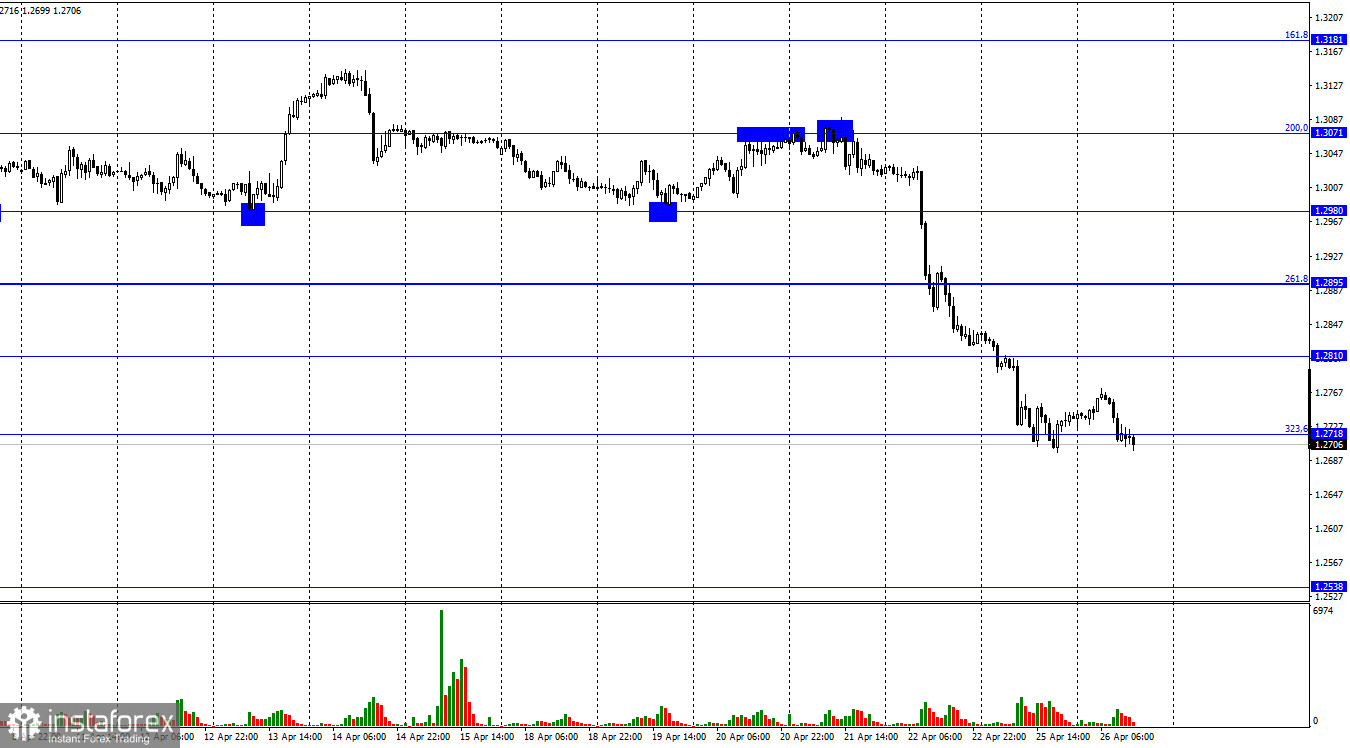

Greetings, dear traders! On the 1H chart, the GBP/USD remained in the downward channel on Monday. It slipped to 1.2718, the Fibonacci correction level of 323.6% at the end of the day. Today, the pair declined below this level. It means that it may drift lower to 1.2570. The pound sterling is far from hitting the bottom. It is also unable to halt its drop. In my article on the euro, I have already said that last week the macroeconomic calendar remained empty on Thursday and Friday. It could be the main reason for such a strong fall in the pound sterling. Therefore, the euro and the pound sterling plunged due to the same bearish factors such as the more dovish approach of the BoE on monetary policy compared to the Fed and geopolitical tensions in Ukraine. Notably, the crisis in Ukraine may cause a recession in the EU and the UK. Apart from that, both countries cannot curb galloping inflation. The regulators also have not voiced certain steps on how they are going to fight it. Thus, the EU is coping with lots of issues currently. As long as geopolitical tensions persist, the eurozone is likely to experience face more serious problems.

A few weeks ago, like the Fed, the Bank of England hinted that it might also raise the key rate at a faster pace. At that time, the regulator had already hiked the key rate three times to 0.75%. The Fed's benchmark rate is now 0.50%. Many believed that the Bank of England would undertake more hikes as inflation in the UK remains high. However, the situation has changed drastically over the past few weeks. In his several speeches, BoE Governor Andrew Bailey signaled a pause in monetary policy tightening. As I said earlier, tighter monetary policy is aimed at cooling the economy, which may lead to a slowdown in economic expansion. For this reason, the US is ready to hike the key rate more aggressively as its economy is now quite strong. So, monetary policy is unlikely to hurt economic expansion. Yet, the UK cannot boast of such strong economic indicators. This is why policymakers take into account GDP and inflation.

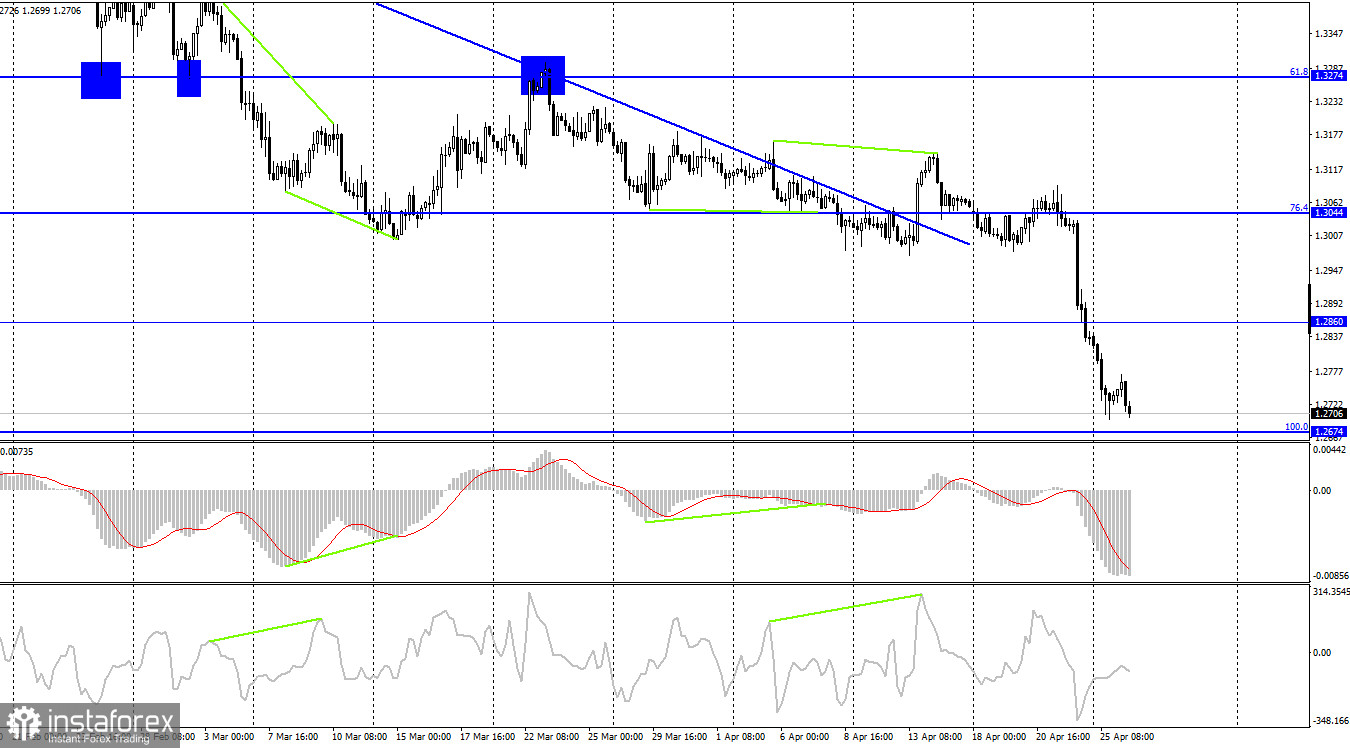

On the 4H chart, the pound/dollar pair is gradually decreasing to 1.2674, which corresponds to the Fibonacci correction level of 100.0%. If the price rebounds upwards from this level, it may rise to the 1.2860 level. The consolidation below the level of 1.2674 will increase the chance of a further fall to 1.2253, which is the next Fibo level of 127.2%. There is no divergence in any indicator today.

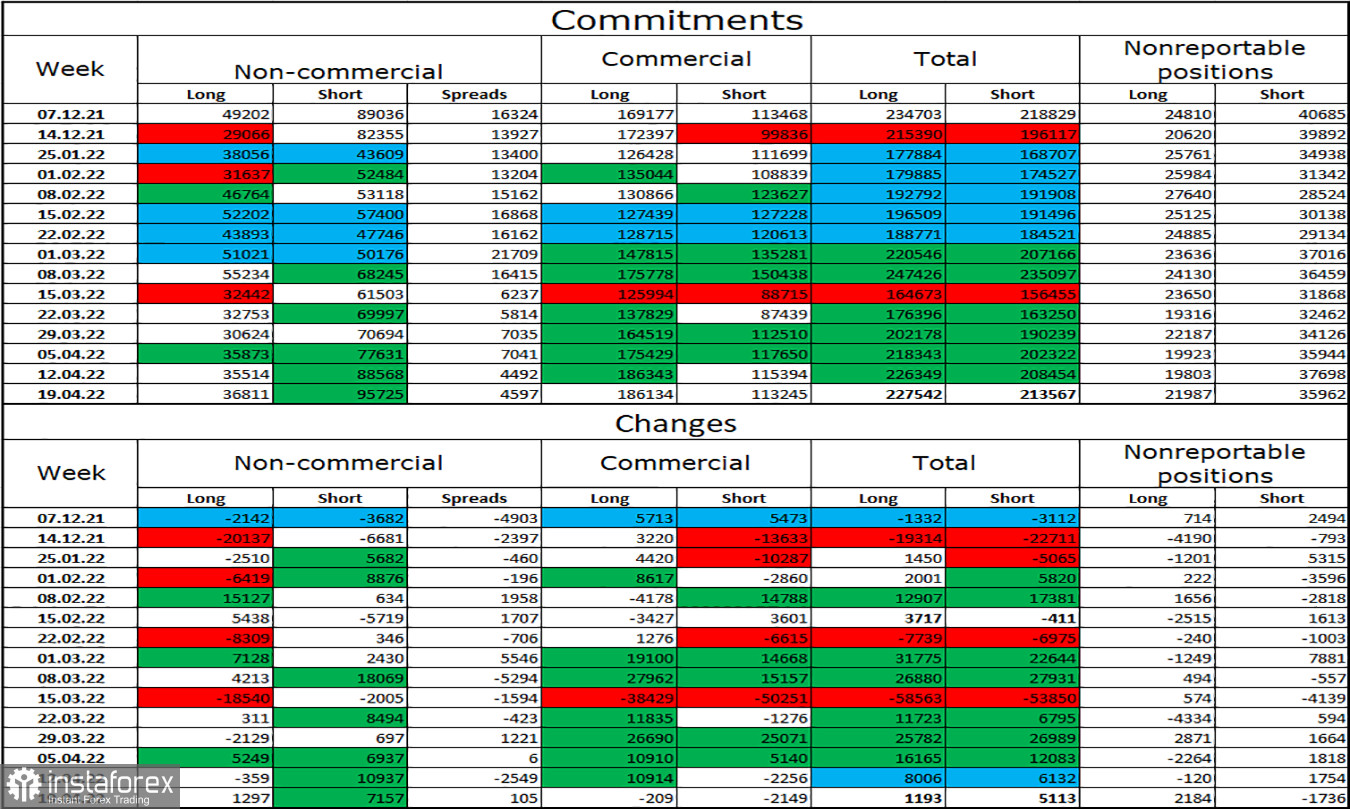

Commitments of Traders (COT):

The mood of the "Non-commercial" category of traders has changed drastically over the past week. The number of Long-contracts in the hands of speculators increased by 1,297, while the number of Short ones jumped by 7,157. Thus, the general mood of the major market players has become even more bearish. The ratio between the number of Long and Short contracts still corresponds to the real market situation. The number of longs traders exceeds the number of short ones by 2.5 times (95,725 - 36,811). Big market players continue to get rid of the pound sterling. This is why it is likely to continue its downward movement. COT reports indicate such a scenario. However, there are other bearish factors that push the pound sterling down.

Macroeconomic calendar for the US and UK:

US – Durable Goods Orders (12:30 UTC).

US – Consumer Confidence Index (14:00 UTC).

The macroeconomic calendar for the UK is empty on Tuesday. The US is scheduled to release two reports today but they are of little importance to traders. Therefore, the market sentiment is likely to remain unchanged amid the absence of news.

Outlook for GBP/USD and trading recommendations:

It is recommended to open short positions on the pound sterling at the level of 1.2570 if the price sinks below 1.2674 on the 4H chart. It is better to open long positions if the price rebounds from 1.2674 with upward targets of 1.2718 and 1.2810.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română