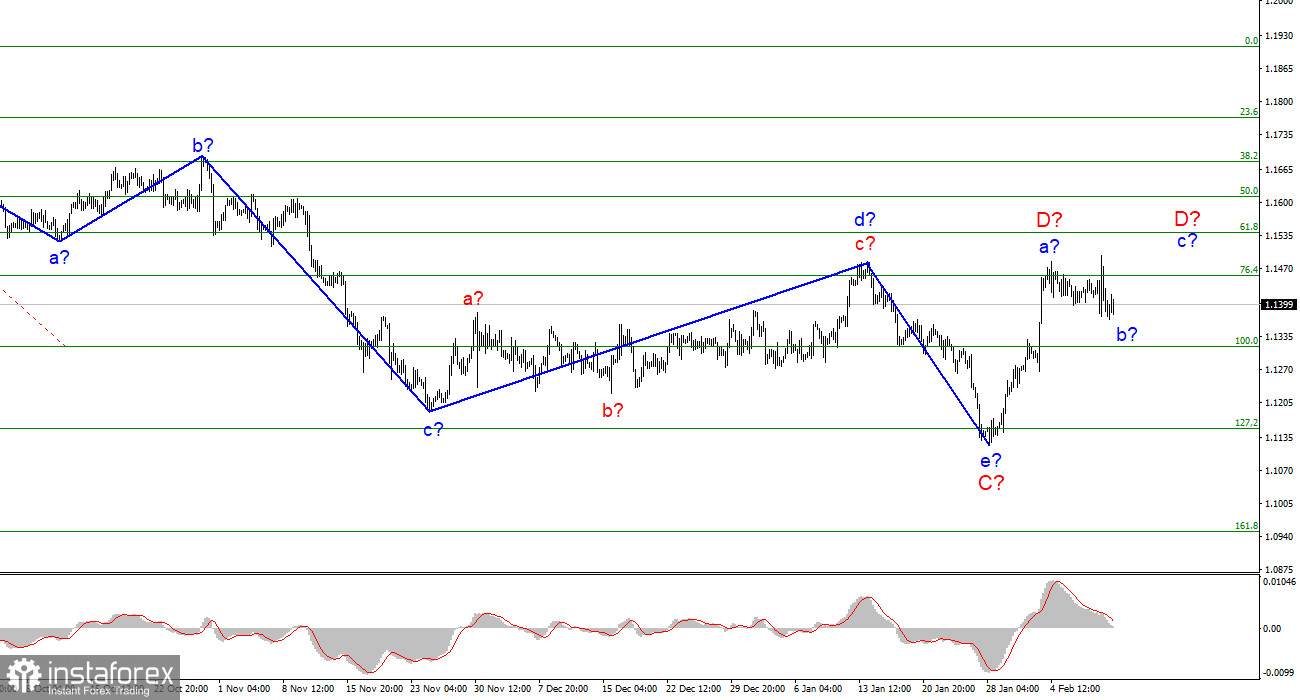

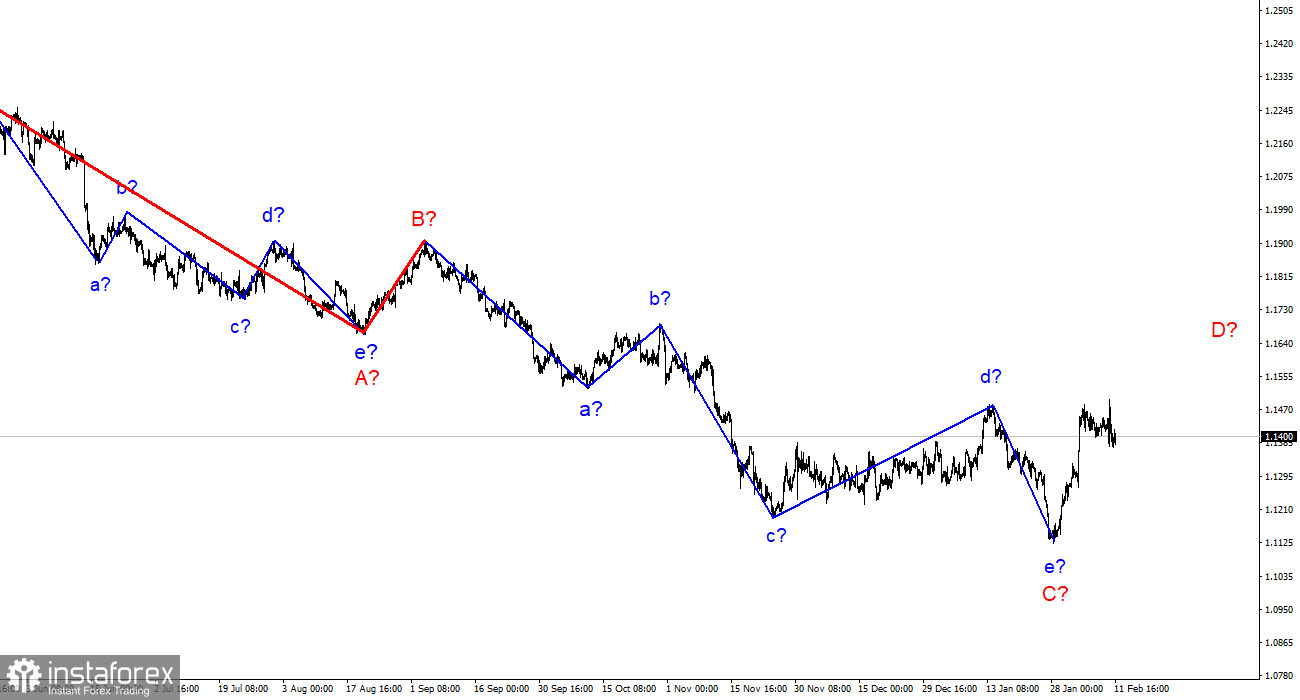

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes and now it no longer looks as unambiguous as before. Last week, there was a strong increase in quotes, so the wave e-C was recognized as completed. Therefore, the current upward wave is either D or 1. Attempts to break through the 1.1455 mark, which corresponds to 76.4% Fibonacci, were unsuccessful, which indicates the possible completion of the construction of an upward wave. The internal wave structure of this wave is quite complex. It can be interpreted as an unfinished wave D, or it can be interpreted as a completed wave D and the first waves as part of a new descending wave E. The US inflation report confused the cards, as the reaction to it was violent and did not quite fit into the current wave markup, which implied an increase in demand for the dollar. However, yesterday, the instrument grew quite a lot, and now the upward wave looks ambiguous.

The wave marking is confused, there is hope for the 1.1455 mark.

The euro/dollar instrument fell by 25 basis points on Friday and generally moved very weakly. The decline in the quotes of the instrument began yesterday evening after the instrument rose by 115 points from the low of the day. This is the reaction to the inflation report, which continues to accelerate in the US. Since the wave marking is now seriously confused, I consider the 1.1455 mark as the key one. Two unsuccessful breakout attempts indicate that the market is not ready for further purchases of the euro currency. And, in fairness, it should be noted that the news background now also does not speak in favor of the growth of the value of the euro currency. At the moment, almost everything rests on the monetary policy of the Fed and the ECB. And here everything remains unchanged, no matter what economic reports come out. The situation is aggravated for the euro currency by the fact that the European Commission lowered forecasts for economic growth for 2022 and raised the inflation forecast. And the ECB, in turn, has not given any signals about its readiness to raise rates this year. We get the following situation: the economy in the Eurozone will slow down, and inflation will grow even without an increase in the ECB interest rate. The ECB cannot raise the rate, as this will further slow down the European economy. There are no other methods of influencing inflation. The economy can only be stimulated by lowering rates or expanding the QE program. This year, the ECB plans to end the QE program to stop the growth of inflation. There is nowhere to lower rates further: they are already negative. A stalemate for the ECB. And with such a news background, the market is unlikely to increase demand for the euro currency. Therefore, I am waiting for the construction of a new downward wave E.

General conclusions.

Based on the analysis, I conclude that the construction of the descending wave C is completed. However, wave D can already be completed too. If so, now is a good time to sell the European currency. At least with a target located near the 1.1314 mark. Another upward wave can be built inside wave D. And if the current wave is recognized not as D, but as 1 as part of a new upward trend segment, then a successful attempt to break the 1.1455 mark should be made. Thus, now there are cautious sales based on MACD signals.

On a larger scale, it can be seen that the construction of the proposed D wave has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There are reasons to assume that wave D has already been completed, but a further increase in quotes will force us to reconsider this assumption.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română