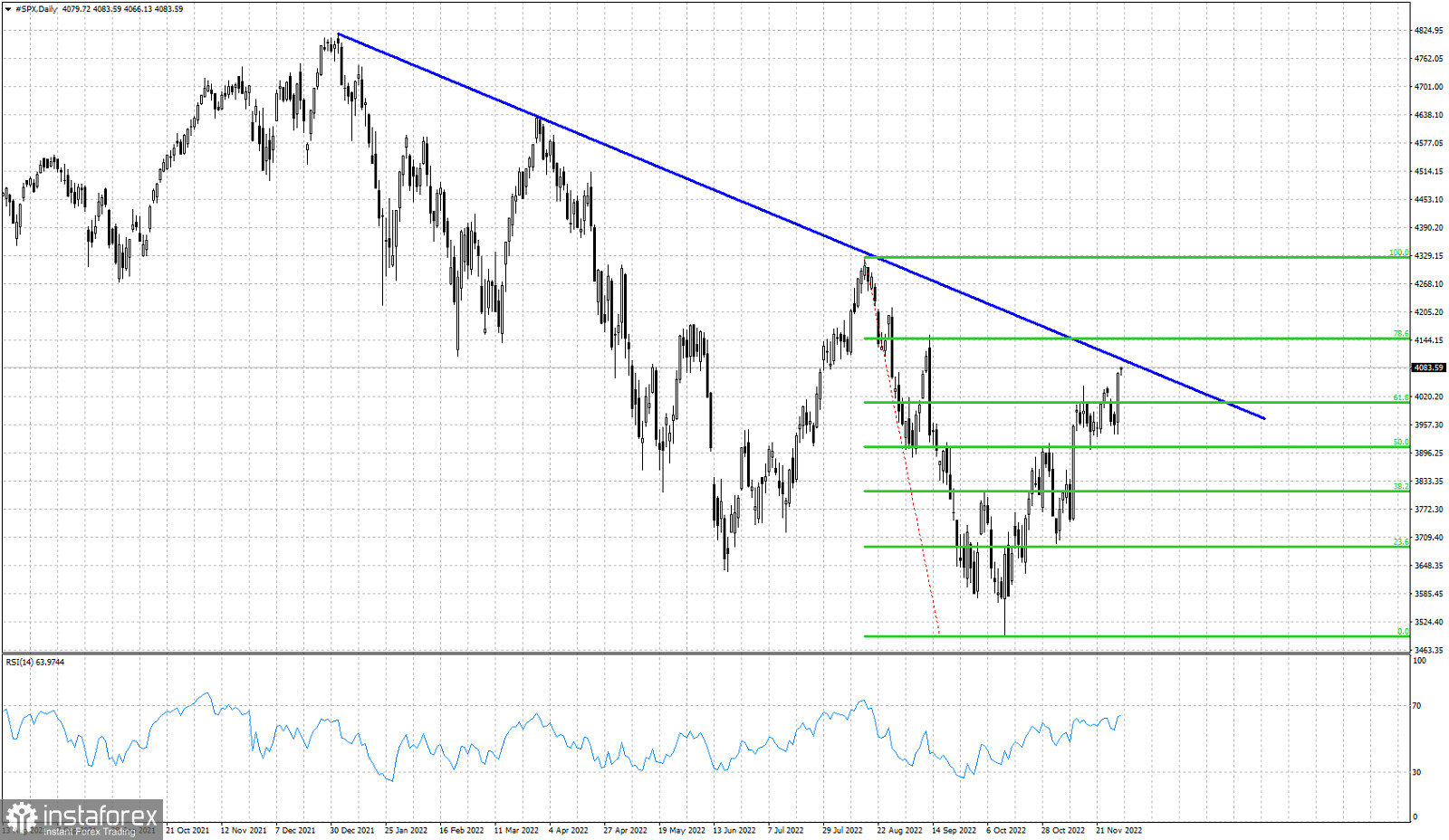

Blue line- resistance

Green lines- Fibonacci retracement levels

Short-term trend remains bullish for SPX as price continues making higher highs and higher lows. Price has now reached a very important resistance area. Price is challenging the blue downward sloping trend line that was already tested twice and the index got rejected. On the other hand price has broken above the 61.8% Fibonacci retracement which is a sign of strength. If the break above the 61.8% level is combined with a break of the trend line resistance at 4,100, then we will have a very strong bullish signal. The RSI is approaching overbought levels. The chances of a reversal are increasing as long as price does not break above the resistance. Both previous times price got rejected at the blue trend line the RSI did not move much higher than the 70 level. At the March top the RSI did not even pass above the 70 level into overbought territory. Support is found at recent low of 3,936, so bulls need to defend this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română