In the current economic situation, there is a shift in investment priorities, and high-risk assets are losing large amounts of liquidity. Bitcoin and cryptocurrencies are also included in this group of financial instruments due to the increased correlation with stock indices and high volatility. However, we are witnessing a rather interesting situation, where Bitcoin is confidently consolidating in a certain range without much pretension to a sharp or massive decline.

Large and long-term investors have become the main supplier of stability and security in Bitcoin. Over the past four months, cryptocurrencies have been in limbo, as correlations with the stock markets did not allow capitalization to grow, but at the same time, the activity of traders decreased by almost 30%. However, over time, a trend has formed for the massive accumulation of BTC in the spot market. According to CrypoQuant, the supply of Bitcoin coins on cryptocurrency exchanges has reached its lowest level since 2018. This is a positive signal, indicating the rationality of investing in cryptocurrencies in the long term. However, how do the activation of hodlers and the passivity of traders affect the price of the asset now?

Spoiler: they reflect very badly. As of May 2, BTC/USD daily trading volumes are $29 billion, which is a local minimum and indicates the passivity of large traders. The market is at the stage when retail traders provide the main trading volumes to the market. Obviously, this is not enough to hold key support areas and a systematic upward movement. Over the past two years, institutional investors have been the main force behind the upward trend in cryptocurrencies. Due to macroeconomic factors and related Fed policies, large investors do not see the prerequisites for quickly profiting from Bitcoin operations, and therefore are looking for alternatives.

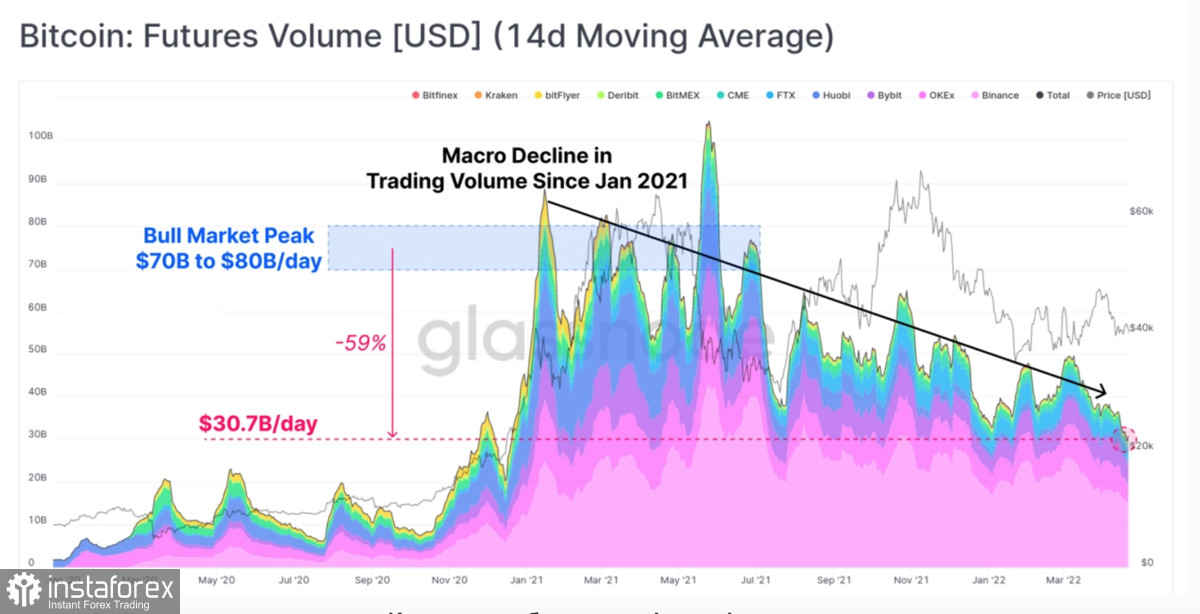

The widespread policy of accumulating BTC coins is also negatively affecting the futures market. Over the past six months, futures trading volumes have fallen from $80 billion to $31 billion per day. This is another indirect fact confirming the negative short-term effect of passive accumulation. It is also important to note that the long-term storage of Bitcoin affects the decrease in volatility in the market, which is a negative fact in the current situation. It was the high level of volatility that was the main fuel of the cryptocurrency, which provided the advantage of BTC over gold as a means of hedging risks, and also gave more profitability than any trading index.

All these factors indicate that massive accumulation in the short term leads to a decrease in trading activity by at least 50%. However, in the current geopolitical environment, investors have no other choice. The growing risks of investing in cryptocurrencies due to the growing key rate are not offset by proper protection of investor rights. Biden's order has already entered into force, but the legal framework will be developed before the end of 2022. Over the same period, the Fed plans to raise the rate to 3%, which will negatively affect the stock market and, apparently, cryptocurrency.

In the near future, Bitcoin will continue to fluctuate within the $37.4k–$40k zone. The gradual tightening of the price and the formation of a "bullish wedge" pattern should not mislead investors. Even with the full potential of this pattern, prices will remain within the $32k–$45k zone. The asset managed to defend the $37.4k mark, but the green candle turned out to be weak and failed to form an engulfing pattern. This suggests that a decrease in trading activity leads to a depreciation of growth/fall patterns due to the lack of the necessary trading volumes for their full implementation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română