The ECB meeting was supposed to be a "check-through" one since no revision of forecasts was planned, but Christine Lagarde managed to shock the markets when she sharply changed her wordings at the final press conference. If during the December meeting, Lagarde regarded the increase in rates this year as "very unlikely", then yesterday, she avoided a direct answer several times and did not exclude that the rate would still be raised this year.

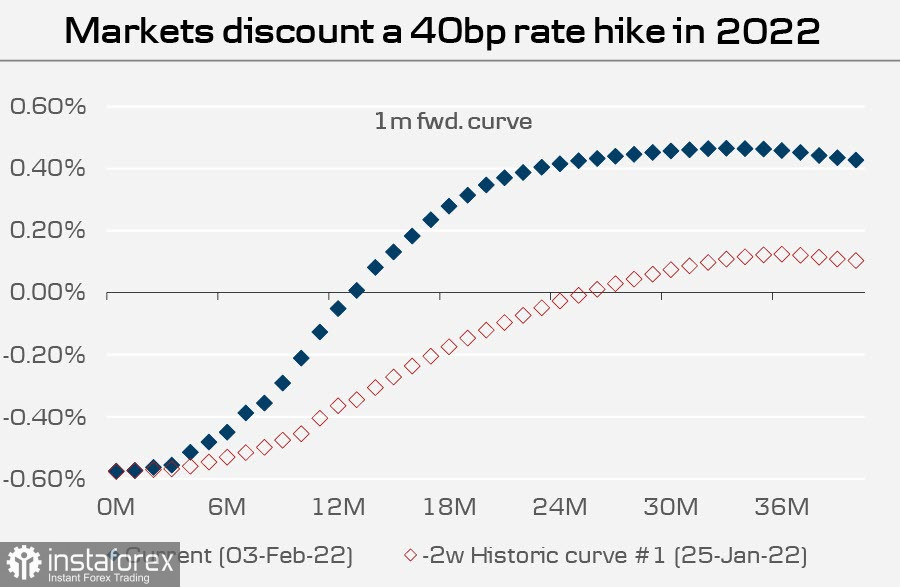

Lagarde noted that "the risks to the inflation outlook are shifted upward, especially in the short term," and pointed to the possibility of a major reversal at the upcoming meeting. Markets immediately increased their forecasts for an ECB rate hike this year with a probability of about 70% by 10 basis points in June and by more than 40 basis points by the end of the year.

It should also be noted that some details of the discussion were leaked to the press – two members of the Council called for an immediate tightening of policy already at the current meeting.

The growing threat of higher and more prolonged inflation than the December forecast was considered to be the main factor in changing the ECB's sentiment. As Lagarde hinted, the ECB may make certain policy changes as early as March, when updated staff forecasts arrive. The EUR/USD pair rose to 1.14, the yield of T-bills in Germany and some other eurozone countries sharply increased, but it is still too early to predict a long-term upward reversal of the euro.

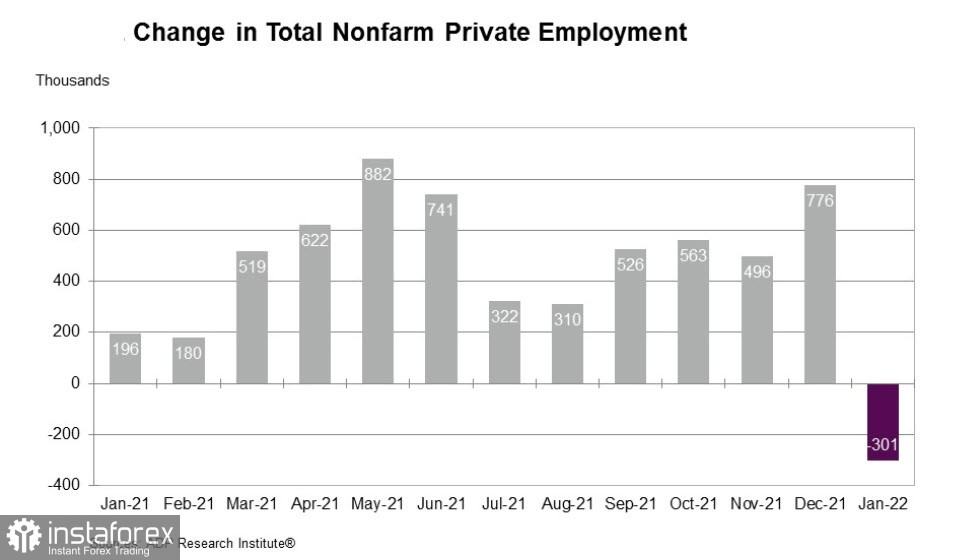

Meanwhile, the US dollar was slightly weakened by an additional negative factor – the ADP report on employment in the private sector unexpectedly showed a loss of 301 thousand jobs in January instead of the expected +207 thousand, which shocked the markets before today's employment report. At the same time, some ISM sub-indexes in the services sector show signs of slowing growth.

But if the US inflation report, which will be released next week, turns out to be no lower than forecasts (growth is forecasted to 7.2% against 7.0% in December), then the US dollar will regain the initiative, since the Fed will have no choice but to confirm the hawkish rate with verbal interventions, and the yield curve will eventually show growth towards the US currency.

The EUR/USD pair found a base at 1.1120 and tried to consolidate above the upper border of the channel. The key point is the possibility of testing the resistance level of 1.1482. If successful, and the chances are good, the euro can develop success. The target will be the level of 1.1560 (38.2% pullback from the 2021 decline).

In turn, the Bank of England also managed to surprise the markets. The rate was expectedly raised by 0.25%, but four out of nine members of the Cabinet voted for a 0.5% increase at once, and this is absolutely surprising. Currently, the Bank of England forecasts a peak in inflation at about 7.5%, and the four who voted for a 50p increase argue that inflationary pressures are intensifying, and a more significant change in the rate will reduce the risk that inflation and wage expectations will be fixed at uncomfortably high levels. That is, according to these four, the forecast of a 7.5% peak does not correspond to market realities.

The Bank of England also confirmed its previous decision to stop reinvesting in its bond portfolio. In fact, this means the beginning of the process of quantitative tightening. Active sales of T-bills are expected to begin after the rate reaches 1%.

The reaction of the market was a little more restrained than in the case of the euro. The growth of UK T-bills yields was also more modest since too high inflation expectations mean lower real yields, which depreciate pound-denominated assets. Nevertheless, the pound has a chance to develop success. We expect it to hit the January high of 1.3646, followed by consolidation above. If this attempt turns out to be successful, then the picture will become more bullish and one can count on the pound's further growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română