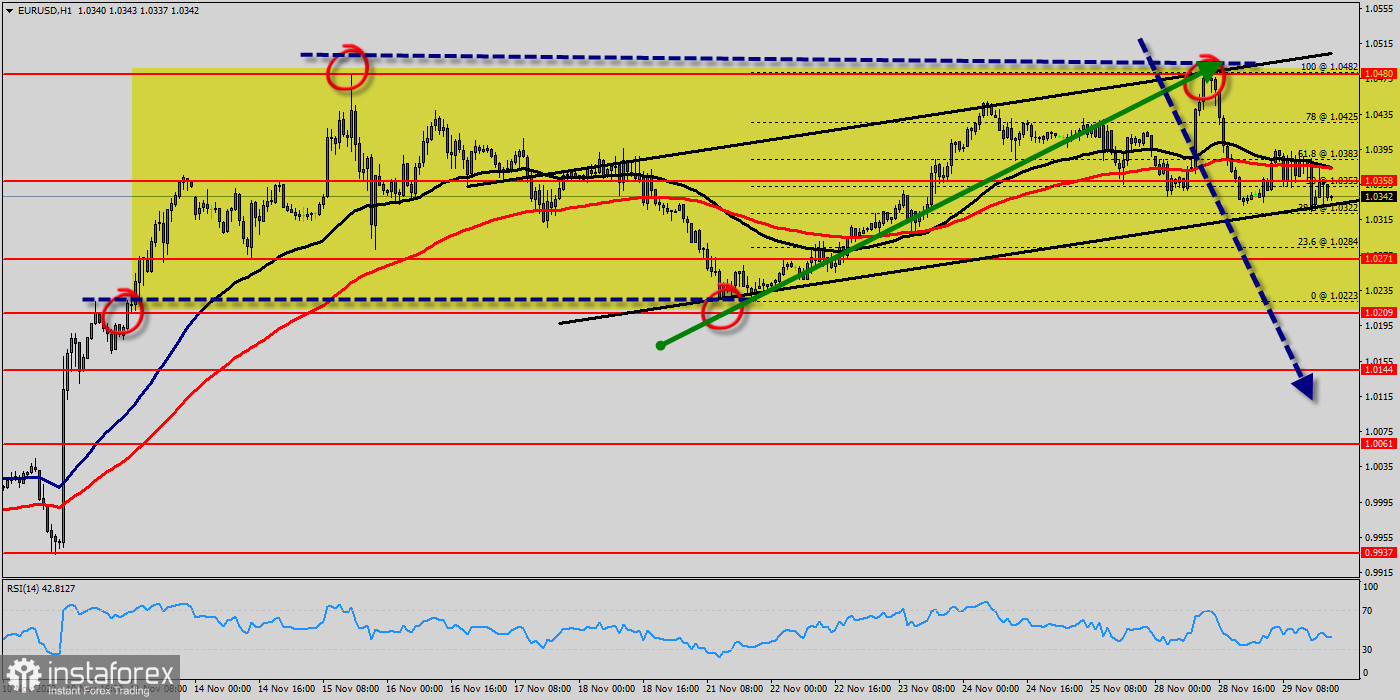

The EUR/USD pair has faced strong resistances at the levels of 1.0425 because support had become resistance on Nov. 29, 2022. So, the strong resistance has been already formed at the level of 1.0425 and the pair is likely to try to approach it in order to test it again. However, if the pair fails to pass through the level of 1.0425, the market will indicate a bearish opportunity below the new strong resistance level of 1.0425 (the level of 1.0425 coincides with a ratio of 78% Fibonacci). Moreover, the RSI starts signaling a downward trend, as the trend is still showing strength above the moving average (100) and (50).

The EUR/USD pair continues to move downwards from the level of 1.0480. Yesterday, the pair dropped from the level of 1.0480 to the bottom around 1.0300. But the pair has rebounded from the bottom of 1.0300 to close at 1.0333. The EUR/USD pair's outlook and further decline is expected with 1.0425 minor resistance intact.

Current down trend should move from the last resistance levels of 1.0425 and 1.0482. Firm break there could prompt downside acceleration to last bearish wave of 1.0425 and 1.0482 (these resistance levels have been rejected several times confirming the veracity of a downtrend). Today, the first support level is seen at 1.0300, the price is moving in a bearish channel now. Furthermore, the price has been set below the minor resistance at the level of 1.0284, which coincides with the 23.6% Fibonacci retracement level.

Thus, the market is indicating a bearish opportunity below 1.0425 so it will be good to sell at 1.0425 with the first target of 1.0300. It will also call for a downtrend in order to continue towards 1.0271. The daily strong support is seen at 1.0271. On other hand, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.0480.

Signal :

According to previous events, the EUR/USD pair is still moving between the level of 1.0480 and the 1.0284 level (these levels coincided with the fibonnacci retracement levels 23.6% and last bullish wave). It should be noted that the 1.0425 price will act as a minor resistance today. Therefore, it will be too gainful to sell short below 1.0425 and look for further downside with 1.0300 and 1.0284 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 1.0480 level today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română