The euro-dollar pair at the beginning of the day updated a three-month high, reaching 1.1484. It would seem that everything was in favor of the further development of the upward movement. The euro strengthened across the market amid a hawkish ECB, while the dollar index showed a reverse trend, falling to the bottom of the 95-point mark.

As they say, nothing foreshadowed trouble – buyers of EUR/USD had every chance to get close to the 15th figure, confirming the strength of the upward movement. But life has made its own adjustments, complicating the already difficult rebus of a fundamental nature.

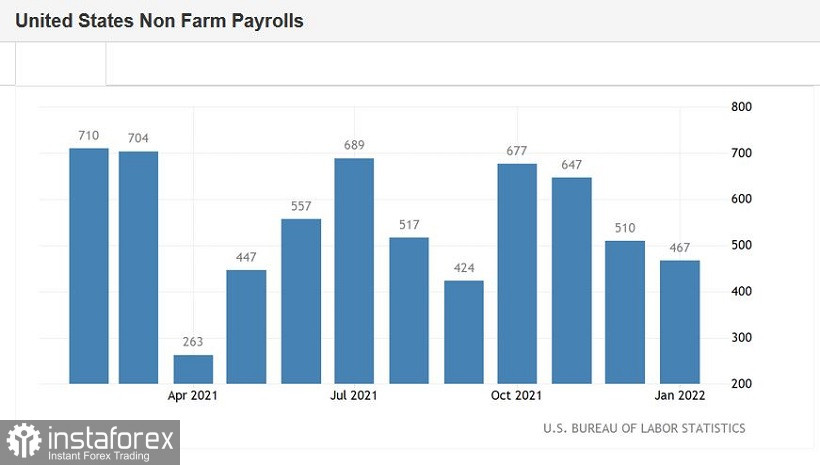

The January Nonfarm Payrolls turned out to be on the side of the dollar, allowing the EUR/USD bears to remind of their existence. The pair retreated from the boundaries of the 15th figure, but did not show a protracted decline. Traders are clearly discouraged by Friday's result, so they cannot decide on the vector of price movement.

The storyline for the euro-dollar pair is really full of surprises. Just Thursday, the single currency received a powerful 200-point support from the European Central Bank. The regulator is finally worried about record inflation in the eurozone. ECB President Christine Lagarde agreed that eurozone inflation will remain high "longer than previously thought." At the same time, she focused her attention on the negative consequences of high inflation: a decrease in citizens' incomes, a decline in consumer activity and a decrease in investment.

However, Lagarde did not say the main thing: is the regulator ready to start raising the interest rate? Answering relevant questions from journalists, she said that any decision on the rate would depend on incoming macroeconomic data. Lagarde also de facto did not answer the repeated clarifying question on this topic. But at the same time, she did not repeat the well-worn phrase that the ECB will not tighten monetary policy this year. Actually, this factor became decisive for the euro: the market came to the conclusion that the head of the ECB voiced a tacit agreement with the hawkish scenario.

On Friday, reporters from the Reuters news agency added fuel to the fire. Citing informed (but anonymous) sources in the Central Bank, they said that the regulator is ready to take active steps already at the March meeting. Especially if the February inflation will be in the "green zone." However, we are not talking about raising the rate.

For starters, the European Central Bank plans to speed up the phasing out of the asset purchase program (APP). According to the December decision of the Central Bank, APP after the completion of the pandemic emergency purchase program (PEPP) will be 40 billion euros per month in the second quarter, 30 billion in the third, and 20 billion in the fourth quarter. It is obvious that in March the ECB will accelerate the pace of curtailing the program.

As for the interest rate, there are no insiders here, but there are experts' assumptions. In particular, according to currency strategists at Deutsche Bank and Goldman Sachs, the European Central Bank will decide to take this step as early as September of this year and will return to this issue again in December. As a result, by the end of 2022, the deposit rate will increase to zero.

Admittedly, this is the most hawkish forecast of all, but it reflects the general sentiment among traders. Lagarde's "taciturnity" was taken too seriously, on the principle of "no denial=consent." At least, many analysts of the foreign exchange market came to such conclusions.

But the cloudless weather for EUR/USD buyers did not last long. After all, the Fed also intends to tighten monetary policy, and much more likely and much more aggressively. Fed Chair Jerome Powell has not ruled out a rate hike at every meeting this year. But at the same time, he "tied" this issue to the main macroeconomic indicators, primarily in the field of the labor market and inflation. And on Friday the first exam for the dollar took place, which was successfully passed. The January Nonfarm Payrolls report did not disappoint for the most part, some components exceeded the forecast levels, while the December figures were revised upwards.

So, almost all components of Friday's Nonfarm Payrolls report came out in the green zone. The number of people employed in the non-agricultural sector increased by 467,000 (against the forecast of growth by 110,000). In the private sector of the economy, the indicator jumped to 444,000 (against the forecast of growth by 150,000). Also, the failed ADP report was published the day before yesterday, which came out at -330,000.

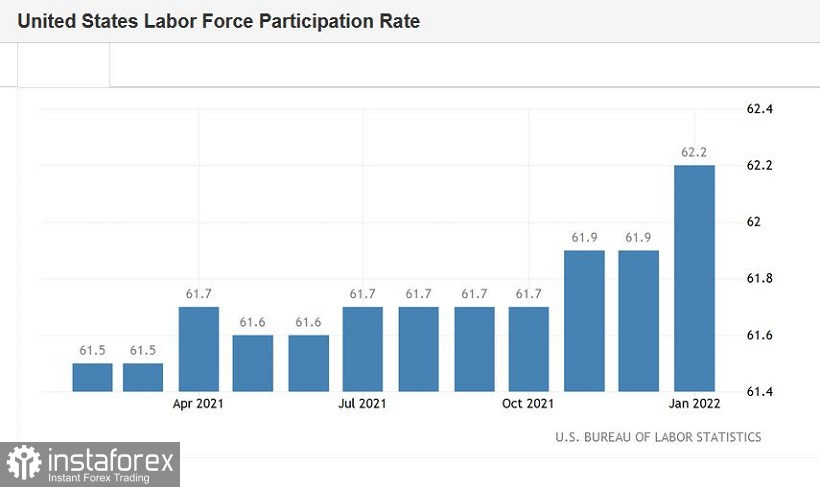

As you can see, in this case, we can talk about a significant correlation, which was interpreted in favor of the dollar. The rate of wage growth did not disappoint either. Friday's figures (0.7% MoM and 5.7% YoY) supplemented recent inflation releases. The share of the economically active population also increased to 62.2%. This is the best result since April 2020.

The headline figure let us down a little: the unemployment rate rose to 4.0%, while most experts were sure that it will remain at the level of December, that is, at around 3.9%. But this nuance did not spoil the overall picture, especially since some indicators of the previous month were revised upwards - according to updated data, the number of people employed in the non-agricultural sector increased by 510,000 in December (the initial estimate was 199,000).

In other words, Friday's release suggests that the Fed will remain hawkish at its March meeting on the prospects for monetary tightening. This fact strengthened the position of the U.S. currency throughout the market, although it is in pair with the euro that the greenback feels most insecure. The EUR/USD buyers are counterattacking and do not allow the sellers to develop the peremptory downward momentum. Plus, there is the "Friday factor," which does not allow an objective assessment of the current situation.

Next week it will become clear where the scales will tip: traders will either "believe" in the hypothetical probability of an ECB rate hike, or "return" to the dollar, which has a more straightforward Fed as its allies. For now, it is risky to open any trading positions. As you can see, the EUR/USD pair jumped to the multi-week high at 1.1484 at the beginning of the day, then updated the low at 1.1418, but eventually flattened around the opening price. Market participants cannot decide on the vector of price movement, especially on the eve of the weekend. In such circumstances, it is best to take a wait-and-see position - at least until Monday, when it becomes clear in which direction the pendulum will swing.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română