaemon.

There is certain truth in Richter's words because at present, the crypto market already has institutional recognition and its liquidity is far different from that in 2017-2018. Several investors are also optimistic on crypto and blockchain technologies. And as mentioned before, crypto startups have raised millions, with Fireblocks attaining $8 billion in a $550 million round. Its rival, Blockdaemon, made $155 million on a $1.3 billion valuation. Some negotiations on these deals began at the end of last year.

So far, the market is under pressure because of the scheduled rate hike in March. But a common investment argument in favor of Bitcoin is that it can act as a store of value and a hedge against inflation, so if the Fed begins to fight price pressure, investors are likely to leave part of their money to the cryptocurrencies market, counting on more profitable and safe offers for US bonds. CEO and co-founder of Mythical Games, John Linden, said a bear market may not be the worst thing that could happen right now.

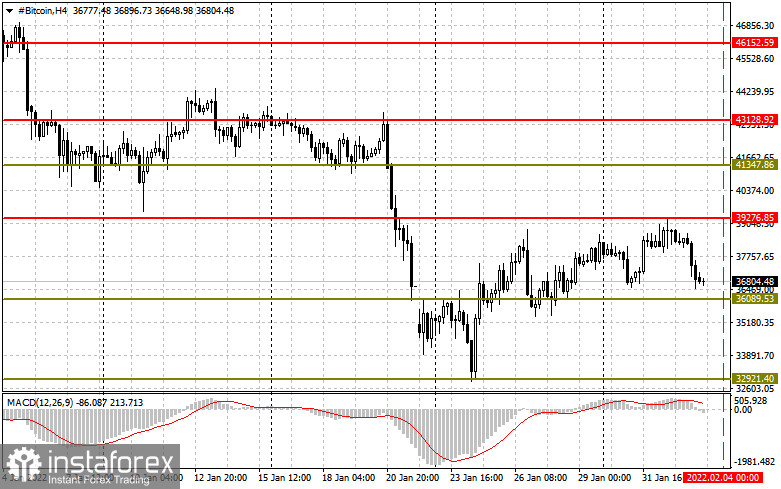

Technical analysis for bitcoin

BTC rose above $36,000, but activity lagged around $38,5000, so there is a chance that the price will dip today to $36,000 and then to $32,900. Only going beyond $39,200 will lead to a rise to $41,340 and $43,120, and then to $46,150.

Technical analysis for Ethereum

ETH hit $2,720. If bullish activity persists, its price could reach $2,980. But if sellers manage to control the market, it could dip to $2,720 and then to $2,470 or $2,430.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română