Ethereum along with Bitcoin were the leaders of the bullish trend in the cryptocurrency market. At some point, Ethereum surpassed BTC in terms of growth rate. Consequently, Ethereum, major altcoins and Bitcoin approached a key resistance level. The asset is facing a period of local consolidation, after which it will resume its upward trend. ETH is likely to hit a new historical high, stimulating its competition with Bitcoin.

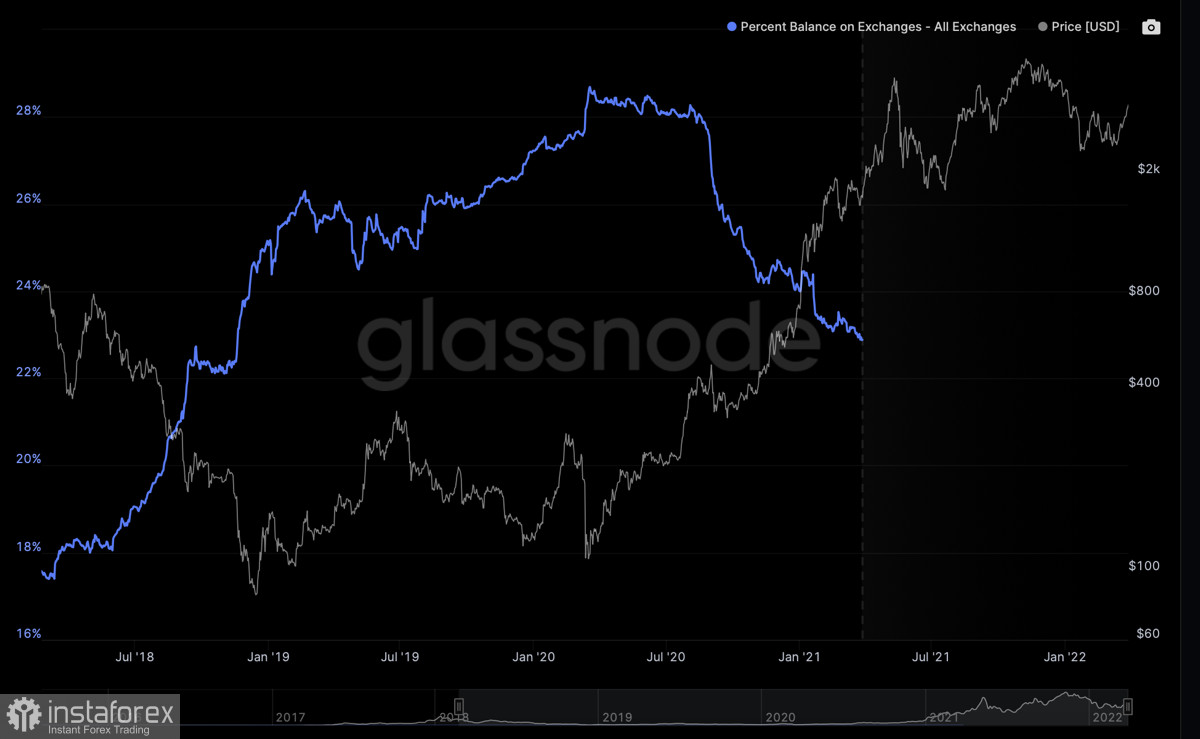

First, Ethereum continues to strengthen its role as an ambitious project with a lot of updates. In this respect, it differs significantly from Bitcoin. At the end of March 2022, ether as well as BTC became a safe haven asset. According to Glassnode data, the number of ETH coins on exchanges has reached their low. Ethereum managed to become a key investment option on a par with Bitcoin amid tightening monetary policy and the global economic crisis.

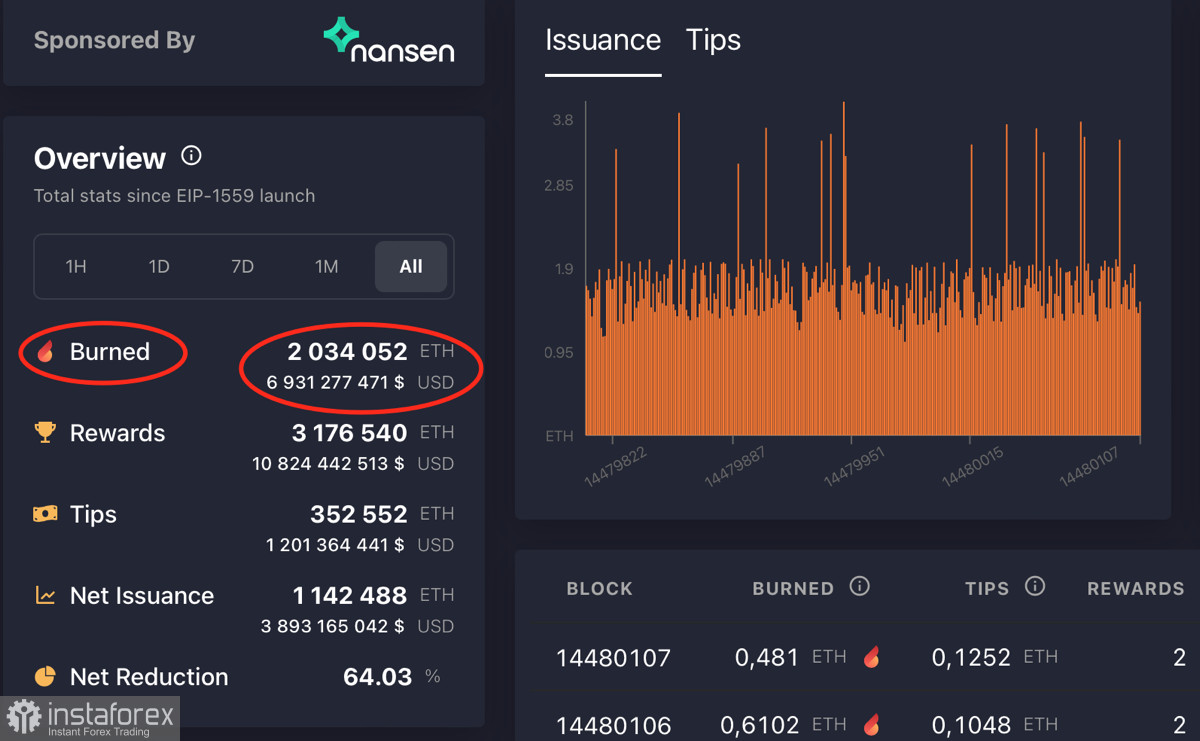

Moreover, Ethereum has been a deflationary instrument for over 7 months. Some of Ethereum's commissions are being burned due to the London update in August 2021. Over 2 million ETH coins, equivalent to more than $6.5 billion, have been burned since the launch of the hard-fork. Therefore, the major altcoin became a more deflationary asset than Bitcoin. However, Ethereum still lags behind the main cryptocurrency in institutional investments. This is partly due to significantly increased fees. However, the key reason for it is conservatism of institutional investors. In February, major companies preferred gold to BTC as they had more extensive investment experience in the precious metal. The current situation is similar: Bitcoin is a more common investment instrument than Ethereum.

However, Bitcoin may lose its deflationary advantage over the next 6 months due to the long-awaited launch of the new digital solution. This mechanism is designed to gradually increase the level of computational complexity of the algorithms used to reward miners. Ultimately, the target of the digital solution is the gradual transition of ETH miners to Proof-of-Stake. This upgrade will be a significant step in the merging of ETH 1.0 and ETH 2.0. However, this process is lengthy. Moreover, the algorithms of this mechanism will partially affect the speed and complexity of mining new blocks. In other words, Ethereum will become a more deflationary and limiting financial instrument.

Ultimately, it will lead to increased interest in ETH at the expense of its scarcity. With liquidity tightening, the limited or deflationary nature of the financial instrument will be the main argument for institutional investors. As of March 29, Ethereum slowed as it reached an important resistance level at $3,400. Bitcoin managed to break through the range of $32,000-$45,000 due to an impulse breakout of the upper level. The situation is opposite with Ether, indicating low buying activity of major market players.

If Ethereum fails to break through $3,400, the price will locally decline to the range of $3,100-$3,200 for temporary consolidation. Technical indicators imply this scenario: RSI and the stochastic oscillators are in the overbought zone. Therefore, they have to stop their movement to prevent volatility levels from rising. Meanwhile, the MACD continues to remain within the uptrend, indicating power of the medium-term uptrend. If the price consolidates above $3,400, the asset will also face consolidation. The complex psychological level of $3,400 requires some respite before the price rally continues. Subsequently, the cryptocurrency will resume its upward movement. Moreover, a combination of fundamental factors and innovations will allow ETH to increase institutional interest.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română