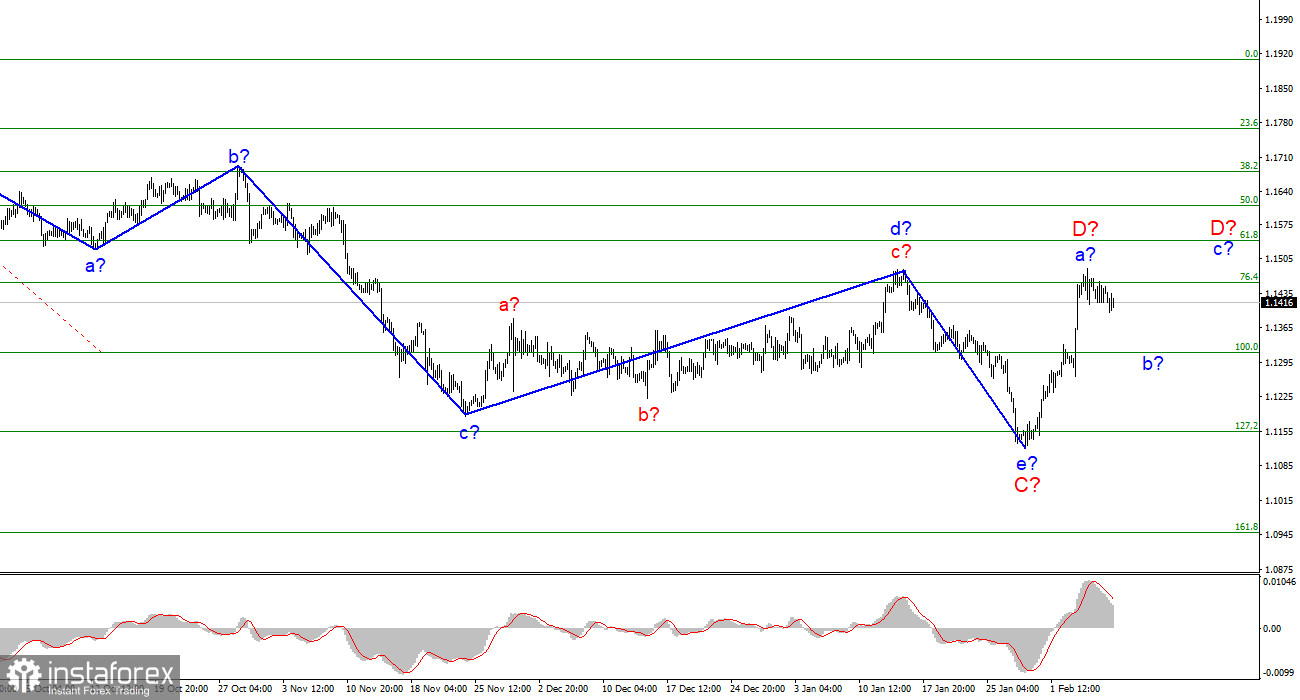

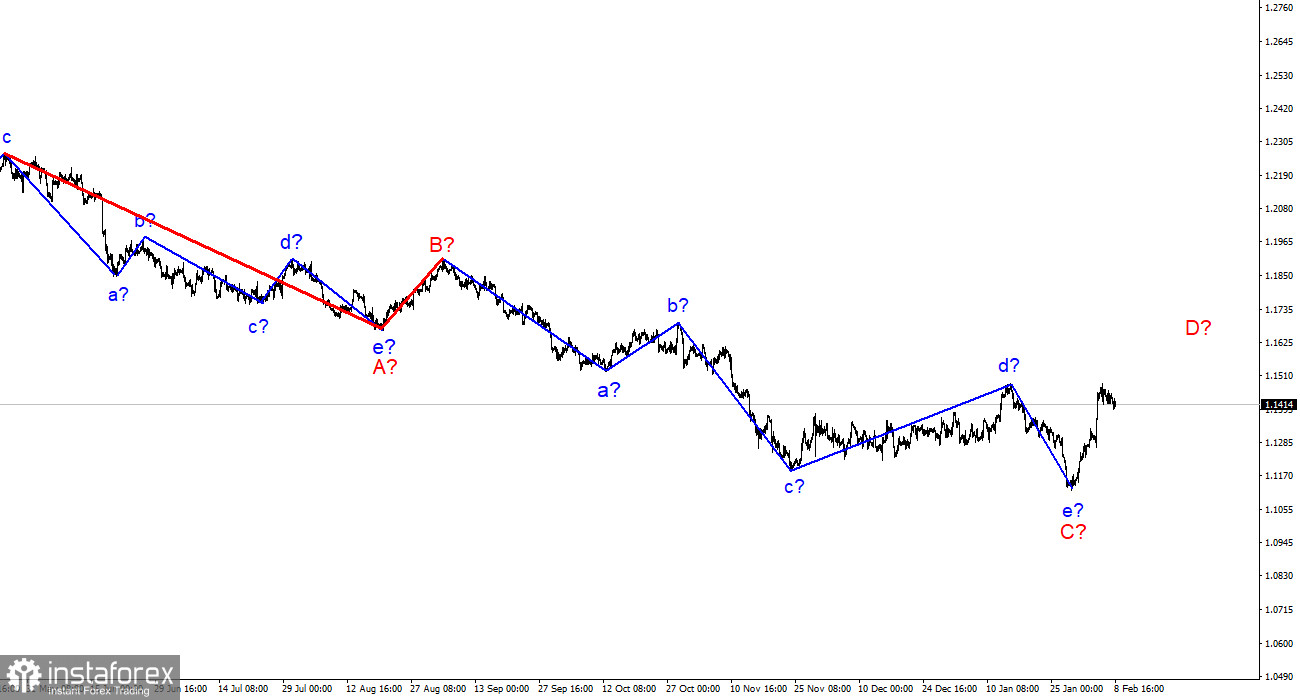

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes, but nothing drastic. In the last week, a fairly strong increase in quotes continued. Thus, wave e-C is recognized as completed, since it turned out to be about the same size as the previous wave d-C. Therefore, the current upward wave is either D or 1. In the first case, the increase in the euro currency may already be completed. The picture below clearly shows that the correction wave B turned out to be shortened. The same can happen with wave D. An unsuccessful attempt to break through the 1.1455 mark, which corresponds to 76.4% Fibonacci, may become the second in recent weeks and lead to a departure of quotes from the reached highs, as well as to the end of the current wave. Thus, the wave marking now indicates a decline in quotes. And depending on how strong this decline will be, it will be possible to talk about which wave is being built now. The proposed wave D may turn out to be three-wave, but for now, this option looks like a backup.

The market can only wait for the US inflation report

The euro/dollar instrument fell by 30 basis points on Tuesday. Market activity remains very weak. The instrument continues its unhurried departure from the previously reached highs. Since the news background is now almost completely absent, the weak activity of the market does not raise any questions. In this case, if the market does not find reasons to trade more actively, it remains only to rely on those economic events that will take place this week. And the list here, I must say, is small. On Thursday, the US will release an inflation report for January. And perhaps that's all. I don't take into account those reports that the market reacts to once a year. But what can we expect from the inflation report? Forecasts suggest that this indicator will continue to grow and will amount to 7.3% y/y by the end of January. How will this affect the demand for the dollar? I believe that the only thing that can be expected with such a value of the indicator is a new increase in the US currency. There are two reasons for this. First, the wave markup now implies an increase in the dollar. Second, rising inflation will mean that the Fed will have to act even faster and even more aggressively in changing the parameters of monetary policy. The more inflation rises, the more difficult and longer it will be to bring it back to 2%, which is the "target" for the Fed. Therefore, I expect a slight decline in the instrument until Thursday, and on Thursday it may intensify. What will happen next largely depends on a successful or unsuccessful attempt to break through the 1.1314 mark, which corresponds to 100.0% Fibonacci.

General conclusions

Based on the analysis, I conclude that the construction of the ascending wave C is completed. However, wave D may already be completed too. If so, now is a good time to sell the European currency. At least with a target located near the 1.1314 mark. Another upward wave can be built inside wave D. And if the current wave is recognized not as D, but as 1 as part of a new upward trend segment, then a new upward wave is guaranteed to go beyond the peak of February 4. Thus, now cautious sales are ready for new purchases.

On a larger scale, it can be seen that the construction of the proposed wave D has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and were approximately the same size, the same can be expected from the current wave. There are reasons to assume that wave D has already been completed, but a further increase in quotes will force us to reconsider this assumption.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română