To open long positions on EURUSD, you need:

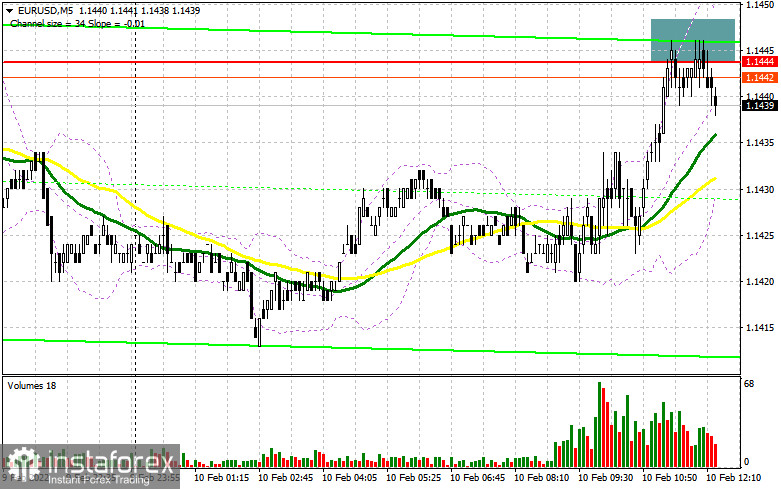

In my morning forecast, I paid attention to the 1.1444 level, and also recommended that it make decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. Growth to this level, which occurred by analogy with yesterday, again did not bring success to buyers of the European currency, who failed to break above this range. The formation of a false breakdown there led to the formation of a signal to sell the euro, which was valid at the time of writing the forecast. Until the moment when trading is conducted below 1.1444, we can expect a decline in the euro - especially after the data on the US consumer price index. From a technical point of view, nothing has changed. And what were the entry points for the pound this morning?

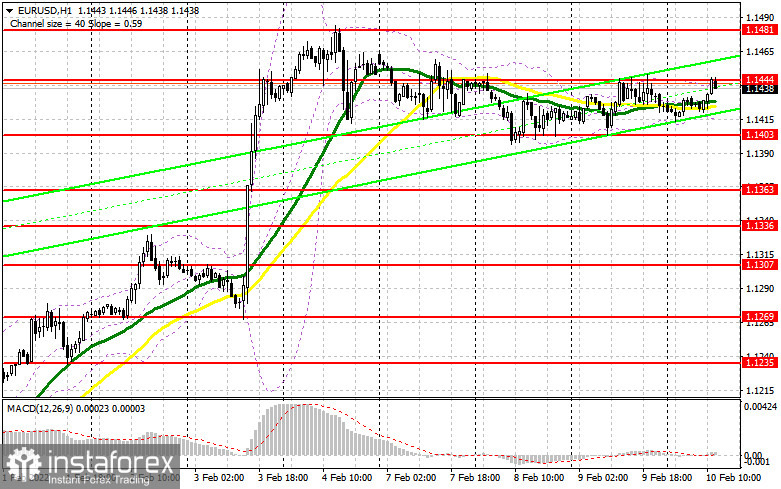

During the American session, important data on the consumer price index in the United States will be released, which will lead to a significant surge in market volatility. Many economists expect that the final figure for January may surpass even the worst estimates - this will make the Federal Reserve System move even more. In this scenario, a bearish signal for risky assets is realized. Only in the event of a decrease in inflationary pressure in the US, euro buyers will have a chance to continue growing in the short term, but this requires going beyond the average border of the side channel, which they failed to do in the first half of the day. The most optimal scenario for buying will be the formation of a false breakdown at 1.1403. The pair may go down to this level just after the publication of fundamental statistics on the American economy. Control over the middle of the 1.1444 channel remains an equally important task during the American session. A break in this range, as well as a top-down test - all this will lead to an additional buy signal and open up the possibility of restoring the euro to the area of this month's maximum - 1.1481. However, it is unlikely that the bulls will stop there. A breakdown of this range will also open a direct road to 1.1514 and 1.1562, where I recommend fixing the profits. A test of these levels can be seen in the event of a decrease in inflationary pressure in the United States on an annualized basis. If the pair falls during the American session and there is no activity at 1.1403, it is best to postpone purchases to 1.1363. However, I advise you to open long positions there when forming a false breakdown. You can buy the euro immediately for a rebound from the 1.1336 level with the aim of an upward correction of 20-25 points within a day.

To open short positions on EURUSD, you need:

Sellers tried to declare themselves again, but nothing has come of it yet - there are a lot of people who want to buy euros against the background of a bullish trend. For this and not the only reason, it was not possible to see a major drop from the 1.1444 level. As a result, we are now watching the bulls' attempts to regain control of 1.1444. Reports on the American economy will have a serious impact on the market and everything depends on them. Bears need to try not to miss 1.1444. Give 1.1444 - they will completely lose the initiative. In the case of strong US data and the next formation of a false breakdown at 1.1444, all this will increase pressure on the pair and form an entry point into short positions to reduce EUR/USD to the area of 1.1403. A breakdown and a bottom-up test of this range will give an additional signal to open short positions already with the prospect of falling to a large minimum of 1.1363. A more distant target will be the 1.1336 area, where I recommend fixing the profits. In the case of a rise in the euro and the absence of bears at 1.1444, it is best not to rush with sales. The optimal scenario will be short positions when forming a false breakdown at the monthly maximum of 1.1481. You can sell EUR/USD immediately on a rebound from 1.1514, or even higher - around 1.1562 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for February 1 recorded an increase in both long and short positions, and the latter turned out to be slightly more. This led to a slight reduction in the positive delta. However, it should be understood that the data do not take into account the meeting of the European Central Bank, at which its president Christine Lagarde made it clear to all market participants that the regulator will act more aggressively if the observed picture with inflation does not change. As the latest data showed, there is no need to wait for a slowdown in inflationary pressure. This is a strong bullish signal to buy the euro at the moment, as there is a real prospect of a tighter monetary policy and an increase in interest rates in the eurozone this year. On the other hand, we should not forget about the increase in interest rates by the Federal Reserve as early as March of this year, which will be some deterrent for buyers of EUR/USD. Some traders expect that the central bank may resort to more aggressive actions and raise rates by 0.5% at once, rather than by 0.25% - this will become a kind of bullish signal for the US dollar. The COT report indicates that long non-profit positions rose from the level of 213,408 to the level of 213,563, while short non-profit positions jumped from the level of 181,848 to the level of 183,847. This suggests that traders continue to build up long positions, and the future report will indicate a serious advantage in the direction of buyers, as it will take into account the February results of the ECB meeting. At the end of the week, the total non-commercial net position decreased slightly and amounted to 29,716 against 31,569. The weekly closing price also dropped and amounted to 1.1229 against 1.1323 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted slightly above 30 and 50 daily moving averages, which so far indicates the bullish nature of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the lower limit of the indicator around 1.1415 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română