The EUR/USD currency pair resumed its downward movement on Friday and at the end of the week was again near its 15-month lows. Thus, in general, the technical picture has not changed at all during the last trading week. The European currency is still under market pressure, and the market itself does not believe that the ECB is capable of raising the rate. And to do it more than once, "in public", they say, look, we have tightened monetary policy. And start a whole cycle of raising the key rate to stop further inflation growth! After all, it is absolutely clear to everyone that inflation will begin to slow down only in the event of a significant increase in the rate. And at the moment, the ECB deposit rate is -0.5%. That is, it is not even zero. Therefore, first, the European regulator needs to raise it to at least 0%, and only then think about raising it to a neutral level. In general, the words of Luis de Guindos last week so far look like fiction.

Recall that the inflation rate is now affected not only by the monetary policy of the central bank during the pandemic when hundreds of billions of euros were sent to the economy out of nowhere. At this time, the world has not yet fully recovered from the pandemic, which, moreover, has not yet ended. For example, in China, "lockdowns" were introduced just recently due to new outbreaks of the "coronavirus". In addition, a war has begun in Ukraine, which may well spill out beyond its territory. Recall that initially, it was supposed to be a "special operation", which implied a quick seizure of Ukraine and/or a quick change of government in Ukraine to please the Kremlin. However, at this time, when this plan has failed, and half the world stands for Ukraine, this conflict can no longer be considered Ukrainian-Russian. Now, this is a global conflict. It is obvious that there are more factors influencing the price increase now, and the consequences will be not only for the Russian and Ukrainian economies but also for the economies of many other countries of the world.

New performances by Christine Lagarde and Luis de Guindos.

There will be several events in the European Union this week that hypothetically could affect the movement of the euro/dollar pair. Recall that the euro currency can only be saved from a new fall by a strong "foundation" or an improvement in the geopolitical situation in Ukraine. You can't even dream about the second one now. And the first point means that the ECB should sharply change its rhetoric to "hawkish" and show readiness to raise the key rate at the same pace as the Fed. This week, ECB President Christine Lagarde will give a speech on Wednesday. At this time, a lot of attention will be focused on her speeches, since it is she who should make it clear to the markets whether de Guindos' statement reflects the real state of things? Lagarde did not confirm this last week. Also on Thursday, there will be a new speech by the ECB Vice-chairman Luis de Guindos himself, who may also slightly adjust his statement, taking into account the fact that his immediate superior did not confirm his words.

Of the important macroeconomic reports, we highlight the reports on GDP for the first quarter (preliminary value) and on inflation for April. Forecasts suggest that economic growth in the European Union will be 0.2-0.3%, and inflation will remain at the March level of 7.4%. If these forecasts come true, then these macroeconomic statistics can hardly be called positive. GDP in the fourth quarter was very weak, and in the first, it may become even lower. And with such growth, how can we expect to raise rates? Any tightening of monetary policy and the economy will slide into recession. And the absence of an acceleration of inflation in one particular month can hardly mean that now prices will stop growing. There is also no reason for this: raw material prices continue to rise, sanctions against the Russian Federation continue to be imposed, and the conflict between Ukraine and Russia persists. That is, it is unlikely that this week the European currency will receive support from the macroeconomic or fundamental background.

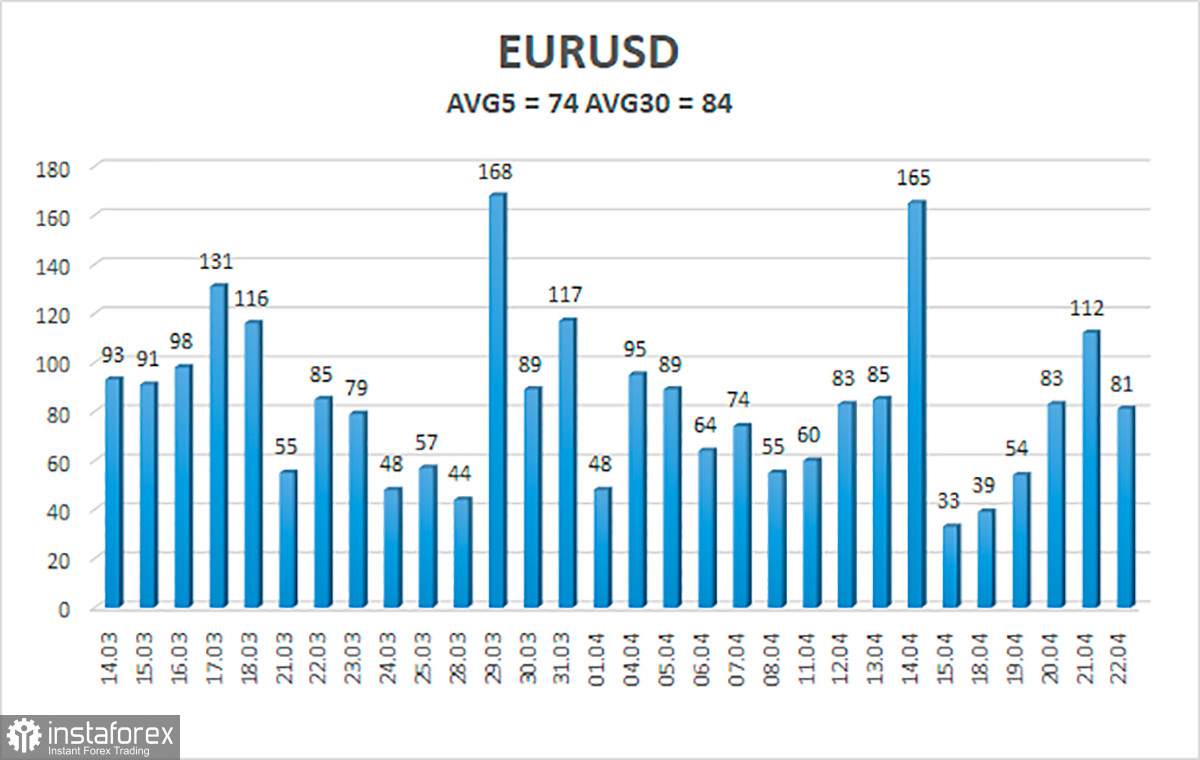

The average volatility of the euro/dollar currency pair over the last 5 trading days as of April 25 is 74 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0724 and 1.0872. The upward reversal of the Heiken Ashi indicator will signal a new round of upward correction.

Nearest support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair has consolidated back below the moving average line. Thus, now it is necessary to open and stay in short positions with targets of 1.0742 and 1.0620 until the Heiken Ashi indicator turns upwards. Long positions should be opened with a target of 1.0986 if the price is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română