Conditions to open long positions in EUR/USD:

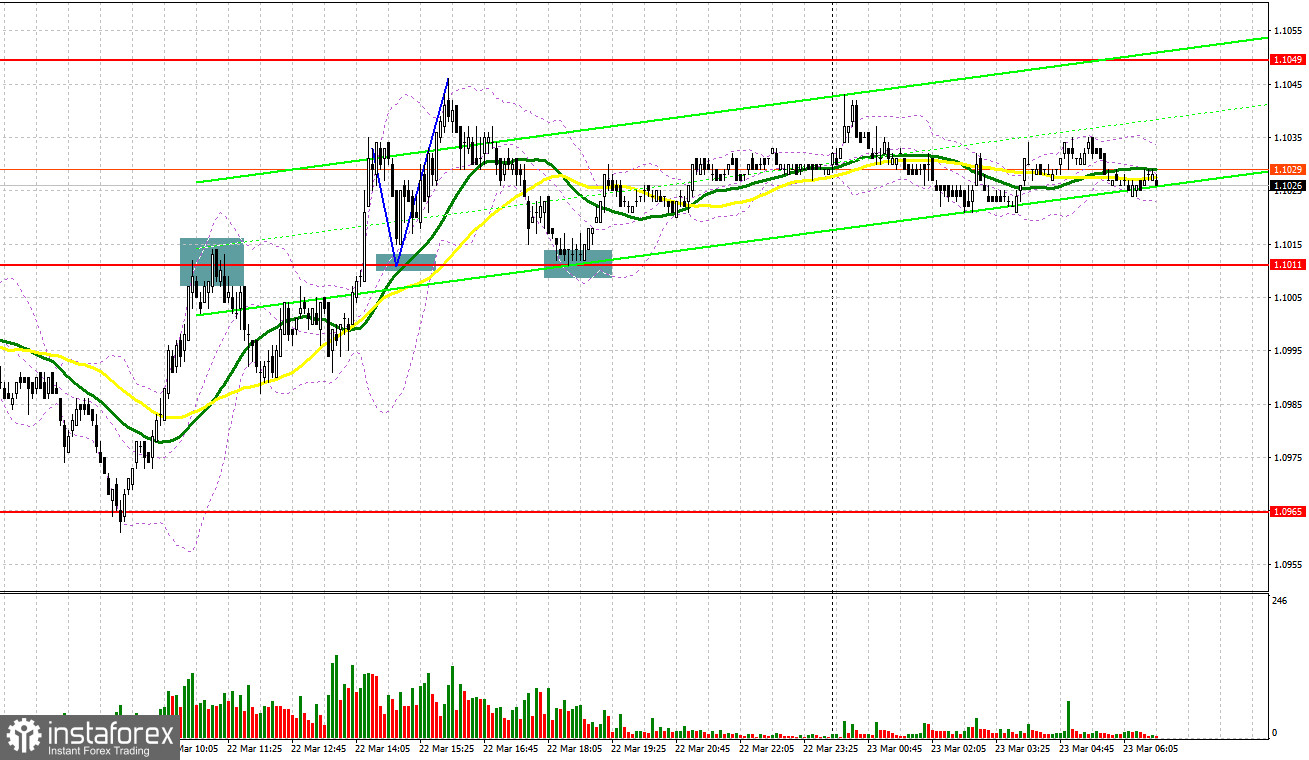

Yesterday, traders got several signals to enter the market. Let us take a look at the 5-minute chart to analyze the market situation. Earlier, I attracted your attention to the level of 1.1007 so that you might decide when to enter the market. In the first part of the day, the euro was under pressure amid the recent announcements made by Fed Chair Jerome Powell. He said that the regulator intended to switch to a more aggressive approach concerning the key interest rate hike. However, the pair failed to hit the level of 1.0953. That is why traders did not receive any signal to enter the market at this level. Later, the euro recovered, but bears managed to protect the resistance level of 1.1007. A false break of the level provided traders with a sell signal. The euro lost 20 pips and then, pressure on the currency became weaker. In the second part of the day, the euro/dollar pair consolidated above 1.1011. However, it did not downwardly test the level. That is why we did not consider buy positions. However, during the US trade, the pair tested the mentioned level and surged by 25 pips.

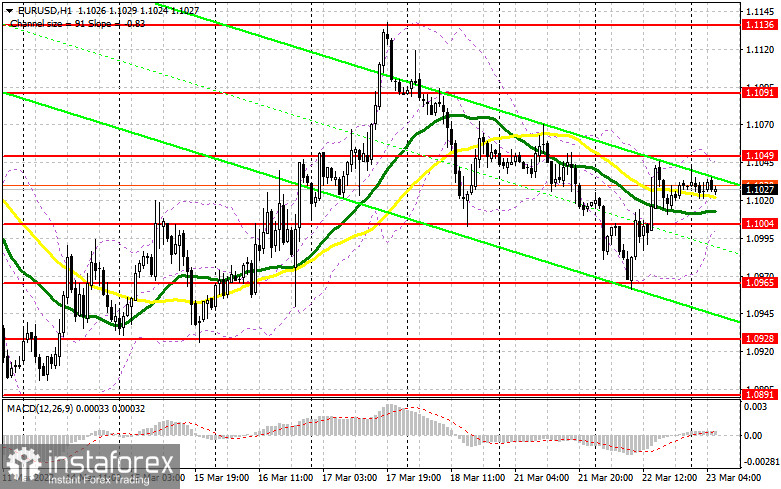

Today is a very interesting day and the expected reports may influence a further rise in the euro/dollar pair. The eurozone consumer confidence index could be significantly worse than expected. The data for March may reveal the real state of affairs in the eurozone's economy. In case of very weak figures, pressure on the euro will return. That is why bulls should do their best to protect the support level of 1.1004. Only a false break of the level may provide the first entry point for long positions. To see a considerable rise, bulls should be very active and break the resistance level of 1.1049. Yesterday, buyers decided to lock in profits near this level, thus causing a downward correction. Notably, there are no positive changes in the geopolitical situation. In addition, US President Joe Biden is planning to meet with the EU representative to persuade them to ban the import of Russian energy. In the light of these events, demand for risk assets will be limited. Only a downward test of 1.1049 will give a buy signal, thus allowing the pair to recover to 1.1091, a strong resistance level that was formed at the end of the previous week. A farther target is located at the high of 1.1136, where it is recommended to lock in profits. A break of the range may change the market sentiment and lead to the execution of sellers' stop orders. In this case, the euro/dollar pair may climb to such highs as 1.1181 and 1.1227. The scenario will become possible only amid a better geopolitical situation. If the pair declines and bulls fail to protect 1.1004, it will be better to avoid long positions. Traders may go long after a false break of 1.0965. It is also possible to open long positions from 1.0928, expecting a rise of 30-35 pips.

Conditions to open short positions on EUR/USD:

Bears' activity was rather sluggish to support pressure on risk assets caused by the comments provided by the Fed's representatives. Today, sellers should protect the nearest resistance level of 1.1049. A false break of the level will provide a sell signal with the target at the support level of 1.1004. Yesterday, bulls opened many positions from this level in an attempt to boost the uptrend. The lower limit of the upward channel is also located at this level. Early today, only the UK will report on its economic situation. That is why traders are likely to focus on the eurozone consumer confidence index. A break of 1.1004 may affect stop orders of speculative buyers, who were opening positions after yesterday's market reversal.An upward test of 1.1004 will give an additional short signal with the target at 1.0965 and 1.0928. A farther target is located at a new low of 1.0891. If the euro continues rising and bears fail to protect 1.1049, bulls will go on opening long positions, expecting a further increase in the pair. Thus, it is better to avoid sell orders. It will be wise to open sell positions after a false break of 1.1091. It is also possible to sell the asset from 1.1136 or from 1.1181, expecting a decline of 20-25 pips.

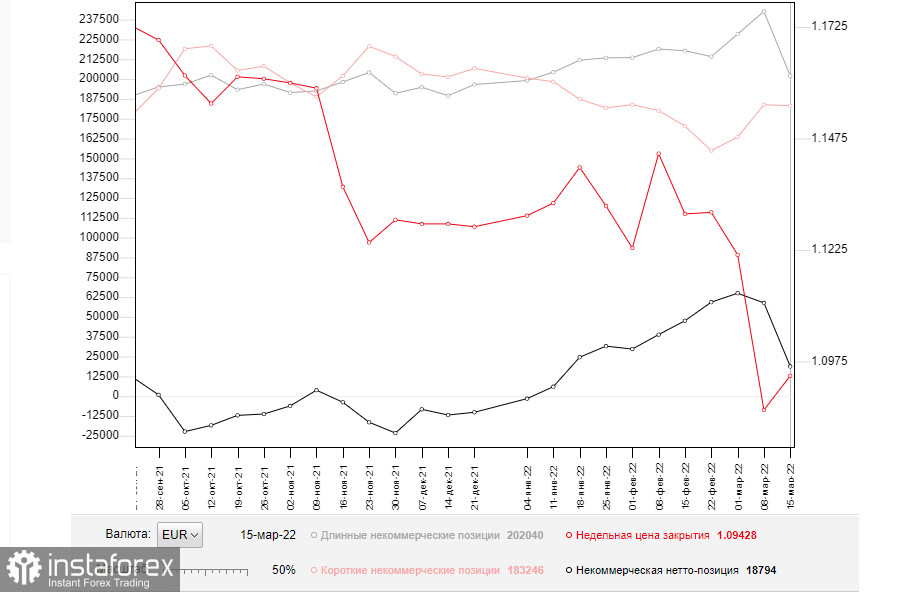

Commitment of Traders Report

According to the COT report from March 15, the number of long and short positions dropped. However, a decline in the number of short positions was insignificant, whereas the number of long positions slumped. Such a considerable decrease was mainly caused by the special military operation in Ukraine. The Fed's meeting was the main event of the previous week. The regulator raised the benchmark rate by 0.25%. However, the decision did not affect the market since traders had priced in such a result long ago. Notably, Fed Chair Jerome Powell took the wait-and-see approach during the press conference. He did not announce a more aggressive approach, thus boosting the number of long positions on risk assets. However, early this week, the Fed Chair changed his approach, emphasizing that the key interest rate could be raised by 0.5% at the following meeting. It is a strong bullish signal for the US dollar, which is highly likely to go on climbing against the euro. Not so long ago, the ECB also held a meeting, where Christine Lagarde announced the central bank's plans for a faster QE tapering and key interest rate hike. It is good for the euro's mid-term future since the currency is significantly oversold against the greenback. According to the COT report, the number of long non-commercial positions declined to 202,040 from 242,683. Meanwhile, the number of short non-commercial positions dropped to 183,246 from 183,839. The weekly close price inched up to 1.0942 from 1.0866.

Signals of indicators:

Moving Averages

Trading is conducted just below the 30- and 50-day moving averages, which indicates that bears are still controlling the market. .

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the price rises, the upper limit of the indicator located at 1.1049 will act as a resistance level. In case of a decline, the lower limit of 1.1004 will act as a support level.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total long position opened by non-commercial traders.

- Short non-commercial positions is a total short position opened by non-commercial traders.

- The total non-commercial net position is a difference between the short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română