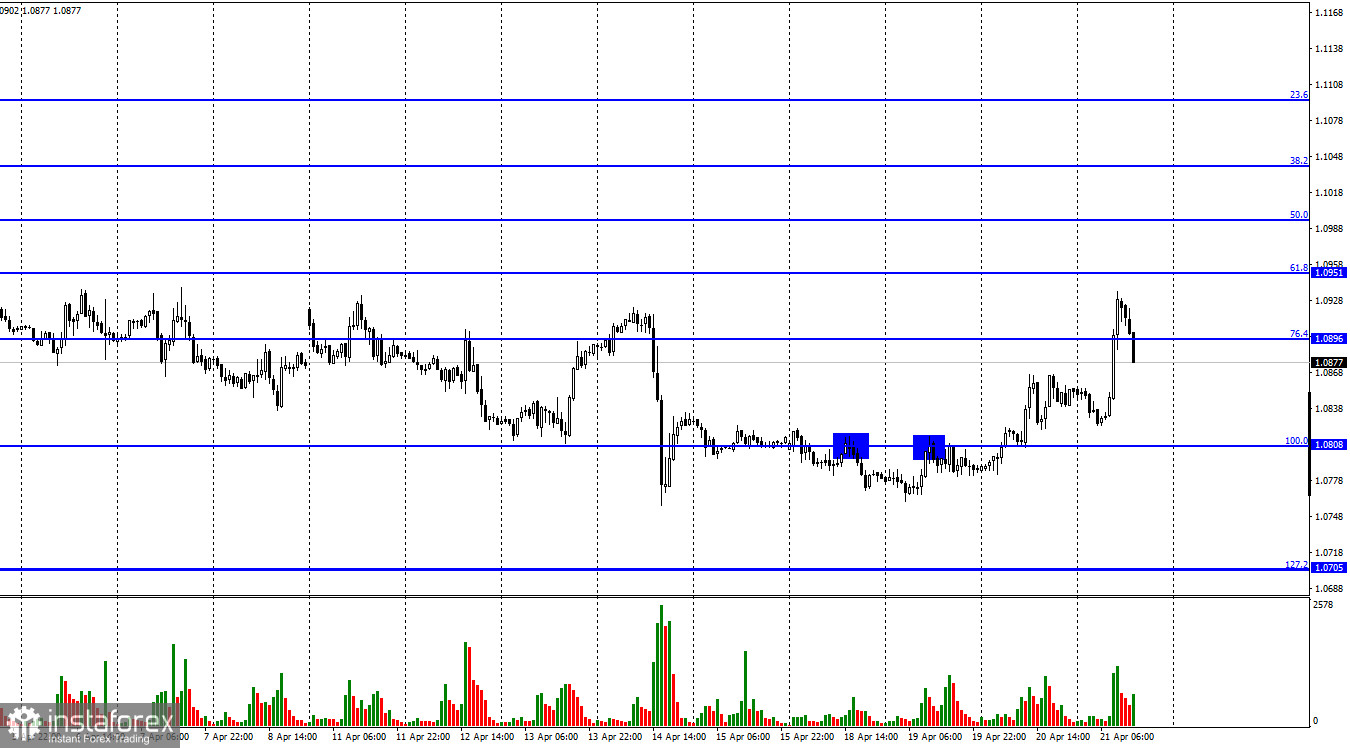

Hi, dear traders! On Wednesday, EUR/USD went on its moderate growth. Today, having spiked today, the currency pair closed above 1.0896, that matched the 76.4% Fibonacci level. However, in a couple of hours, the price reversed in favor of the US dollar and settled above 1.0896. This price action indicates that traders may predict a new decline towards 1.0808 that corresponds to the 100.0% Fibonacci correction. Importantly, the information background in the last two days was able today that the central bank might withdraw the APP stimulus program in July and venture into the first rate hike in a long stretch of time. This statement caught investors off-guard. Indeed, previously Christine Lagarde frequently appeared with comments that the European economy would not tolerate tighter monetary policy. Her words were confirmed by rock-solid facts and statistics.

The EU economic weakness was mirrored in GDP reports for a few previous quarters and a threat of energy and food crises in the EU. To sum up, does it make sense to expect tightening of monetary policy if 27 countries of the union are on the verge of two looming crises? Perhaps, Christine Lagarde has revised her viewpoint to but hasn't been able to announce it. Later today, she might answer this burning question. If she comes up with hawkish statements and signals a rate hike in 2022, the single European currency might be able to extend its advance. However, Fed chairman Jerome Powell will also deliver his speech today. Market participants will not be puzzled about his comments on further policy moves. Investors are almost 100% sure that the US central bank will raise interest rates in the rest of 2022. Besides, there is a slim chance that the federal funds rate could be increased by 0.75% at a time at the nearest meeting in May. Therefore, whatever the ECB might announce, the US Fed is a few steps forward. So, I don't expect strong growth of the euro.

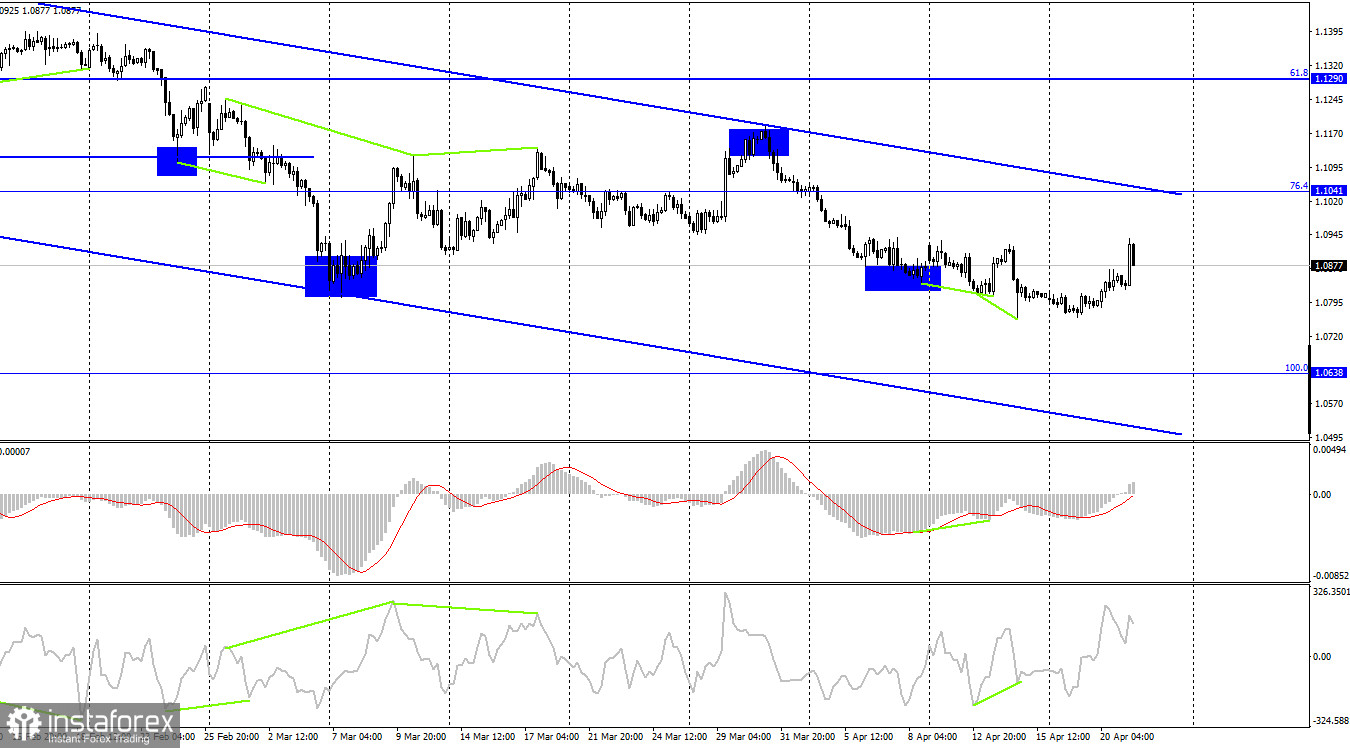

EUR/USD reversed in favor of the euro on the 4-hour chart and began its growth towards 1.1041 that matches the 76.4% Fibonacci correction. I view this level as the highest probable target for the single European currency. If the price drops off this level or off the upper border of the downward trend channel, the US dollar will regain its footing and the pair will decline towards 1.0638, the 100.0% Fibonacci level.

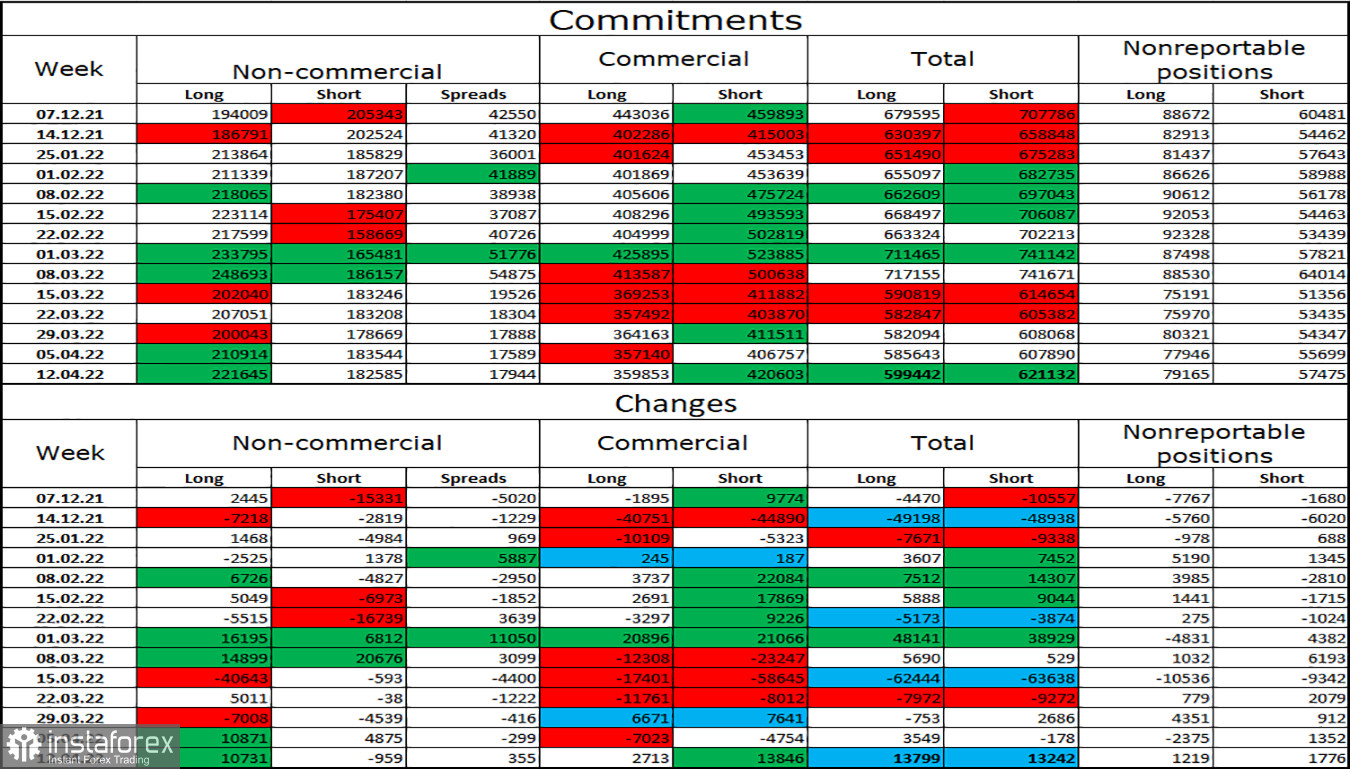

Commitments of Traders report (COT):

Last week, speculators opened 10,731 long contracts and closed 959 short contracts. It means that large market players are cementing the bullish sentiment. The overall number of long contracts kept by large market players equals 221,000, but short contracts amount to 182,000. Thus, the overall sentiment in the category of non-commercial traders is defined as bullish. In this context, the single European currency is expected to grow for a few weeks in a row. Instead, the euro has been stuck in a downward spiral without any hopes for recovery. Interestingly, we cannot make true forecasts based on COT reports at present. Trading sentiment is greatly affected by simmering hostilities in Ukraine, fierce standoff between Russia and the West, and a new package of sanctions on the Kremlin.

Economic calendar for US and EU

EU – Consumer Price Index (09-00 UTC)

US – Initial and Continuing Unemployment Claims (12-30 UTC)

US – US Fed Chairman Jerome Powell speaks (15-00 UTC)

EU – ECB President Christine Lagarde speaks (17-00 UTC)

On April 21, an inflation report was released in the EU. The CPI for March was below the consensus. Today the euro has been growing thanks to a speech by Luis de Guindos. In the second half of the day, remarks from Jerome Powell and Christine Lagarde could impact on market sentiment.

Outlook for EUR/USD and trading tips

I would recommend plan new sell positions if EUR/USD drops off the level of 1.1041 on the 4-hour chart with the targets at 1.0896 and 1.0808. I don't recommend buying the currency pair as the bears are holding the upper hand in the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română