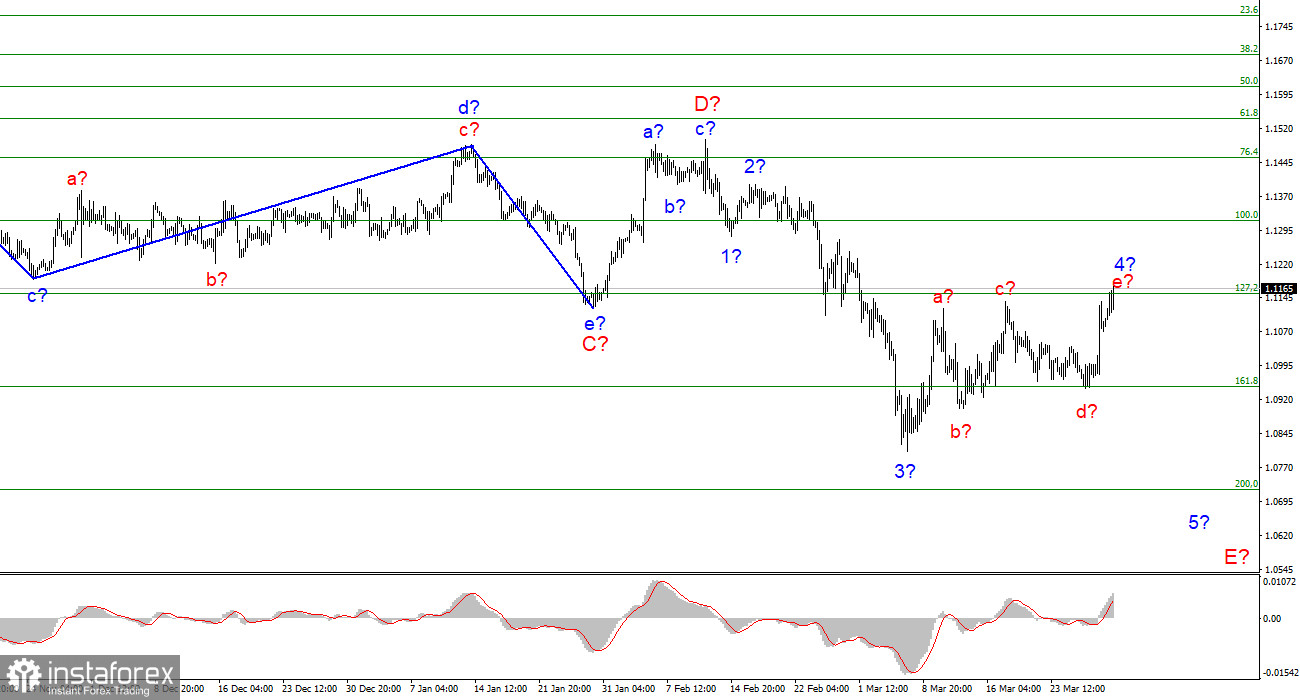

The wave marking of the 4-hour chart for the euro/dollar instrument is becoming more complicated due to the increase in quotes yesterday and today. Now the assumed wave 4 has taken a five-wave form and fits very poorly into the current wave layout. Nevertheless, the wave pattern still does not require drastic changes. If the construction of the proposed wave 4 still ends in the coming days, then the tool can still build the proposed wave 5 in E. If the increase in quotes continues, then the entire wave markup will require adjustments. I note that wave 4 looks like a correction in any case. That is, it cannot be the first wave of a new upward trend segment. The 127.2% Fibonacci level, near which waves a and c ended at 4, should not miss the instrument above itself. An unsuccessful attempt to break through it will signal that the market is ready for new sales of the instrument. If the decline in the quotes of the instrument ends there, then the entire wave E will take a single-wave form and will be recognized as completed on March 7. Geopolitics had a serious impact on the market on Tuesday but may have it in the future. Therefore, I would now allow an option with the beginning of the formation of a new upward section of the trend, too.

The ECB president will soon start turning to fortune tellers

The euro/dollar instrument increased by another 80 basis points on Wednesday. Thus, market activity remains quite high. The news background during the day today was interesting. ECB President Christine Lagarde made a speech in Europe. Since all the attention in the European Union is now paid to only one issue – inflation – then Lagarde could only talk about it. "Food and energy prices must stop rising," Lagarde said. According to her, "something should help the Eurozone avoid stagnation and high inflation." The inflation forecast is currently very unstable, as the military conflict between Russia and Ukraine does not end and continues to have an impact on world markets and the European economy. Lagarde expects that prices will still stabilize, but at the same time, they will be much higher than budgeted and higher than before February 24, 2022. "We do not predict that energy prices will continue to rise and rise, however, they are likely to remain high," the ECB president concluded.

I think her statement on Wednesday is pure uncertainty about the future and even about what is happening right here and now. It is obvious that sooner or later prices will stop accelerating in their growth. However, the market is very interested in the information when this happens. The ECB cannot answer this question. The ECB cannot influence the price growth. It remains only to sit and silently watch the prices of oil, gas, raw materials rise, and after them everything else. There are no effective instruments to combat inflation in Europe right now. The risk of stagflation, given the latest GDP reports, is very high.

General conclusions

Based on the analysis, I still conclude that the construction of wave E is currently underway. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave marking assumes the construction of wave 5 in E. This option will be canceled in case of a further increase in quotes, above the level of 1.1153.

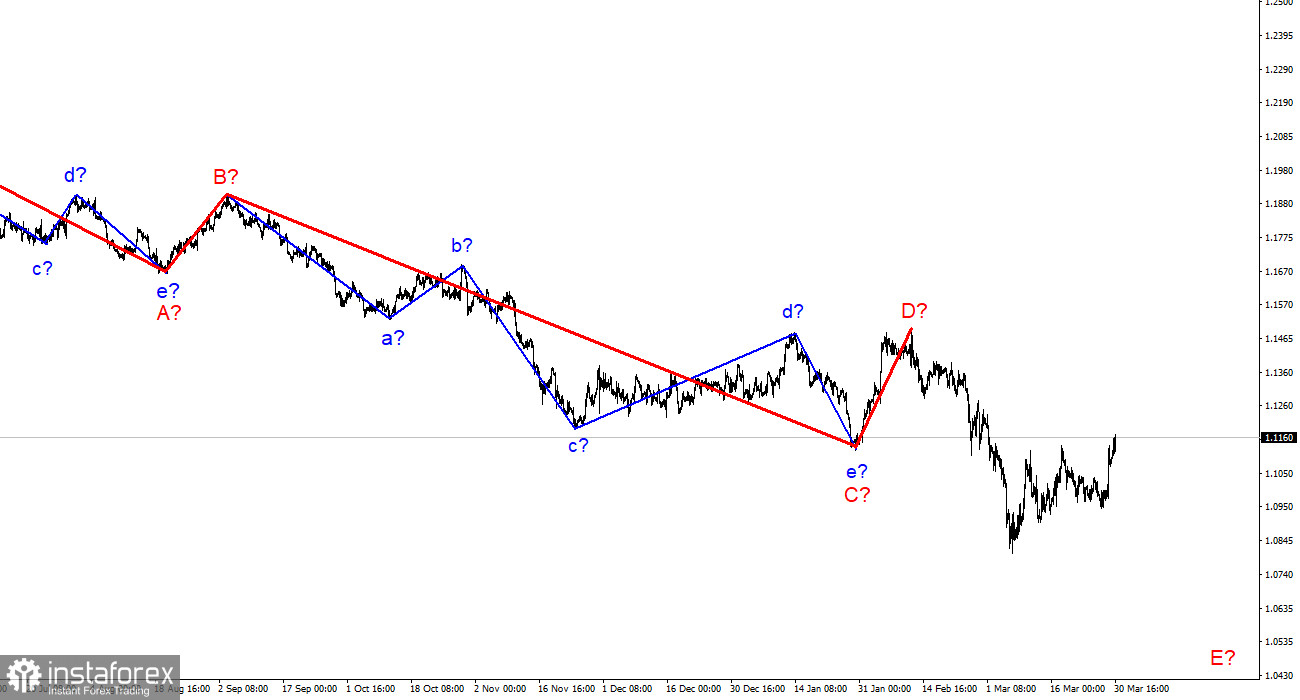

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română