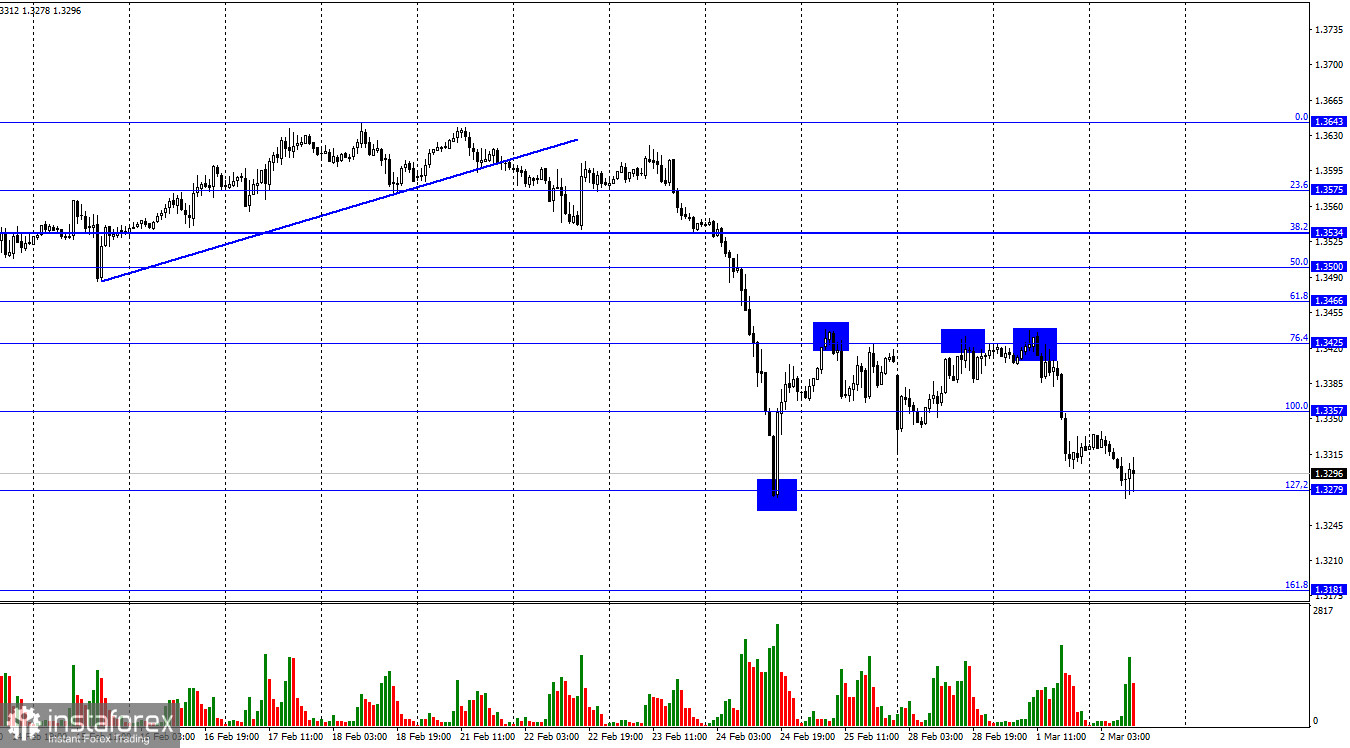

According to the hourly chart, the GBP/USD pair on Tuesday performed a new rebound from the corrective level of 76.4% (1.3425), a reversal in favor of the US dollar, and a fall to the corrective level of 127.2% (1.3279), which ended today. The rebound of the pair's rate from this level will allow bear traders to take a short break. But fixing quotes below the level of 127.2% will work in favor of continuing the fall towards the next Fibo level of 161.8% (1.3181). At the moment, I believe that the fall has a great chance of its continuation. I am closely monitoring all official data concerning the Ukrainian-Russian military conflict, and I believe that it is these data that now have the greatest impact on traders. Judge for yourself, yesterday the business activity index for the manufacturing sector was released in the UK. It grew in February by 0.7 and amounted to 58.0. The same index was released in the USA, with the same result.

It is unlikely that traders are now ready to respond to such data, and there are simply no others. Today, in the UK, there are no important entries in the calendar at all, and in the USA only Jerome Powell's performance can attract attention. What can Powell say? It should be remembered that he is the president of the Fed, that is, the central bank of the United States. It is unlikely that he will comment on the situation in Ukraine or announce sanctions against the Russian Federation. He can only outline the risks that the American economy may face in the near future, talk about monetary policy, rate hikes, and the timing of tightening. But traders have been ready for an interest rate hike for a long time. How can they be surprised here? Therefore, I do not think that traders will work out Powell's speech today. Most likely, geopolitical news will continue to be the most important for traders. The second round of negotiations between Ukraine and Russia may take place tonight.

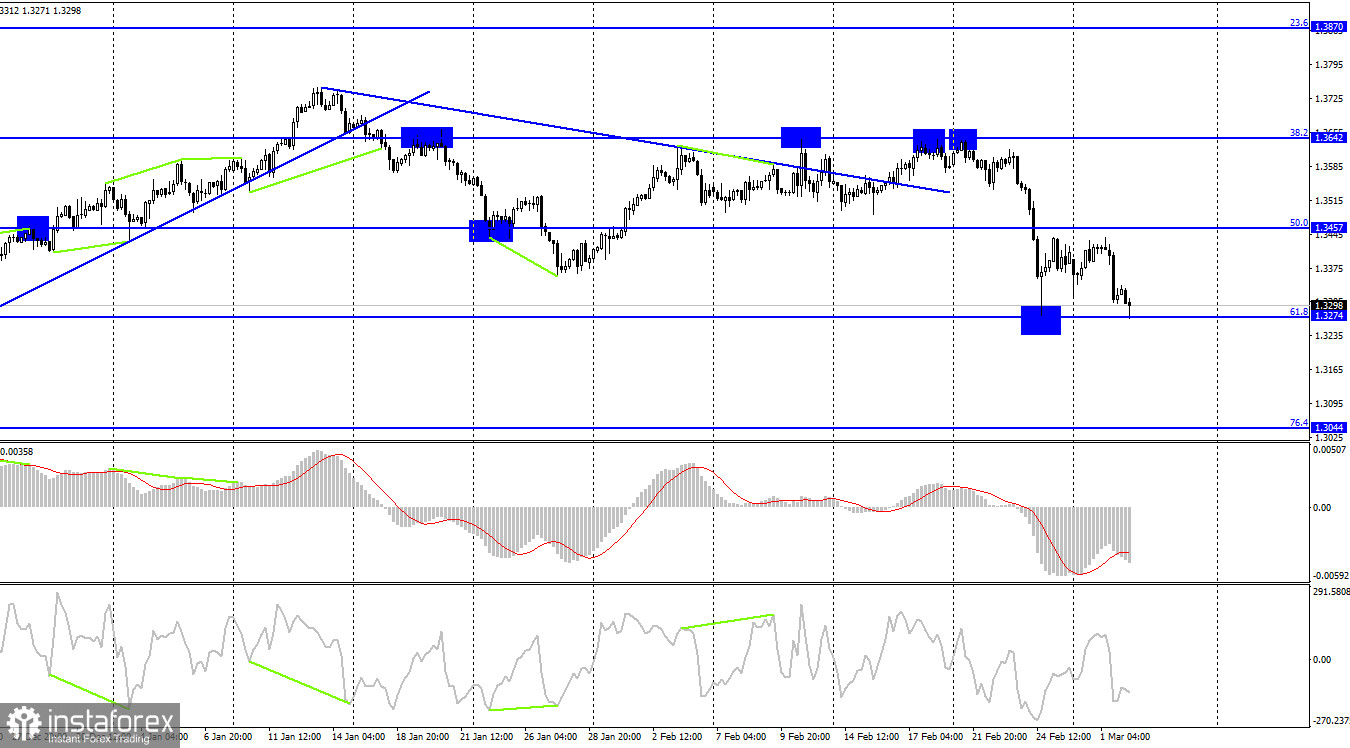

On the 4-hour chart, the pair performed a drop to the corrective level of 61.8% (1.3274) once again. A new rebound from this level will allow us to count on a reversal in favor of the British and some growth in the direction of the Fibo level of 50.0% (1.3457). Fixing the pair's rate below the level of 1.3274 will increase the probability of a further fall in the direction of the next corrective level of 76.4% (1.3044). In the near future, two "bullish" divergences may start brewing at once for the CCI and MACD indicators, but the level of 1.3274 and geopolitical news will be more important.

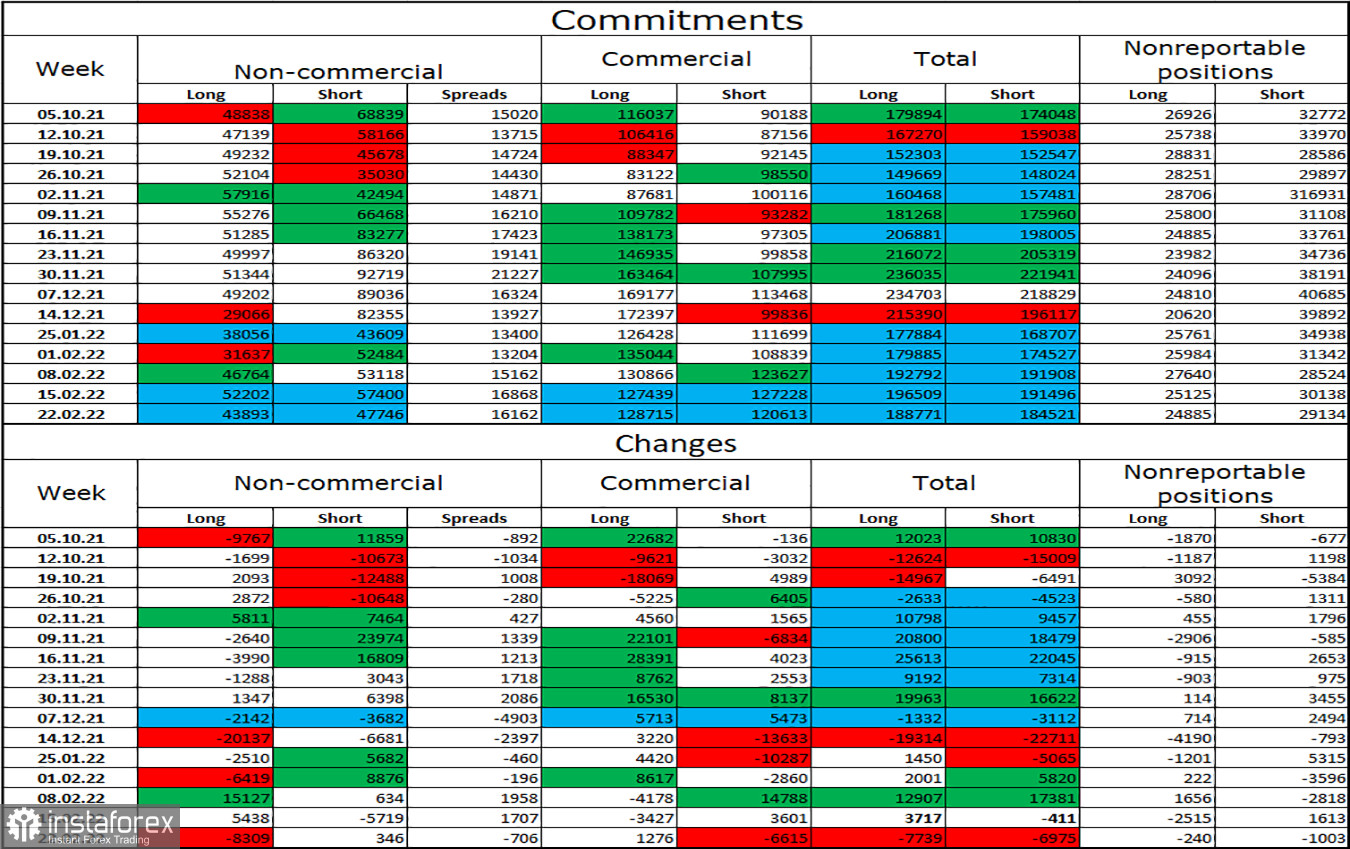

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts decreased in the hands of speculators by 8,309, and the number of short contracts increased by 346. Thus, the general mood of the major players has become more "bearish", but at the same time, equality in the number of long and short contracts is now observed in almost all categories of traders. Thus, I conclude that the mood is now more neutral than bearish. But even this does not matter much, since geopolitical factors can continue to have a very significant impact on the mood of traders. Therefore, their mood can change very sharply and quickly.

News calendar for the USA and the UK:

US - change in the number of employees from ADP (13:15 UTC).

US - Chairman of the Fed Board of Governors Jerome Powell will deliver a speech (15:00 UTC).

On Wednesday in the UK, the calendar of economic events does not contain important events. In America, only Powell's speech can affect the mood of traders. However, geopolitical news can interfere again at any moment.

GBP/USD forecast and recommendations to traders:

At this time, I would recommend selling the British dollar if a close is made under the corrective level of 127.2% (1.3279) with targets of 1.3181 and 1.3071. I would recommend buying the pound if there is a rebound from the 1.3279 level on the hourly chart with targets of 1.3357 and 1.3425.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română