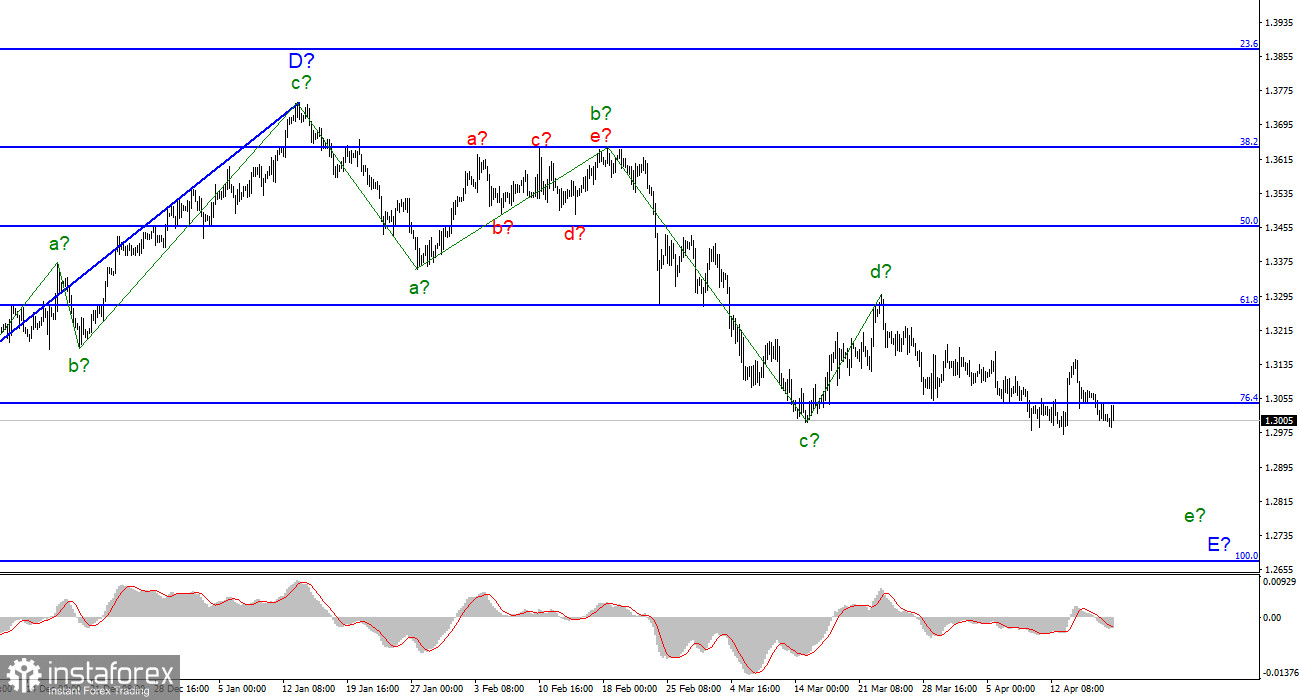

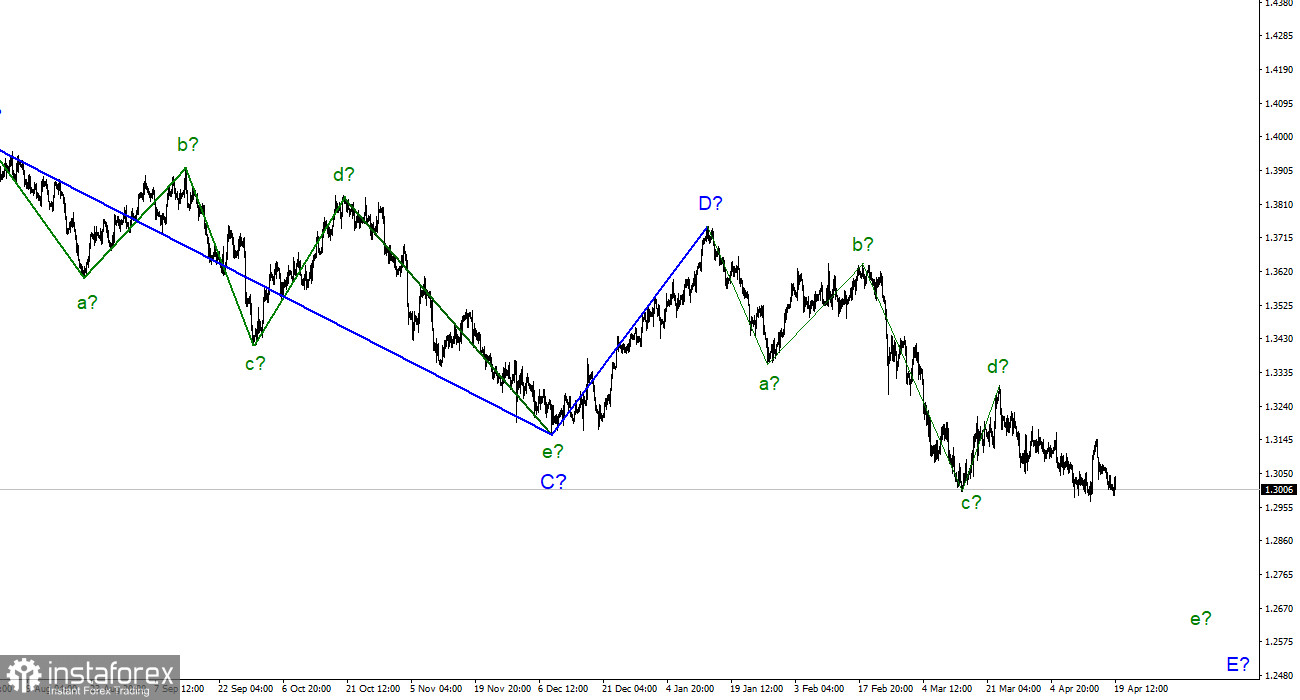

For the pound/dollar instrument, the wave markup continues to look very convincing, even taking into account the unexpectedly strong growth last Wednesday. The assumed wave d-E is completed, and there should be five waves in total inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time within the wave e-E. An unsuccessful attempt to break through the low wave c-E does not allow the market to continue selling the instrument. Near this mark, the instrument turned sharply upwards and began a powerful increase, which also quickly ended. Thus, the wave e-E should be more extended than it is now. Since the low of the supposed wave c-E is still broken, then theoretically the wave e-E can end at any moment. However, I still expect that the decline in the British dollar within this wave will be much stronger, given the current situation in Ukraine and the economic background in the UK, USA, and Europe. I am not considering alternative options for wave marking yet, but I admit that in the near future the downward section of the trend may complete its construction.

Demand for the British remains low but has stopped falling

The exchange rate of the pound/dollar instrument decreased by 20 basis points on April 19. In total, the British lost 60 points on Monday and Tuesday. Thus, the demand for the pound continues to decline this week, but the iron level of 1.2980 does not allow the instrument to continue building a downward wave e-E. If, as I assume, the conflict between Ukraine and Russia is put on pause in the near future, as well as earlier peace talks, this may finally provide support to the European and the British. Let me remind you that for both instruments, despite the good potential for further decline, the last waves are still being built as part of the downward trend sections. Consequently, the trend areas are close to their completion. It remains only to find out how long their last waves will be.

If the special operation in Ukraine continues for several more weeks with a noticeable advance of Russian troops deep into Ukraine, then there is no doubt that the West will throw new sanctions at the Russian Federation. And this time it will be about the oil and gas embargo. If it is not possible to go noticeably deep into Ukraine, then Russian troops can take the positions that they managed to win and defend them. This means that there will be no active hostilities on the part of the Russian Federation in the next few weeks or months. However, this does not mean that the Ukrainian troops, who possess a huge amount of Western weapons, will not go on the offensive. Let me remind you that in recent weeks, EU and US countries have been transferring heavy weapons to Ukraine and, according to some reports, planes, tanks, and other weapons for the offensive. However, the conflict can still be put on pause for several weeks or months after the "second phase of the special operation in Ukraine." It is this pause that the euro and the pound can use to start building corrective, upward trend sections.

General conclusions

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave e-E does not look fully equipped yet. Maybe this wave won't be too long, but it doesn't look complete right now.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the instrument to continue to decline with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română