World stock indices gained last week, thanks to the final decisions of central banks and the easing of tension in Ukraine.

It appears that investors are tired of reacting negatively to the geopolitical situation, so it seized on the topic of negotiations in the country. Now, markets are looking for new drivers, which means that a lot will depend on the incoming economic data.

With regards to the actions of central banks, only the Bank of England and the Fed announced rate hikes to combat skyrocketing inflation. But the Fed did not take the risk in the most difficult economic situation, raising the rate by only 0.25% instead of 0.50%. That was the reason why dollar remained under pressure despite hawkish moves from the US central bank and rise in Treasury yields.

Certainty also played an important role because if earlier the markets did not know how the Fed would act in reality, then after the meeting and speech of Fed Chairman Jerome Powell, the real future monetary policy of the central bank became clear.

The development of events in Ukraine is also a key factor as markets are now convinced that the West will under no circumstances try not to interfere in the conflict with its military force, but will limit itself to all kinds of sanctions and restrictions, as well as a large-scale information war. If that really happens, risk appetite will return, despite high oil prices.

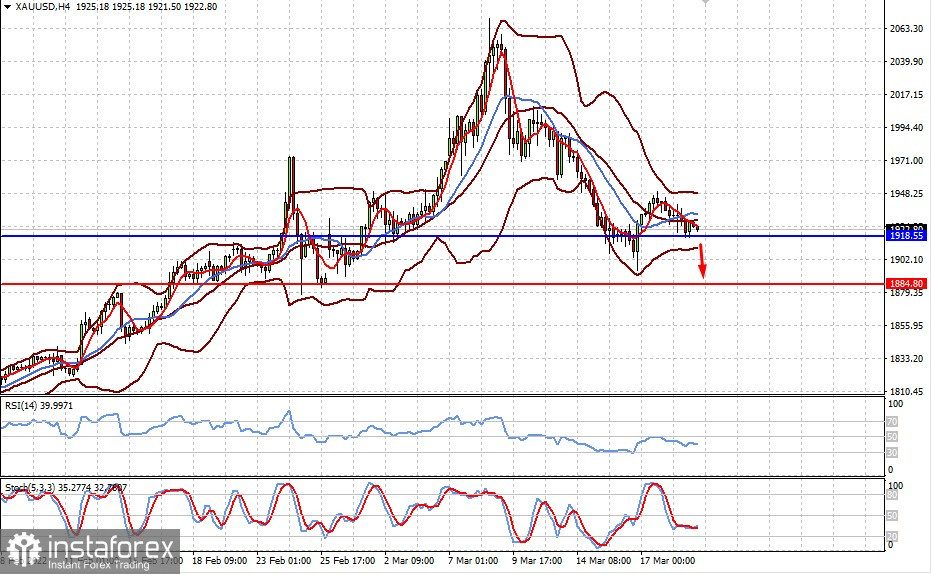

An important signal indicating a decrease in fears in the markets is a rollback in gold prices. Experts believe that in the context of a recovery in demand for shares and important commodity assets, the yellow metal will continue its gradual decline, unless something extraordinary happens.

With regards to dollar, growth is likely to be limited, so it will consolidate in ranges against other major currencies.

Forecasts for today:

EUR/USD is currently trading above 1.1000. A breakout, as well as a surge in risk appetite, will lead to a rally to 1.1265.

Spot gold is consolidating above 1,918.55. Positive market sentiment will stimulate further decline to 1884.80, after breaking below 1,918.55.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română