To open long positions on EUR/USD, you need:

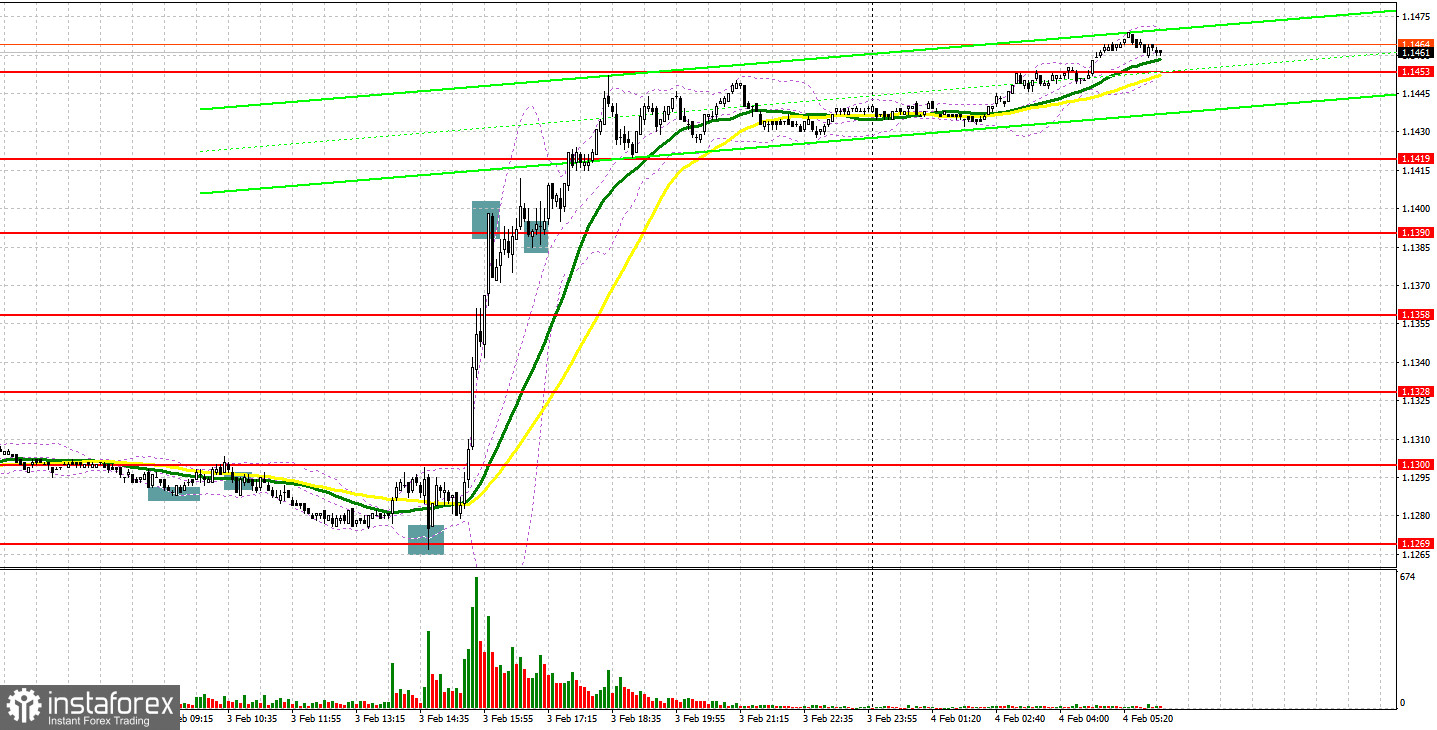

Yesterday, several excellent signals for the long positions on euros were formed. Let's look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the 1.1291 level, and also recommended that you make decisions on entering the market. A slight decrease in activity in the services sector of the eurozone countries resulted in forming pressure on the pair in the first half of the day. The bulls, of course, tried to defend the 1.1291 support and even created an excellent entry point into long positions on a false breakout from there – however, after moving up by 10 points, the initiative quickly ended. In the afternoon, after the revision of the technical picture, another entry point into long positions was formed from the level of 1.1269. As a result, after the press conference of European Central Bank President Christine Lagarde, the euro flew up to the resistance of 1.1390. There I advised selling on a rebound. The downward movement was about 20 points, after which the bulls achieved a consolidation above this range, which led to another buy signal. The upward movement was about 60 more points.

The ECB's decision from yesterday to leave monetary policy unchanged was not the main thing. The emphasis was on Lagarde's speech, who made a number of unexpectedly harsh comments. Currently, ECB officials are not going to rush to conclusions, as it is necessary to wait for new statistics to make a more complete judgment on whether the ECB needs to change its mind about the path of monetary policy or not. However, Lagarde's emphasis on high inflation and risks to the economy made it clear that no one will delay changing policy in a tougher direction anymore. This has become a catalyst for the euro's growth.

Given that the bullish trend continues in a fairly strong form, an important task for bulls is to protect the nearest support of 1.1449. The formation of a false breakout at this level, together with strong data on retail sales in the eurozone and the volume of industrial orders in Germany, create an excellent entry point into long positions in continuation of the upward trend. An equally important task is to control the nearest resistance of 1.1481. The breakthrough of this range and consolidation above directly depends on the data on the change in the number of people employed in the non-agricultural sector of the United States, the release of which is scheduled in the afternoon. A breakdown and a reverse test from top to bottom of 1.1481 will lead to another buy signal and open up the possibility of recovery to the area: 1.1514 and 1.1562. A more distant target will be the level of 1.1607, however, it is possible to count on updating this range only with very weak data on the US labor market for January of this year. I recommend taking profits there. If the pair declines during the European session and there is no bull activity at 1.1449, the pressure on the euro may increase slightly, but there will be absolutely no reason to panic. In this case, it is best to postpone long positions until 1.1416. However, I advise you to open long positions there when forming a false breakout. You can buy the euro immediately for a rebound from the 1.1390 level with the goal of an upward correction of 20-25 points within the day. There are moving averages that play on the side of the bulls.

To open short positions on EUR/USD, you need:

Bears had no choice but to flee the market yesterday after statements by representatives of the ECB. It is unlikely that they will be able to do something now to stop the bull market in the first half of the day. For this reason, the focus will shift to US statistics, which may force speculative traders to take profits after a large weekly rise in the euro. To slow down the upward trend today, you need to try very hard not to miss the 1.1481 level. The formation of a false breakout there will be a signal to open short positions in order to pull EUR/USD to the area of 1.1449. A breakthrough of this area depends entirely on the market reaction to the data on the eurozone, Germany and France. If we see a breakthrough of 1.1449, a reverse test from the bottom up of this range will provide another signal to open short positions with the prospect of falling to large lows: 1.1416 and 1.1390. A more distant target will be the 1.1363 area, where the moving averages are playing on the bulls' side. I recommend taking profits there. In case the euro grows and the bears are not active at 1.1481, it is best not to rush with short positions. The optimal scenario will be short positions when forming a false breakout in the area of 1.1514. You can sell EUR/USD immediately for a rebound from 1.1562, or even higher - around 1.1607 with the goal of a downward correction of 15-20 points.

I recommend for review:

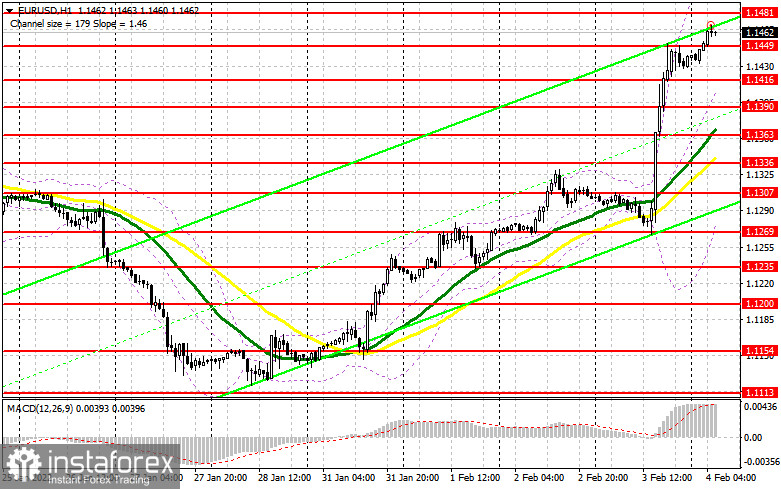

The Commitment of Traders (COT) report for January 25 showed that long positions had increased while short ones decreased, which led to a further increase in the positive delta. The demand for risky assets will continue to persist, because even after the results of the Federal Reserve meeting, where there were clear hints of an increase in interest rates in March 2022, the market did not react with a serious drop in risky assets, and the changing balance of power speaks for itself. This week, everyone is waiting for the results of the European Central Bank meeting, at which a decision on monetary policy will be made. Some traders expect that the central bank may resort to more aggressive statements aimed at policy changes in the near future and to abandon measures to support the economy due to the threat of high inflation. However, most analysts do not expect changes from the ECB. Much will depend on whether the ECB agrees to fully complete its emergency bond purchase program as early as March this year, or not. If so, the demand for the euro will only increase, since such actions will sooner or later lead to an increase in interest rates in the eurozone. The COT report indicates that long non-commercial positions rose from the level of 211,901 to the level of 213,408, while short non-commercial positions fell from the level of 187,317 to the level of 181,848. This suggests that traders continue to build up long positions on the euro in hopes of building an upward trend. At the end of the week, the total non-commercial net position remained positive and amounted to 31,569 against 24,584. But the weekly closing price decreased and amounted to 1.1323 against 1.1410 a week earlier.

Indicator signals:

Trading is above 30 and 50 daily moving averages, which indicates an upward trend for the pair.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decrease, the average border of the indicator in the area of 1.1416 will act as support. In case of growth, the upper border around 1.1525 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română