US stock index futures are trading mixed but remain within yesterday's bearish correction. Falling oil prices dampen pessimism and allow investors to reduce their long positions in precious metals, including gold. A drop in oil prices adds to hopes that energy prices will not drag the US economy into recession. Market participants also continue to closely follow the cease-fire talks in Ukraine and the news on quarantine in China. Another coronavirus outbreak could cause serious damage to supply chains. Investors also prefer to refrain from entering the market ahead of the Federal Reserve's interest rate decision, which will be announced tomorrow. The Fed is expected to raise the rates for the first time since 2018.

Dow Jones Industrial Average futures are trading near yesterday's closing levels. S&P 500 and Nasdaq 100 futures gained 0.1% and 0.3%, respectively. As mentioned above, oil prices continue to fall for the second day in a row, with WTI futures plummeting by about 8% to $94.55 a barrel after reaching above $130 a week ago. The Brent benchmark fell by more than 7% to $98.46 a barrel.

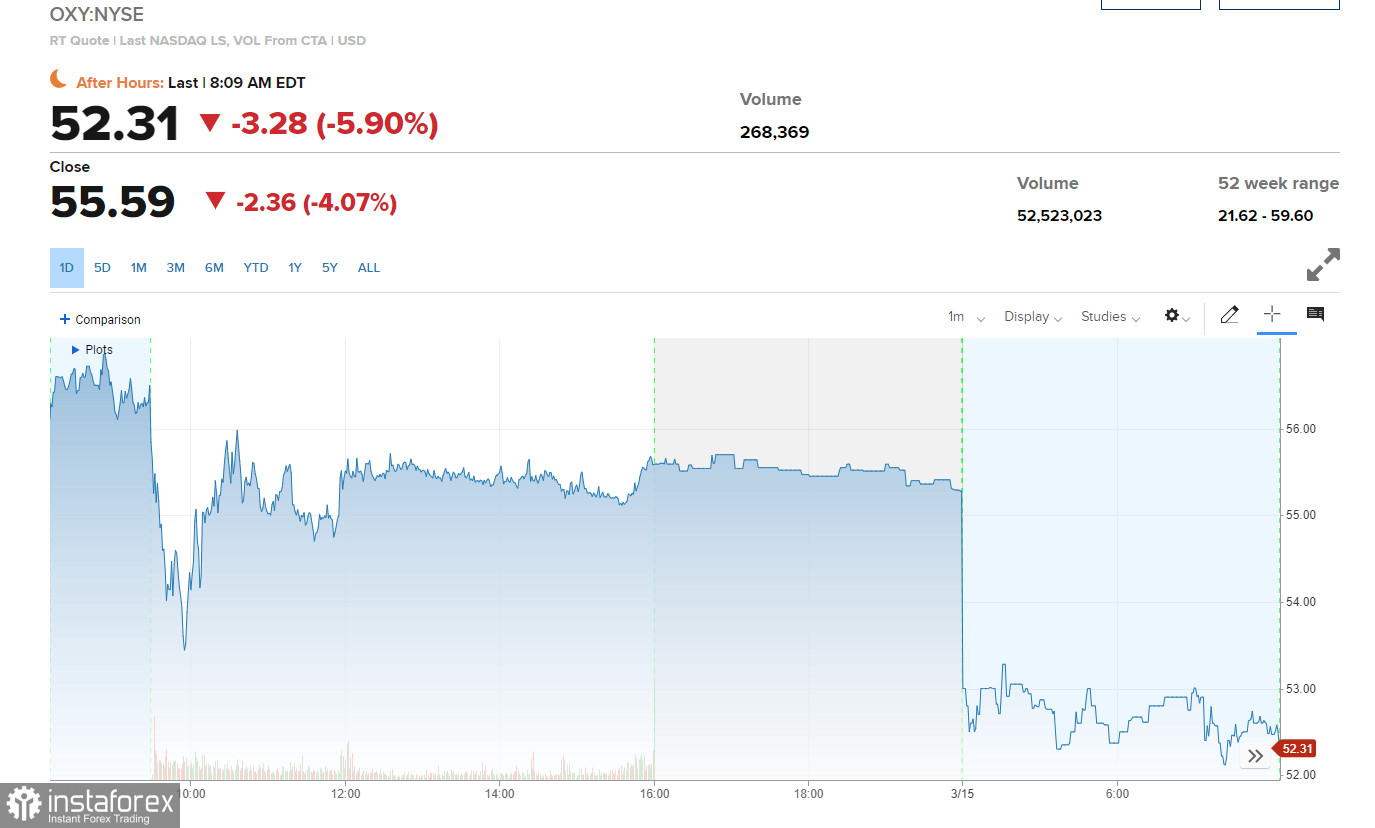

The drop in oil prices has affected the shares of energy companies. Occidental Petroleum lost more than 5% at the premarket, while Schlumberger and Halliburton lost more than 4%.

China is facing its most serious coronavirus outbreak since the pandemic began, raising concerns about further global economic recovery. Representatives of China and the US are also planning to hold a meeting on Russia's military operation in Ukraine.

However, investors are waiting for the Fed's two-day meeting. They are expecting a 0.25% rate hike to be announced on Wednesday. However, rising inflation concerns could lead to more aggressive measures, and the US stock market may drop as a result of this.

As for premarket:

Delta Air Lines, United Airlines, and Southwest Airlines securities rose at the premarket. These airlines raised their earnings forecasts, saying air traveling is recovering from the previous downturn caused by the spread of the Omicron strain.

Coupa Software (COUP) fell by 29.5% at the premarket after the business software company reported a much weaker-than-expected yearly outlook. GitLab gained 8.9% at the premarket after the company reported strong results for Q4 2021.

Toyota Motor announced additional cuts in its production due to semiconductor shortages. Nevertheless, Toyota added 2.8% at the premarket.

News of another coronavirus outbreak in China pushed Moderna up by 4.3% during premarket trading after rising by 11.9% in Monday's trading session.

Alibaba dropped by 4.7% in premarket trading. The Chinese e-commerce giant is under pressure because of concerns about slowing economic growth in China, as well as the threat of delisting the company from the US market.

As for S&P 500 technical indicators

Bulls need to be more aggressive if they expect a rise earlier this week. Risk appetite will be constrained by the Federal Reserve meeting, the outcome of which will be released on Wednesday. Higher interest rates are not good news for the stock market. Bulls will probably try to reach above $4,206, which they failed to do yesterday. If so, the pressure on the trading instrument will increase, which may cause a decline to the area of $4,160. A breakthrough of this level depends on the outcome of the negotiations between Russia and Ukraine. A negative outcome would return the bear market with the prospect of retesting the lows at $4,113 and $4,085. If the index closes above $4,206, it is likely to cancel the market recovery. In the case of growth, it is possible to expect new sell-offs near $4,258 and $4,319. Much will depend on further developments in Ukraine.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română