Hi, dear traders!

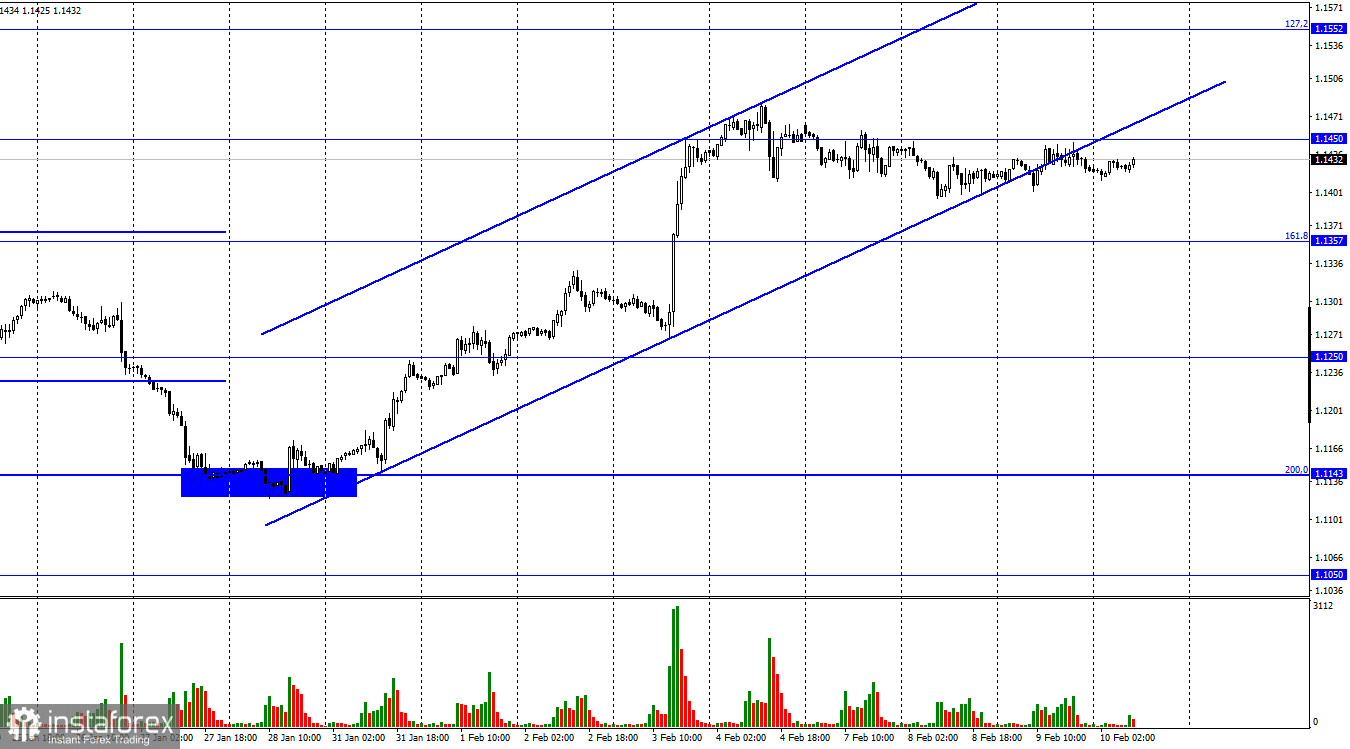

On Wednesday, EUR/USD remained below 1.1450 and continued to move alongside this level. There has been no changes in its trajectory for the past 3 days, as investors await important data releases. Today, US CPI data for January is due - traders expect inflation to accelerate, reaching 7.2-7.3%. However, it is unclear how the market would react to such a report.

Last month, on January 12, USD fell on the news of US inflation increasing to 7%. Another significant report released today is the European Commission's economic outlook. Disappointing data revisions (higher inflation, lower economic growth) are likely to trigger a EUR sell-off. This data does not correlate with the actions of the European Central Bank. The ECB has yet to give any signals about an interest rate hike in 2022.

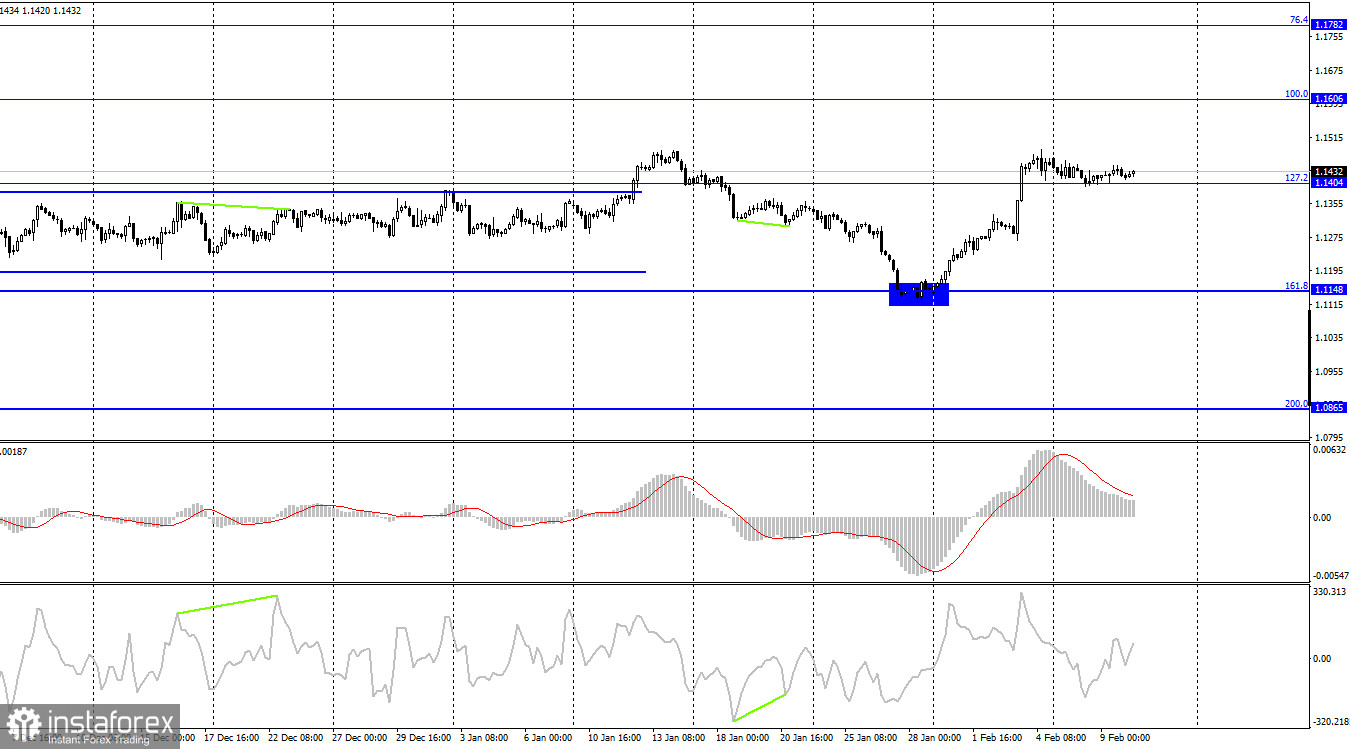

According to the H4 chart, the quote settled above the retracement level of 127.2% (1.1404). It could then continue to rise towards the next Fibonacci level of 100.0% (1.1606). If the pair closes below the 127.2% level, it could fall towards the retracement level of 161.8% (1.1148). Technical indicators show no signs of emerging divergences today.

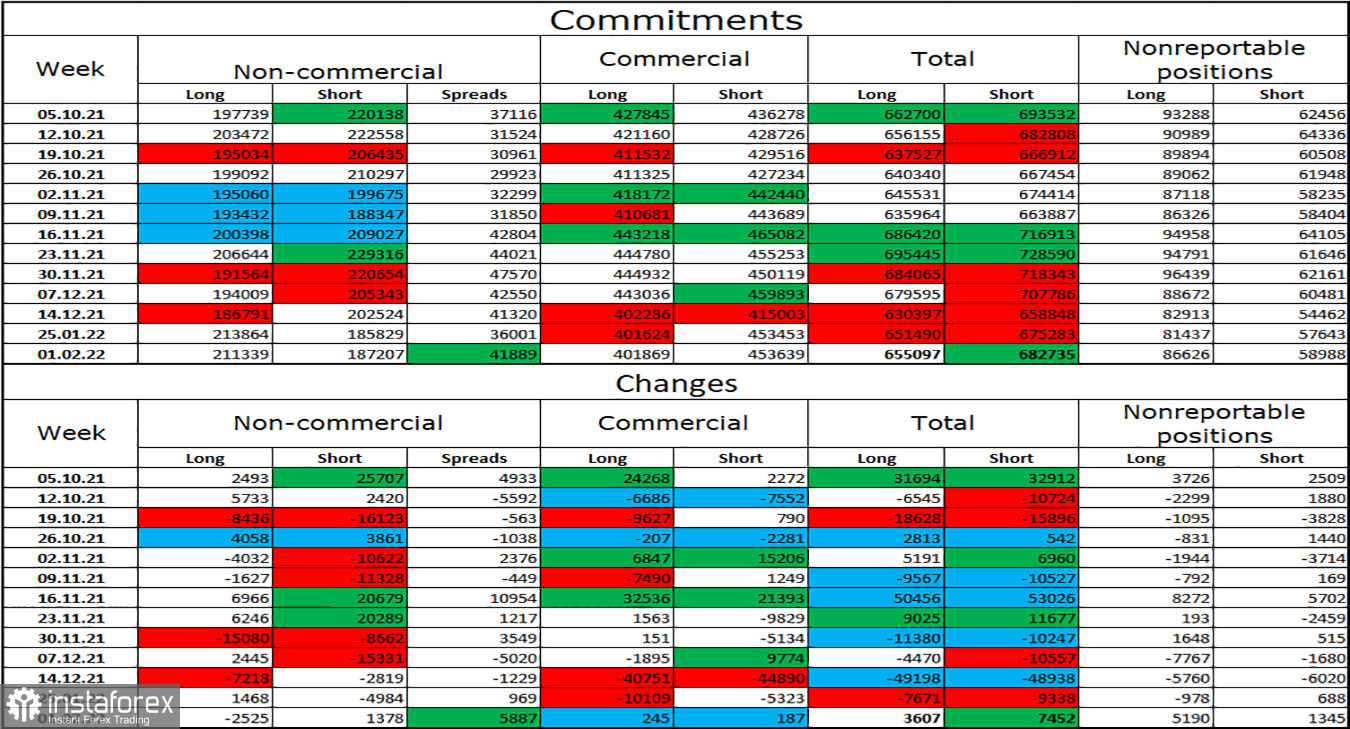

COT (Commitments of Traders) report:

During the last week covered by the report, traders closed 2,525 Long positions and opened 1,378 Short position, indicating an increasingly bearish trend. The total number of open Long positions is 211,000, and the amount of open Short positions is 187,000. The mood of Non-commercial players is now predominantly bullish, which could push the pair up even further. For the past few weeks, the number of long positions have been on the increase, while short positions have declined. This change in trader sentiment could indicate a possible uptrend during the next few months.

US and EU economic calendar:

EU - European Commission economic outlook (10-00 UTC)

US - CPI data (13-30 UTC)

The US CPI data is the most important event today and could influence traders significantly.

Outlook for EUR/USD:

Traders are advised to open new short positions if the pair closes below 1.1404 on the H4 chart, targeting 1.1357 and 1.1250. Long positions could be opened if the pair closes above 1.1450, with 1.1552 being the target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română