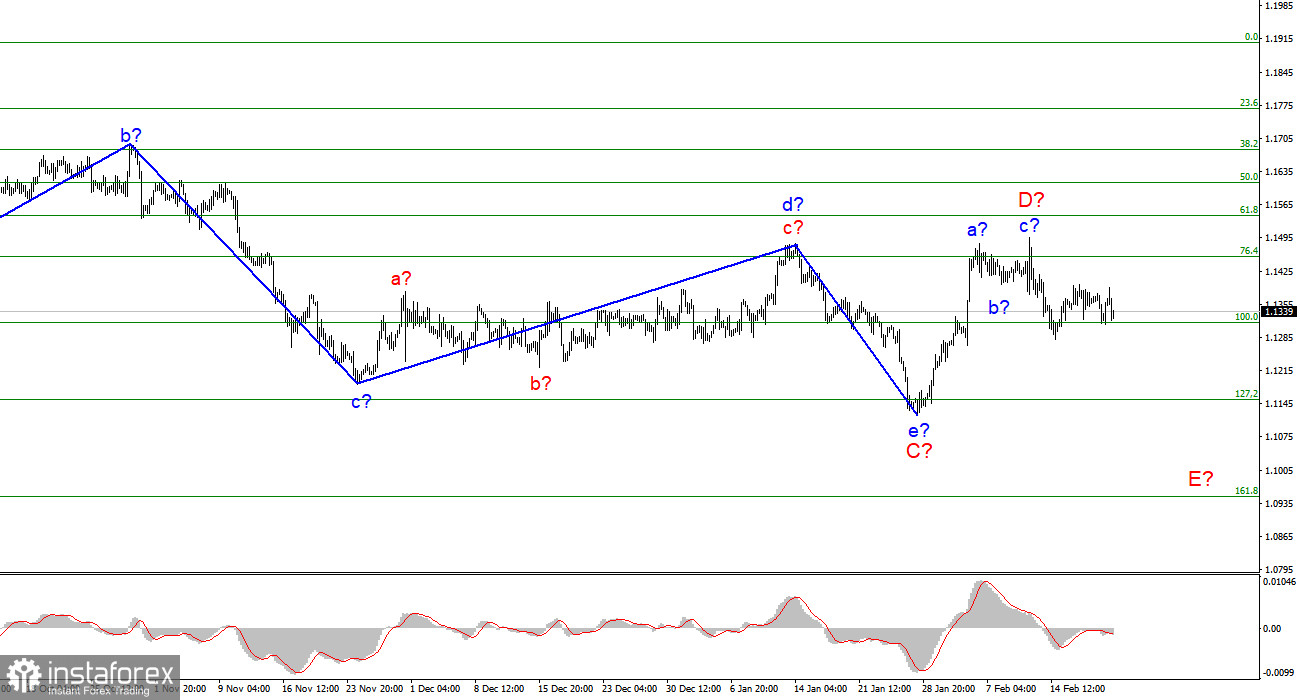

On the four-hour chart, the wave picture for the euro/dollar pair has changed. Last week, a decline in the quote was represented by wave E. Now, I suppose that wave D is completed since the news flow is supporting the US dollar.

Thus, it is highly possible that the trading instrument has started the formation of wave E. At the same time, wave D will hardly become more complicated since it is almost finished. There is another variant that presupposes the end of the formation of the downward section of the trend. If this assumption is true, on January 28, a new upward section of the trend began its formation. However, amid the current situation, the upward section of the trend is unlikely to be formed. A break of 1.1341 will point to the market's readiness to sell the euro.

Market remains stagnant

On Monday, the euro/dollar pair was hovering within 40 pips. During the whole day, market participants were closely monitoring the geopolitical situation in Ukraine. In addition, everyone was focused on the speeches provided by the heads of the US, Russia, the UK, and the EU. All the information was devoted to the issue. The macroeconomic calendar was absolutely empty. On February 24, Vladimir Putin and Joe Biden are planning to hold a meeting. Notably, all the previous talks led to nothing. There are no reasons to expect other results.

Stock market continues falling. Meanwhile, the Russian ruble dropped to 79 against the US dollar. In fact, it is not the limit especially if Russia recognizes Luhansk and the Donetsk People's Republic. In this case, Moscow will have grounds to send its own troops to Luhansk and the Donetsk People's Republic as a peacekeeping mission.

Conclusion

Judging by the analysis, the formation of wave D is finished. Thus, it is high time to sell the euro with the target of 1.1153 amid every downward signal of the MACD indicator. A new upward wave could be formed within wave D. A successful break of 1.1314 will point to the market readiness to sell the euro.

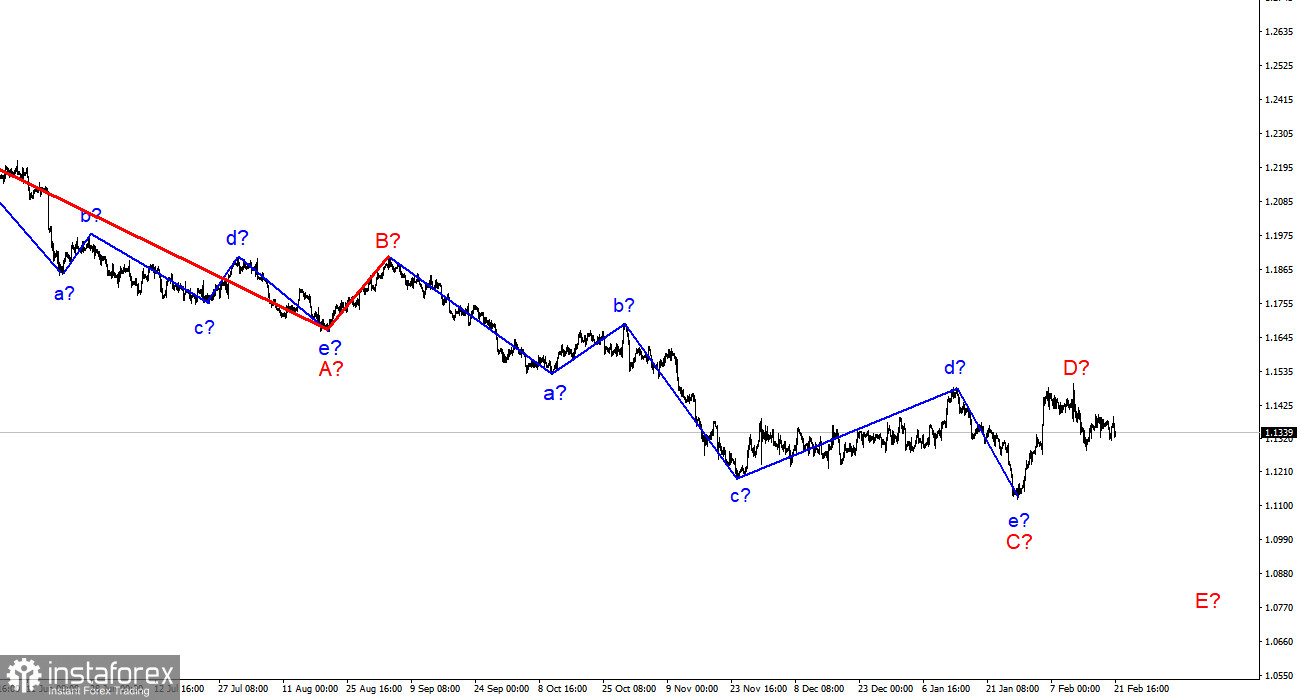

On bigger time frames, we see that wave D is under formation. It could be shorter than expected or consist of three waves. Taking into account that all the previous waves were not long and were of almost the same length, wave D could also be quite short. Notably, there is an assumption that wave D is completed. In this case, wave E may start its formation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română