In the past few days, the main currency pair managed to fall towards the historical, psychological and technical level of 1.1000. This time the decline towards this crucial mark was halted at 1.1058. The factors contributing to the weakening of the single European currency against the US dollar are the same. First and foremost is the difference in monetary policy between the US Federal Reserve (Fed) and their counterparts at the European Central Bank (ECB). As you know, this difference lies in the Fed's much more hawkish attitude and their intention to raise the key interest rate several times this year. The start of military operations in Ukraine also worked for the US dollar's benefit as a safe haven currency. We know that at times like this, investors run away from risk on a massive scale and head for safe havens. I am sure that the military action in Ukraine has also contributed to the strengthening of the US currency as a defensive asset.

If we look at the economic calendar, we see that according to yesterday's reports from the Eurozone, consumer prices in the region continued to rise to 5.8%. However, this was not a surprise to the market as there was virtually no reaction to yesterday's consumer price reports from the Eurozone. Today's main event will undoubtedly be Fed Chairman Jerome Powell's semi-annual monetary policy report. There will also be other fairly interesting and important macroeconomic data, which you can find out more about by checking the economic calendar. Well, now it's time to take a look at the EUR/USD price charts.

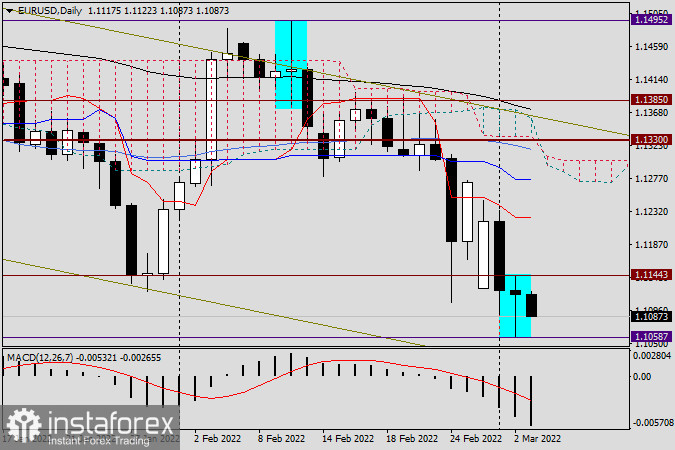

Daily

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română