Although reluctant, the Bank of England is leaning towards a quick and sharp increase in interest rates in the hope that it can bring inflation under control and slow the process of tightening monetary policy in 2023. The regulator raised borrowing costs for the first time since 2004 in two consecutive meetings, and was close to raising the repo rate by 50 basis points at once, which has not happened since 1995. As a result, the GBPUSD pair rose higher than expected in the previous forecast.

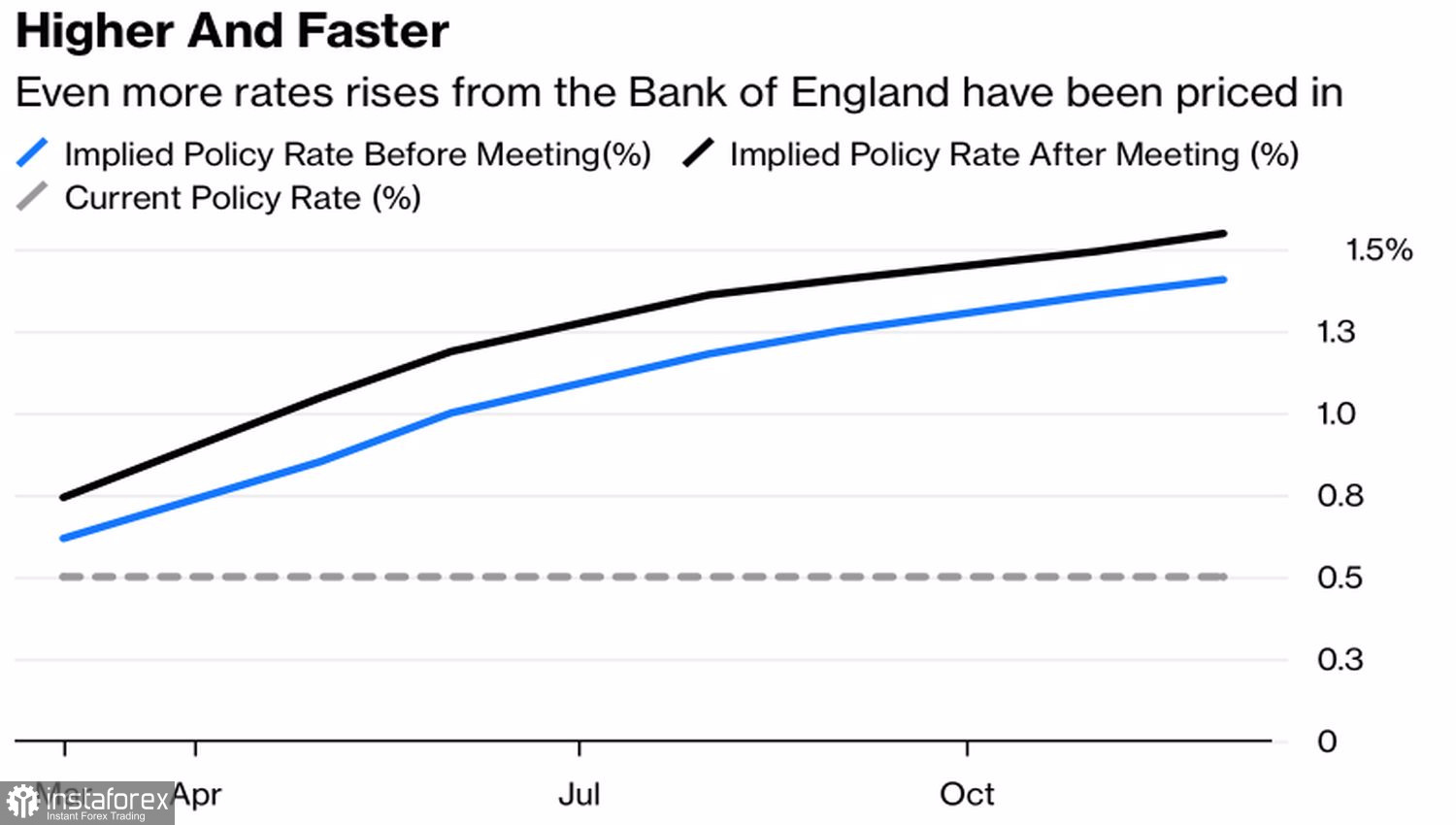

Four out of nine members of the MPC voted for a more aggressive monetary restriction, and BoE Governor Andrew Bailey noted that the Bank of England did not raise rates sharply, as the economy is collapsing. However, Bailey left the door open for a continuation of the monetary tightening cycle. After the February meeting of the Committee, the derivatives market expects to increase the repo rate to 1% by May and to 1.5% by November. It was previously planned that this level would be reached only by March 2023.

Dynamics of the expected repo rate

At the same time, derivatives signal that there will be only one act of monetary restriction next year, which is fully in line with the idea that the Bank of England has taken off the bat and then intends to pull the reins.

According to estimates, the increase in rates, coupled with the highest inflation rate in 30 years, will lead to the largest reduction in household disposable income since at least 1990 and to a slowdown in GDP growth in the UK by 1 percentage point per year. At the same time, the tightening of monetary policy will make it possible to reduce the inflation rate to 2% within three years. Of two evils, BoE chose the lesser, while Bailey's calls to the Britons that they should not demand higher wages were received with hostility. Indeed, the head of the Central Bank, whose salary is £575,000 a year, is easy to say.

Together with the rate increase, the regulator decided to begin the process of winding down the balance sheet. It will stop reinvesting proceeds from redeemable bonds, which will reduce the size of assets by £200bn by 2025. In addition, a plan has been announced to get rid of the entire stock of corporate debt by £20bn.

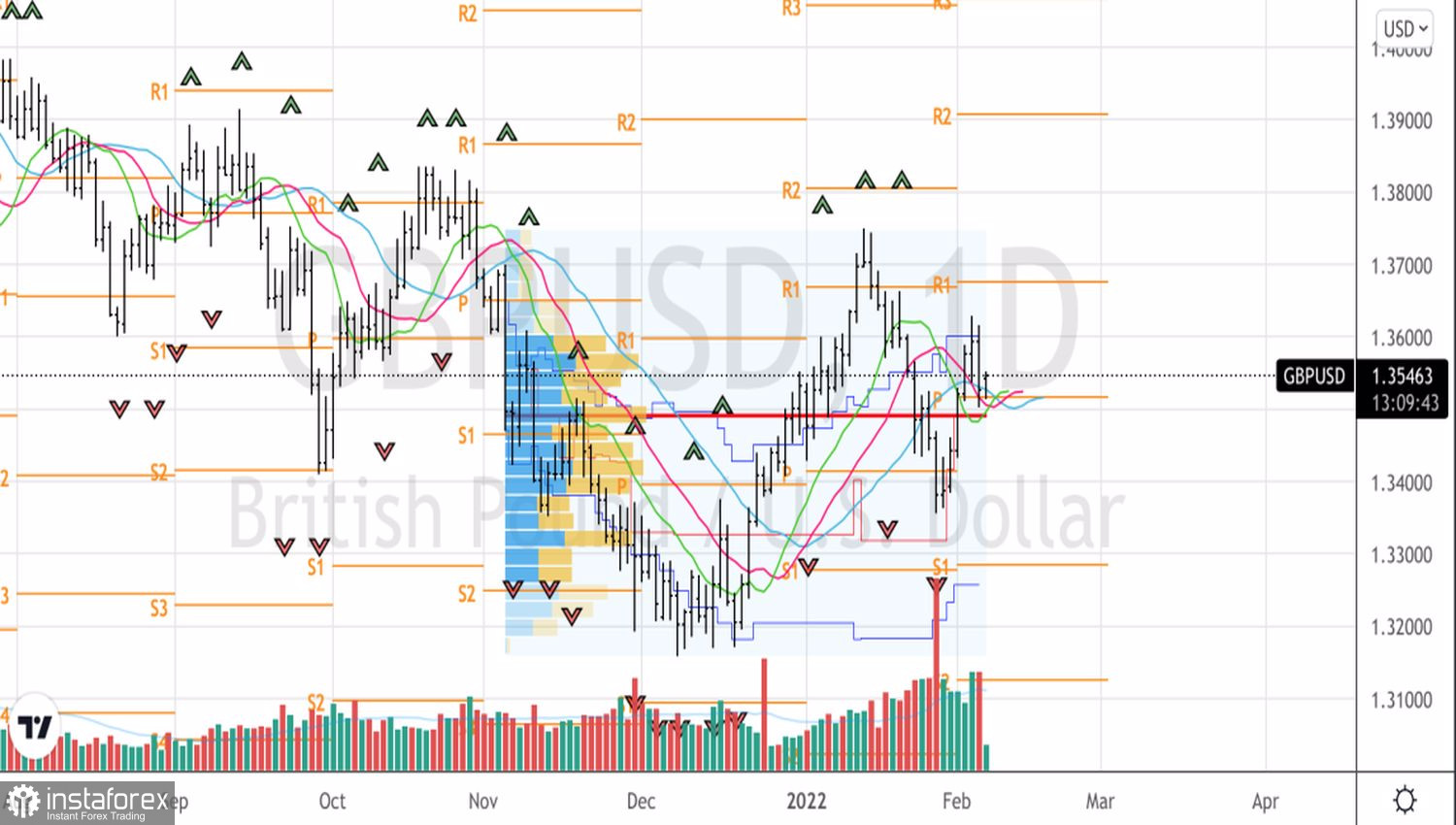

Aggressive tightening of monetary policy by the Bank of England allowed the GBPUSD pair to soar above 1.36, however, due to an unexpectedly strong report on the U.S. labor market, it was not possible to cling to it. In January, employment outside the U.S. agricultural sector increased by 467,000, and the average salary - by 5.7%. As a result, the chances that the Fed will raise the federal funds rate by 50 basis points in March, increased, and the U.S. dollar strengthened against major world currencies.

The key events of the week by February 11 for the GBPUSD pair will be the releases of data on UK GDP and U.S. inflation. The latter is ready to accelerate to a new high in 40 years, which is likely to support the U.S. dollar. On the other hand, the fact that economic growth in the UK in 2021 has become the strongest since 1940 can help the pound.

Technically, the fall of GBPUSD below the supports at 1.351 and 1.349 is a reason to sell the pair. On the contrary, a confident assault on resistance at 1.36 is a reason to buy it.

GBPUSD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română