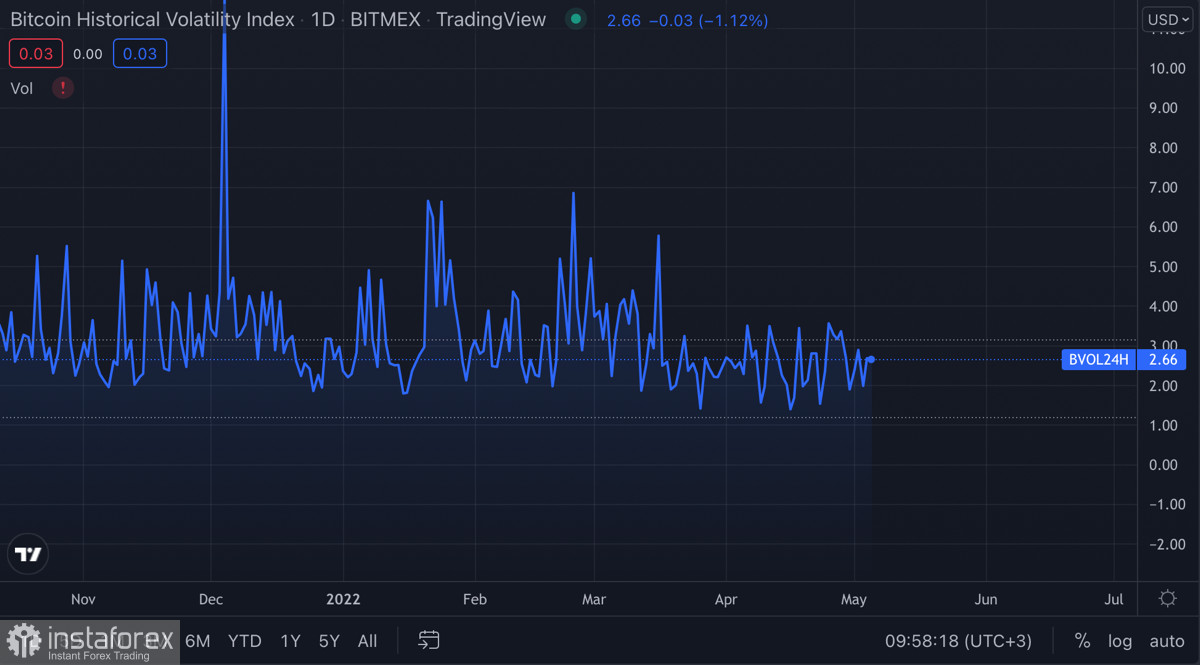

Over the past two weeks, the cryptocurrency market has been intensively preparing for the possible consequences of the "quantitative tightening" program. Bitcoin, following the stock markets, began to decline and reached a local bottom at $37.4k. An atmosphere of dead silence reigned before the meeting: trading volumes fell under $30 billion per day, and volatility continued to fall. All this happened against the backdrop of disturbing news, according to which the Federal Reserve simply has no other options than tight monetary policy.

However, even in a hopeless situation, the Fed managed to maintain the optimism of investors who were set for the worst. The key rate was raised by 50 basis points, there were no pleasant surprises. However, an important part of the investment policy is the analysis of the subsequent speech of Fed Chairman Jerome Powell in order to outline a further picture of what is happening. And it was thanks to the Fed's liberal plans that high-risk assets perked up and resumed growth.

Powell issued several key theses, which turned out to be more optimistic than all the investors' forecasts, which were already included in the price of assets. First of all, Powell assured that the regulator is not considering the option of raising the key rate by 75 basis points at once. This is an extremely important moment for high-risk assets, since such a sharp increase in the rate would start a process that would multiply the outflow of investments from the stock and cryptocurrency markets. Powell also noted that the issue of raising the key rate by 50 basis points at the next two meetings is being considered. Subsequently, the regulator will focus on an indicator of 25 points.

There is a light at the end of the tunnel in this part of the statement, since the Fed's policy did not initially take into account the war in Ukraine. Because of this, everyone expected a tougher and more rapid tightening of monetary policy. This did not happen, and apparently, the regulator began to gain control over the rate of inflation. This is positive news for the stock market, which later pulled the crypto market along with it. Well, the third important news from Powell was the postponement of the launch of the quantitative tightening program to June 2022. This is the key thesis, which suggests that in May we should expect a revival of high-risk markets and an increase in trading volumes.

Thanks to the preservation of current volumes of liquidity, Bitcoin has risen in price by 3.5% in a day, but more importantly, daily trading volumes have reached $37 billion. On the daily timeframe, a powerful bullish engulfing pattern was formed, and the size of the candle turned out to be the most impressive since March 27. The key support zone at the current stage remains at the level of $40k, and judging by the movement of technical indicators, there is no reason to believe that it will be broken. The RSI turned sideways despite local bullish crossovers in MACD and the stochastic oscillator. This indicates a strong selling position around $40k.

Another conclusion emerges from the current situation. Disappointing this time. The upward movement of Bitcoin was largely provoked by an increased correlation with stock indices. However, it was SPX and NDX that became the main beneficiaries of the Fed's liberal policies. The upward momentum of Bitcoin was weaker than that of the above indices. On the one hand, this indicates an investment interest in cryptocurrency, but on the other hand, it indicates its secondary nature. Every month there is more and more reason to believe that any decisions regarding BTC are made based on an analysis of the situation on the stock market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română