Overview :

The EUR/USD pair traded in different directions in the range of 1.0360 - 1.0209 and closed the day without significant changes. Today it fell a little, dropping from the top price of 1.0360 to 1.0245. The EUR/USD pair stayed below the psychological level of 1.0270 over the weekend, indicating a lack of urgency to accumulate at the current levels. The bears are attempting to extend the EUR/USD pair's decline below 1.0270 in the week beginning of this week. Following the price of 1.0270 rejection, the seller takers still have the upper hand in the market, as they were able to impose more correction on the EUR/USD pair from the price of 1.0270. The EUR/USD pair couldn't reach stiff resistance at 1.0360 and pulled back near 1.0270 support, which could be a swing entry opportunity. On the hourly chart, the EUR/USD pair is still trading below the MA (100) H1 moving average line (1.0270). The situation is similar on the one-hour chart. Based on the foregoing, it is probably worth sticking to the north direction in trading, and as long as the EUR/USD pair remains below MA 100 H1, it may be necessary to look for entry points to buy for the formation of a correction. The EUR/USD pair slides below 1.0270 mark amid rebounding oil prices, modest USD weakness. The EUR/USD pair maintained its offered tone through the early European session and slipped below the 1.0270 psychological mark, hitting a fresh daily low in the last three hour at the price of 1.0209. The RSI is still signaling that the trend is downward as it is still strong below the moving average (100). Additionally, the RSI starts signaling a downward trend.

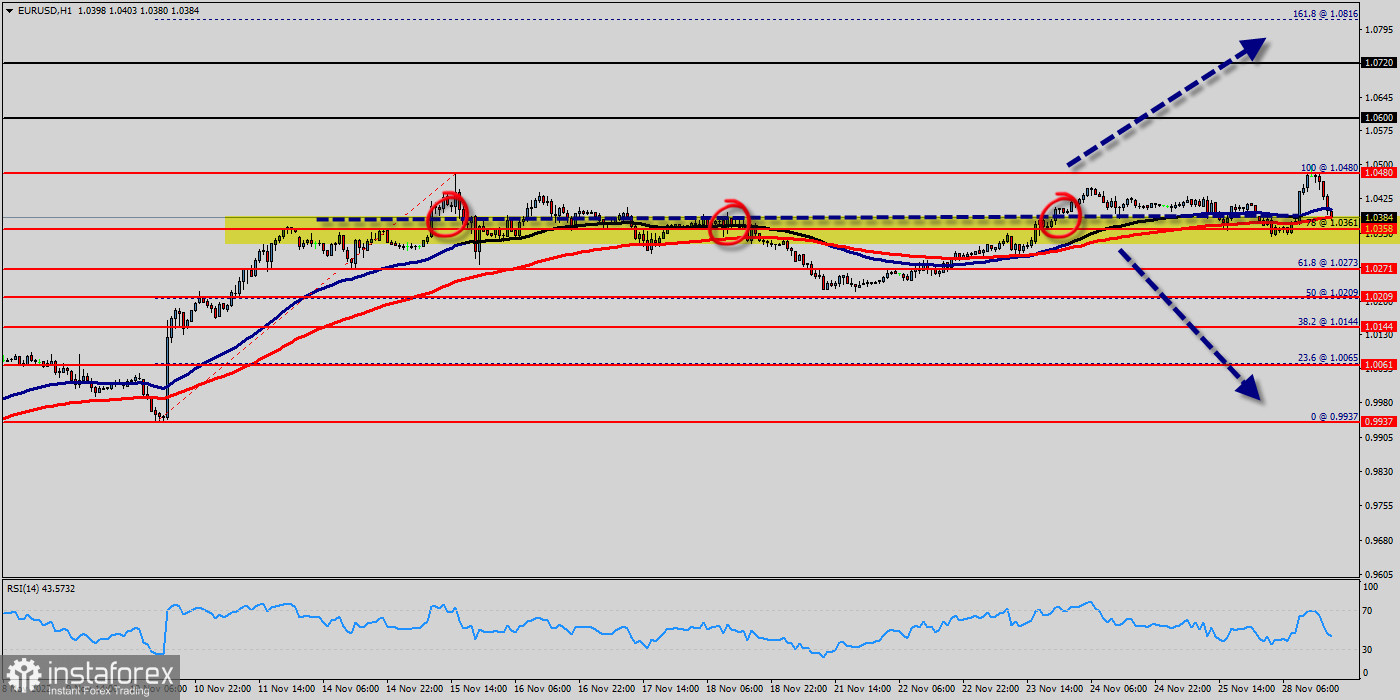

Key level sets at the price of 1.0270. The EUR/USD pair is at an all-time high against the dollar around the spot of 1.0368 for 2 months. The EUR/USD pair is inside in upward channel. Closing above the major support (1.0270) could assure that the EUR/USD pair will move higher towards cooling new highs. The EUR/USD pair is continuing rising by market cap at 1.15% in a day, 5.25% in a week, and 27.75% in a month, and is trading at the area of 1.0270 and 1.0368 after it reached 1.0480 earlier. The EUR/USD pair has been set above the strong support at the price of 1.0270 which coincides with the 61.8% Fibonacci retracement level. This support has been rejected three times confirming the veracity of an uptrend. The bullish trend is currently very strong on the EUR/USD pair. As long as the price remains above the support levels of 1.0270 and 1.0300, you could try to benefit from the growth. The first bullish objective is located at the price of 1.0403. The bullish momentum would be boosted by a break in this resistance (1.0480). The hourly chart is currently still bullish. At the same time, some stabilization tendencies are visible between 1.0270 and 1.0480 in a few minutes. Together with the relatively large distance to the fast-rising 100-day moving average (1.0368), there are some arguments for a relief rally in coming months on the table. The EUR/USD pair is at highest against the dollar around the spot of 1.0368 and 1.0480 USD for three weeks - the EUR/USD pair is inside in upward channel. The EUR/USD pair decreased within an up channel, for that the EUR/USD pair its new highest 1.0403. Consequently, the first support is set at the level of 1.0270. Hence, the market is likely to show signs of a bullish trend around the area of 1.0270.

The US dollar's strong gains against the Euro have continued today ahead of the sturdy news. The common currency reached a high of more than three days earlier this morning. This technical analysis of EUR/USD looks at the one-hour chart. The highest price that EUR/USD reached for that period was 1.0480 (last bullish wave - top). The lowest price that the EUR/USD pair reached during that period was 1.0406 (right now). The bias remains bearish in the nearest term testing 1.0352 or lower. Immediate support is seen around 1.0352. A clear break below that area could lead price to the neutral zone in the nearest term. Price will test 1.0300, because in general, we remain bearish this week. Yesterday, the market moved from its top at 1.0455 and continued to drop towards the top of 1.0400. Today, on the one-hour chart, the current fall will remain within a framework of correction. However, if the pair fails to pass through the level of 1.0480 (major resistance), the market will indicate a bearish opportunity below the strong resistance level of 1.0480 (the level of 0.9961 coincides with tha ratio of 100% Fibonacci retracement). The EUR/USD pair settled below 1.0480 and is testing the support level at 1.0350. RSI and Moving averages continue to give a very strong sell signal with all of the 50 and 100 EMAs successively above slower lines and below the price. The 50 EMA has extended further below the 100 this week. Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength below the moving average (100) and (50). An alternative scenario is a final consolidation below MA 100 H1, followed by growth arund the area of 1.0300. The one-hour chart favors a downward extension, as the pair broke below its 50 and 100 EMAs, both gaining downward traction. Support from MAs comes initially from the value zone between the 50 and 100 EMAs. Industriously, Euro Is Losing ground against U.S. Dollar around +217 pips. Since there is nothing new in this market, it is not bullish yet.

Technical outlook : The EUR/USD pair faced resistance at the level of 1.0360, while minor resistance is seen at 1.0270. Support is found at the levels of 1.0209 and 1.0146. Pivot point has already been set at the level of 1.0270. Equally important, the EUR/USD pair is still moving around the key level at 1.0270, which represents a minor resistance in the H1 time frame at the moment. Yesterday, the EUR/USD pair continued moving downwards from the level of 1.0270. The pair will to the bottom around 1.0209 from the level of 1.1531 (coincides with the ratio of 50% Fibonacci retracement). In consequence, the EUR/USD pair broke support, which turned into strong resistance at the level of 1.0360. The level of 1.0270 is expected to act as the minor resistance today. We expect the EUR/USD pair to continue moving in the bearish trend towards the target levels of 1.0209 and 1.0144. On the downtrend: If the pair fails to pass through the level of 1.0270, the market will indicate a bearish opportunity below the level of 1.0270. Moreover, a breakout of that target will move the pair further downwards to 1.0209 in order to form a new double bottom. So, the market will decline further to 1.0209 and 1.0144. On the other hand, if a breakout happens at the support level of 1.0360, then this scenario may be invalidated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română