The euro may reach parity against the dollar. EUR/USD is falling not only due to the weak euro, but also the strengthening dollar ahead of the Fed meeting next week.

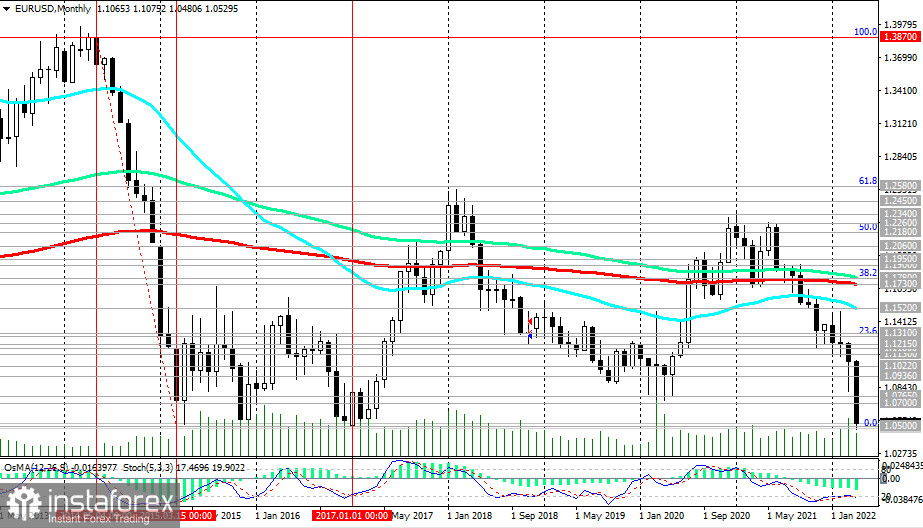

From the point of view of technical analysis, a strong negative momentum prevails. In particular, the Stochastic on the monthly chart of the pair has been in the oversold zone since October 2021, not wanting to leave there, which indicates a strong trend.

The lower limit of the descending channel is also broken, at the level of 1.0700. However, we note that the price dropped to a strong support level of 1.0500, near which there were bounces three times (in February and November 2015, as well as in January 2017) and the price turned up.

Meanwhile, now the situation is developing somewhat differently, and in the context of the growing divergence in the direction of the monetary policies of the Fed and the ECB, a breakdown of this level and a further decrease in EUR/USD, according to many economists, to the parity of the euro with the dollar, is possible.

Below the key resistance levels 1.1310, 1.1520, and 1.1730 EUR/USD is in the zone of a long-term bear market. In the current situation, only short positions should be considered.

For a more accurate entry, you can wait for at least some upward pullback or place Sell-Stop orders for the breakdown of today's low of 1.0480.

In an alternative scenario, there will still be a rebound from the level of 1.0500, and EUR/USD will resume growth. In our opinion, purchases should not be considered until the price breaks the first significant resistance level of 1.0700 (200 EMA on the 1-hour chart), also returning inside the downward channel on the weekly EUR/USD chart.

A more aggressive entry into long positions implies purchases after the growth of EUR/USD into the zone above the local resistance level of 1.0575. However, once again, the best choice in the current situation would be to look for a short entry point. One of them, in our opinion, is the local support level of 1.0480 (today's minimum).

Support levels: 1.0500, 1.0480, 1.0400, 1.0350, 1.0300

Resistance levels: 1.0575 1.0700 1.0715 1.0765 1.0900 1.0936 1.1022 1.1130 1.1180 1.1215 1.1285 1.1310 1.1500 1.15 20 1.1730

Trading Tips

Sell Stop 1.0475. Stop-Loss 1.0565. Take-Profit 1.0450, 1.0400, 1.0350, 1.0300, 1.0200

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română