Bitcoin spiked 13% yesterday. The rally continues near the resistance level of $43,300. Demand for the flagship cryptocurrency is gradually building up as Russia's invasion of Ukraine continues and the United States introduces new sanctions. Meanwhile, ether rose 11% to $2,922.

Bitcoin has been seen as digital gold for years. The asset has been used as a hedge against inflation and a safe haven to protect investors' funds at the time of upheavals. However, everything changed when a plunge in US stocks triggered a fall in BTC after Russia had invaded Ukraine. It became clear that there was a high correlation between the world's most popular cryptocurrency and stock prices. The bear run in the crypto market went on even despite the fact that inflation kept hitting new all-time highs.

However, the situation may drastically change, experts say. They believe this might be a turning point for BTC and other cryptos in the wake of global uncertainty caused by the Ukrainian crisis. The crypto market is distancing itself from traditional markets. Decentralization and high efficiency are what make digital assets more popular. Despite the fact that some crypto exchanges blocked accounts of users in Russia and Belarus and some companies even transferred funds of Russians to help the Ukrainian military, demand for cryptocurrency keeps mounting. On Sunday, Mykhailo Fedorov, the vice prime minister of Ukraine, asked major exchanges to block the addresses of Russian users. Binance said it will block the accounts of Russian individuals who have been sanctioned, but will not "unilaterally" freeze the accounts of all Russian users. Other crypto exchanges have taken a similar stance.

BTC is expected to grow further as the US and the EU keep imposing new sanctions against Russia. Washington banned American companies and individuals from doing business with Russia's Central Bank and froze all its assets in the US. This comes in addition to sanctions targeting oligarchs and Russia's sovereign debt, and cutting the country off from the global financial system. There is an ongoing debate about whether bitcoin, which is not owned or issued by any financial institution, like the US central bank, can be used by Russia to evade sanctions. But the amount of cash in Russian hands is huge for the crypto market to digest. The liquidity issue is highly likely to arise if Russia tries to get around sanctions.

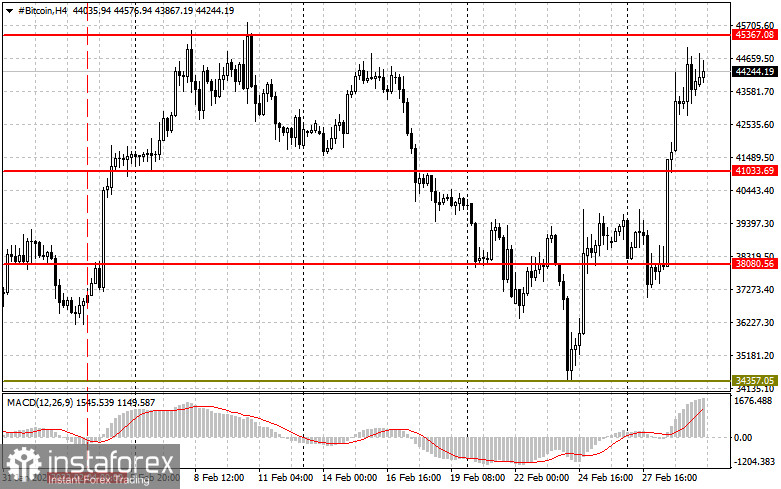

Technical picture of BTC:

BTC is now heading towards $45,300. Major players started actively buying the coin at around $37,000 yesterday. The asset rallied as investors were spooked by the current events. If the trading instrument goes down, the price will fall below the $38,080 low after a breakout at $41,000. The bearish trend will stop if BTC rises above $45,300 with the targets at $48,500 and $51,800. Under the current circumstances, the coin has upside potential in the long term.

Technical picture of ether:

In case of a breakout at $2,940, the levels of $3,190 and 3,400 will stand as targets. If pressure on ETH continues, long positions could be opened near the support level of $2,750. If the price breaks through this range, the asset may go to the $2,550 and $2,312 lows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română