As long as the financial markets continue to play Russian roulette, EURUSD bulls cannot take advantage of the trump card that Christine Lagarde gave them after the February meeting of the ECB. And even though Lagarde, after her historic speech at a press conference, has already spoken several times about patience, investors cannot be deceived. They sensed the hawkish shift of the European Central Bank and are ready to buy the euro. Alas, but so far the "bulls" on the main currency pair are hindered by events in Eastern Europe.

Despite the fact that the share of Russian exports and imports in the structure of foreign trade of the eurozone is negligible, the currency bloc and Europe as a whole are highly dependent on gas supplies from this country. At the same time, the start of hostilities in Ukraine should be regarded as a double-edged sword for the euro. On the one hand, the higher the cost of blue fuel rises, the stronger the energy crisis will hit the economy of the currency bloc. Its slower dynamics compared to the US will contribute to the flow of capital from the Eurozone to the Americas, which will ultimately result in a fall in EURUSD.

Dynamics of the share of foreign trade of the eurozone with Russia

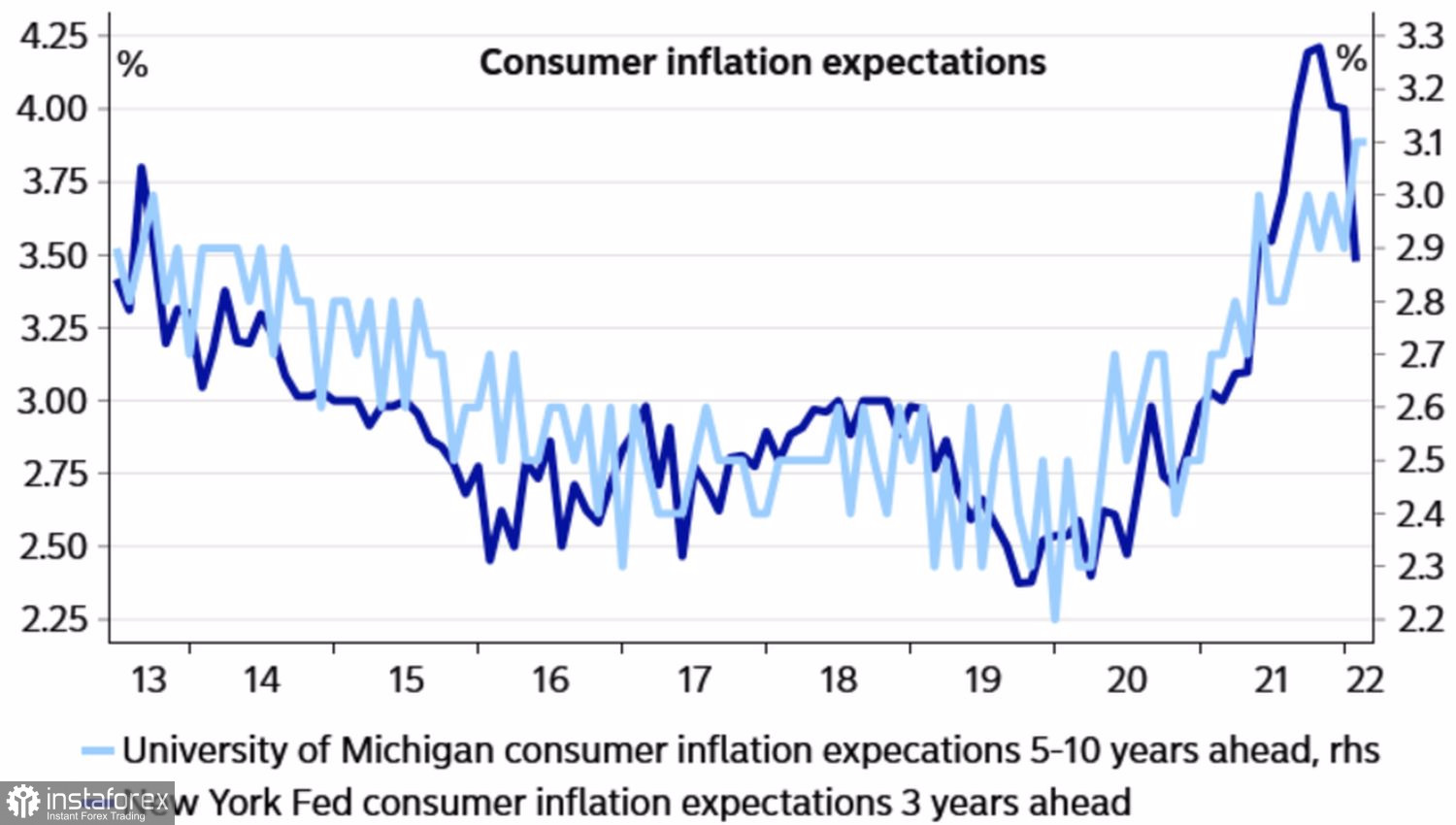

On the other hand, the higher the cost of gas, the higher the inflation in the euro area. And even though historically, central banks did not pay attention to energy prices when making decisions on monetary policy adjustments, today the situation is different. A further rise in CPI will increase inflationary expectations, making high inflation a self-fulfilling prophecy. The Fed realized this a long time ago, so FOMC officials armed themselves with hawkish rhetoric. The latter helped bring down inflationary expectations in the US.

Dynamics of inflation expectations in the USA

No matter how the colleagues from Washington go in Frankfurt, which will be a weighty argument in favor of strengthening the euro. ECB Chief Economist Philip Lane is already saying eurozone consumer prices are unlikely to fall below 2% over the next two years and talks about normalizing the ECB's monetary policy. Yes, the words "patience" and "consistency" slip through his speech, but the very fact that a person who was previously confident in reducing inflation to 1.7%-1.8% in 2023 has now changed his position plays into the hands of "bulls" on EURUSD.

The focus of investors in the week to February 25 will be the talks between the US and Russia on the situation in Eastern Europe, as well as a massive block of macroeconomic statistics for the euro area, including business activity from Markit and business climate from IFO. The euro clearly needs a fresh driver to continue the upward campaign, and the combination of the de-escalation of the Russian-Ukrainian conflict and the positive from the economy of the currency bloc can create a tailwind for the bulls in the main pair.

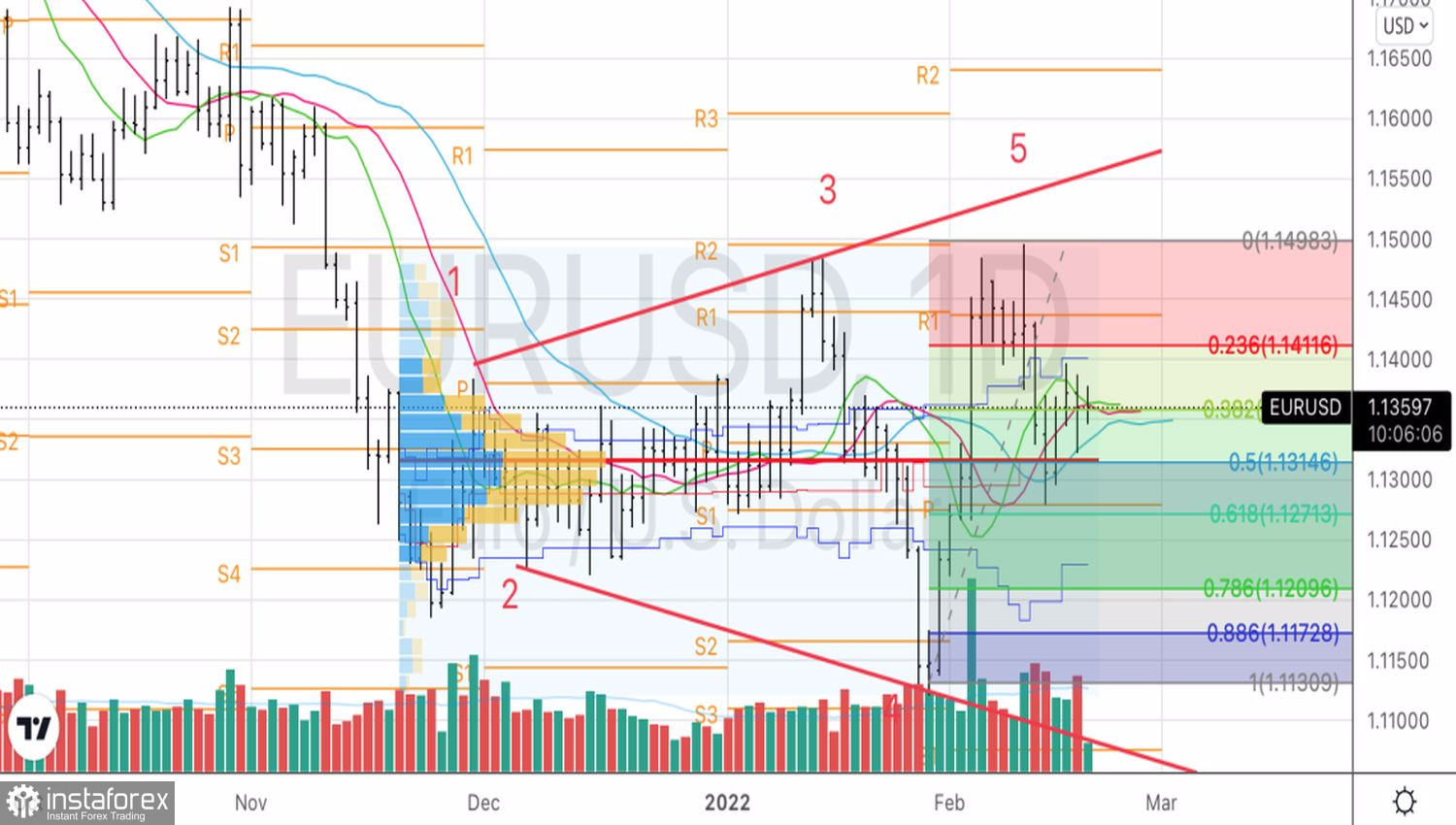

Technically, on the daily chart, EURUSD continues to win back the Broadening Wedge pattern. The reason for buying the euro against the US dollar will be a confident assault on resistance at 1.1395 (local maximum), 1.1415 (23.6% Fibonacci retracement from wave 4-5), and 1.1435 (pivot level), as well as a rebound from support at 1.1315 and 1.1275 (50% and 61.8% Fibonacci from wave 4-5).

EURUSD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română