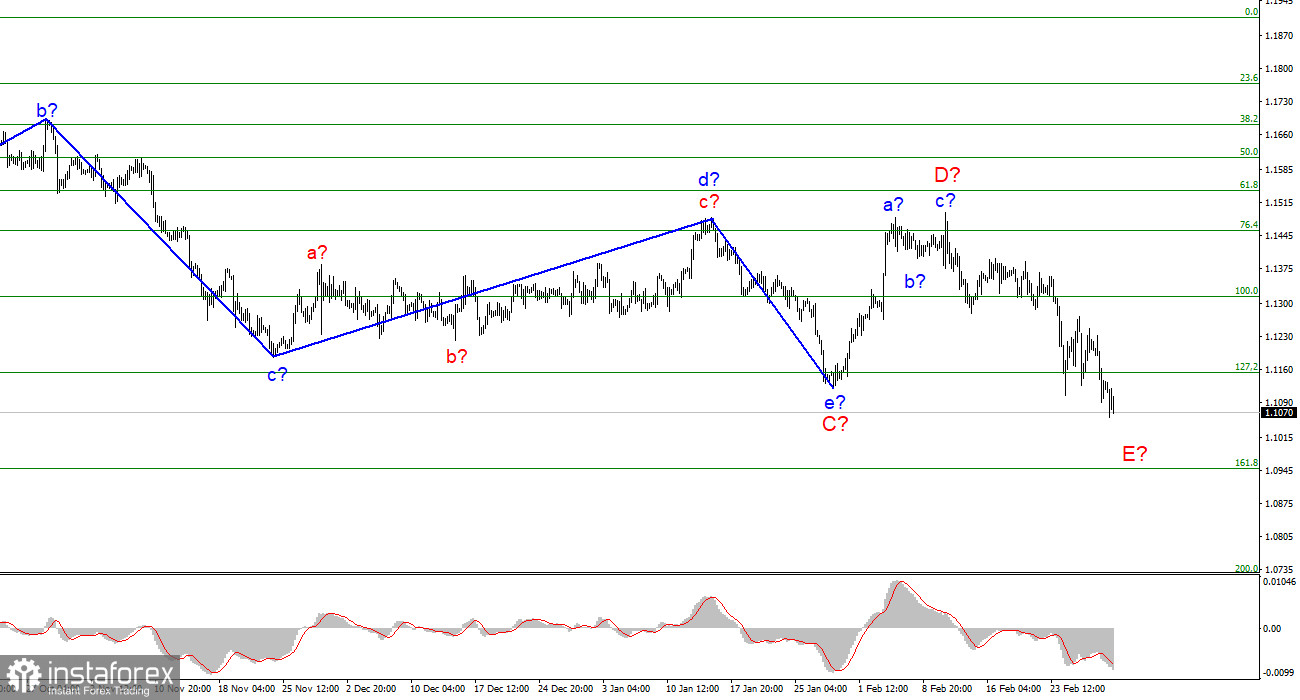

The wave layout on the 4-hour chart for EUR/USD has not changed lately and looks quite convincing. The European currency has been declining over the past few days, which comes fully in line with the current wave structure. On Monday, the pair was steady but it began to fall the next day. The current decline should be interpreted as wave E, which can turn out to have an extended form. At the moment, I believe that the formation of wave D is over, and the news background supports the demand for the US currency. Based on this, I believe that there is an 80% probability that the pair will continue to build the descending wave. Another 20% probability is that the entire wave counting will require some adjustments. However, these days, the market sentiment is largely shaped by the news background which is very unstable. Therefore, I believe that the decline will continue. Given the current situation in Ukraine, the whole wave structure can become very complicated.

Other factors

EUR/USD fell by 65 pips on Wednesday, another tough day for the European currency. Such deep falls in the euro do not happen often, but at the same time, the percentage of "bad days" for this currency is now very high. The news background is entirely devoted to geopolitics now. Today, the European Union released a rather important report on the consumer price index for February. Inflation has already risen to 5.8%. However, it is very difficult to say now whether high inflation is good or bad for the euro. Let me remind you that last year, when many countries faced rising inflation, the demand for local currencies also increased. The explanation is simple: higher inflation means higher chances that the central banks will tighten their monetary policies. At the moment, everything is quite clear with the Fed and the ECB, and the market's expectations remain the same.

The Fed announced its plan to raise the key rate in 2022 at least 5 times. The ECB, on the other hand, is not planning a rate hike. So, nothing will change much regardless of inflation. Therefore, today, it was hardly surprising to see that the market showed almost zero reaction to the inflation report. Following the release, the euro went up by 20 pips but then resumed its decline. This proves that traders are currently focused on the geopolitical news that is very discouraging at the moment. The situation in Ukraine remains tense, if not critical. The war continues, and all parties of the conflict are either involved in the military operations or creating sanctions and restrictions against each other. From my point of view, this approach does not help resolve the conflict, so the markets will stay in a suspended state. This means that the euro may continue to decline, especially given the current wave layout.

Conclusion

Based on the current analysis, I can conclude that the formation of the D wave is completed. If so, now is a good time to sell the European currency with the targets near 1.0949, which correspond to 161.8% Fibonacci, following every sell signal of the MACD indicator. A successful attempt to break through 1.1154 will indicate that the market is ready to sell the instrument.

On a higher time frame, the supposed wave D has begun its formation. This wave may turn out to have a shortened or a three-wave form. Given that all previous waves were not too large and were similar in size, the same can be expected from the current wave. Everything indicates that the wave D has already been completed. The construction of the wave E has started.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română