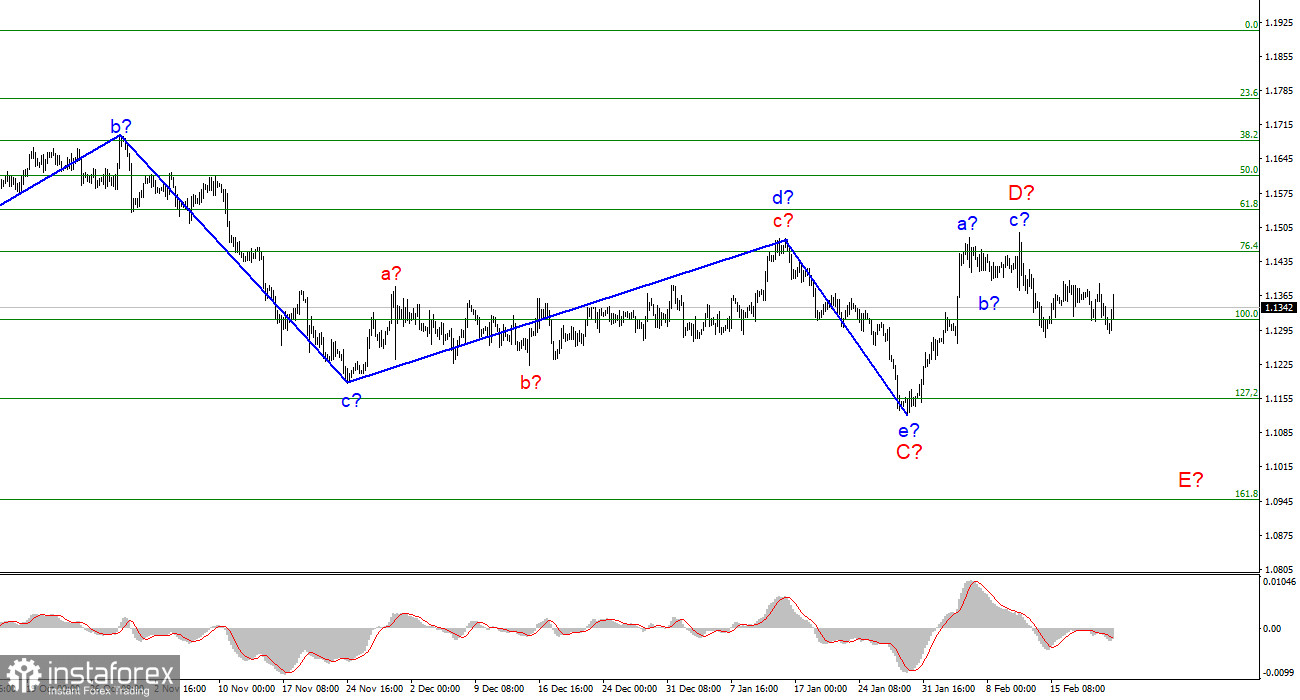

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes and now it no longer looks as unambiguous as before. Nevertheless, the decline in quotes has begun and now it is interpreted as a wave E. At the moment, I believe that wave D is completed, since the news background openly supports the rise of the US currency, and the wave itself has taken a three-wave form. Based on this, I think that the probability that the instrument has moved to the construction of wave E is 80 percent. I give 20% of the probability that wave D will take a more complex form, or the entire wave markup will require additions and adjustments. There is also a backup option with the completion of the construction of a downward trend section. In this case, on January 28, the construction of a new upward trend section began. But the same news background now does not give any reason to expect that an upward section of the trend will be built. A successful attempt to break through the 1.1314 mark, which corresponds to 100.0% Fibonacci, will indicate that the market is ready for new sales of the European.

There are many more questions around the LPR and the DPR than there are answers.

The euro/dollar instrument was not trading most actively again on Tuesday. Nevertheless, at the end of the day, the quotes still increased by 40 basis points, which did not affect the current wave markup in any way. Thus, the internal wave structure of the proposed wave E, which has just begun its construction, may already become much more complicated. The news background now entirely concerns the topic of Ukraine and Russia. Yesterday, Vladimir Putin recognized the independence of the LPR and the DPR, but there was no clear statement about the borders of these unrecognized republics around the world. In particular, the DPR and LPR authorities are calling on Kyiv to voluntarily withdraw its troops outside the Luhansk and Donetsk regions, threatening "appropriate measures" if this requirement is not met. Kyiv is not satisfied with this position and it does not intend to conduct any negotiations with the separatists at all. The State Duma of the Russian Federation stated that the establishment of borders is a matter for the DPR and the LPR, so this issue will not be raised. Nevertheless, Moscow sent military personnel to the unrecognized republics to establish peace. Now it is unclear what will happen next? Sanctions may be imposed against the Russian Federation, but so far they have been imposed only against several Russian banks, the Rottenberg oligarchs, and the republics of the DPR and LPR themselves. Moreover, these sanctions were imposed by the United Kingdom, not the United States, which most of all threatened to "take destructive measures." Probably, the response from the American authorities will still follow, but it is unlikely that it will be as terrible as Western media have written in recent weeks. Therefore, I am even inclined to the point of view that in the near future the ruble will gradually recover. In the case of the euro/dollar instrument, the situation is not quite clear right now. The wave pattern indicates the continuation of the construction of a descending wave and the news background supports this option. Therefore, we need to wait for a new decline.

General conclusions.

Based on the analysis, I conclude that the construction of wave D is completed. If so, now is a good time to sell the European currency with targets located around the 1.1153 mark, which corresponds to 127.2% Fibonacci, for each MACD signal "down". A successful breakout attempt of 1.1314 will indicate that the market is ready for new sales of the instrument.

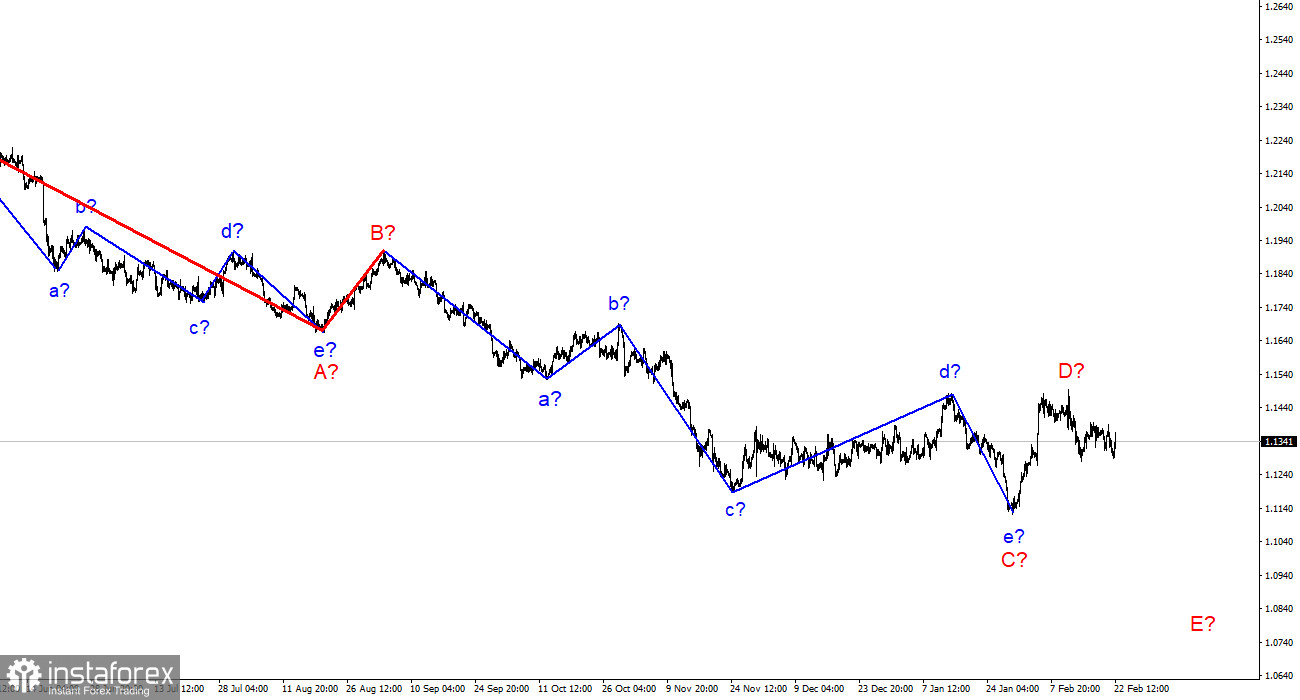

On a larger scale, it can be seen that the construction of the proposed wave D has now begun. This wave can be shortened to three-waves. Considering that all the previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There is reason to assume that wave D has already been completed. Then the construction of wave E began.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română