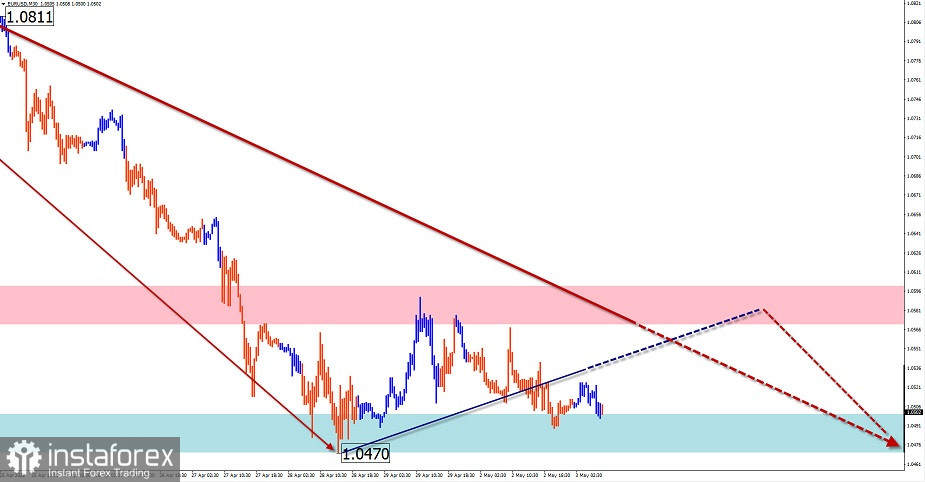

EUR/USD

Analysis:

The European currency is still trading within the downtrend. In the course of a decline, the quotes reached the boundaries of a potential reversal zone on a higher time frame. The structure of the wave looks complete, but there are no signals of an imminent trend reversal on the chart.Forecast:

Today, the pair is expected to trade in the sideways channel between the opposite zones. The pressure on the support zone in the first half of the day may end with a pullback to the resistance area.

Potential reversal zones

Resistance:- 1.0570/1.0600

Support:- 1.0500/1.0470

Recommendations:

It is not recommended to trade in the euro market today as it is risky and may lead to losses. It is better to enter the market only after the price finishes its upside movement. You should track signals of a reversal to sell the pair from the resistance zone.

USD/JPY

Analysis:

USD/JPY has been moving in accordance with the ascending wave since the beginning of last year. The momentum of the last two months has brought quotes to the area of strong monthly resistance. The price has closely approached its upper boundary. On the H1 chart, a descending section of the trend, which has the reversal potential, has been developing since April 28.

Forecast:

In the next 24 hours, the price is likely to move in the price channel formed by the opposite zones. By the end of the day, the quote may rise to the upper line. Then, a reversal is possible, followed by a decline to the support area.

Potential reversal zones

Resistance:- 130.90/131.20

Support:- 129.70/129.40

Recommendations:

Today, trading USD/JPY may be profitable only within individual sessions with a fractional lot. Selling will become possible only after your trading system confirms a reversal signal near the resistance area.

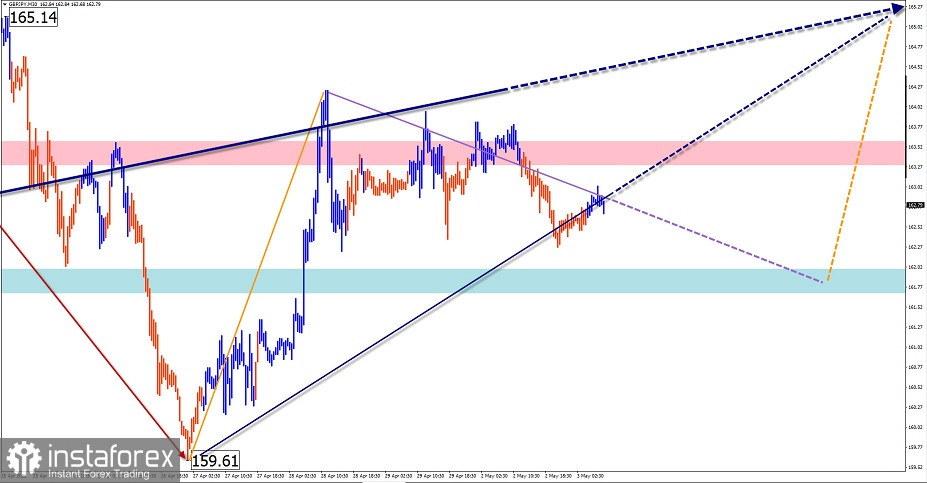

GBP/JPY

Analysis:

On GBP/JPY, the ascending wave from March 7 is relevant today. On April 27, the correction in the form of a sideways channel was finished. After that, the final part (C) of the wave began to form. A corrective pullback has been developing within this wave since April 28.

Forecast:

In the next 24 hours, we can expect the price to move sideways. In the first half of the day, a downward movement is more likely given that the market is flat. In the evening, the pair is more likely to resume the uptrend.

Potential reversal zones

Resistance:- 163.30/163.60

Support:- 162.00/161.70

Recommendations:

Low trading activity in the market in the absence of a trend can cause losses. It is recommended to wait until the pair completes the current decline while tracking buy signals in the area of support.

GOLD

Analysis:

On the gold chart, the price is moving in accordance with the descending wave initiated on March 8. The final part (C) of the wave is being formed. Quotes have reached the upper limit of a strong support zone on a higher time frame.

Forecast:

In the coming sessions, gold is likely to continue its downtrend. The decline may end near the support zone, giving way to a sideways movement.

Potential reversal zones

Resistance:

- 1865.0/1870.0

Support:

- 1825.0/1820.0

Recommendations:

Today, it is possible to open short positions on gold for the short term with a reduced lot from the resistance zone. The downside potential is limited by the support zone.

Explanation: In simplified wave analysis (SWA), waves consist of 3 parts (A-B-C). We analyze the last unfinished wave. The solid arrow background shows the structure that has been formed. The dashed lines show the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română