EUR/USD

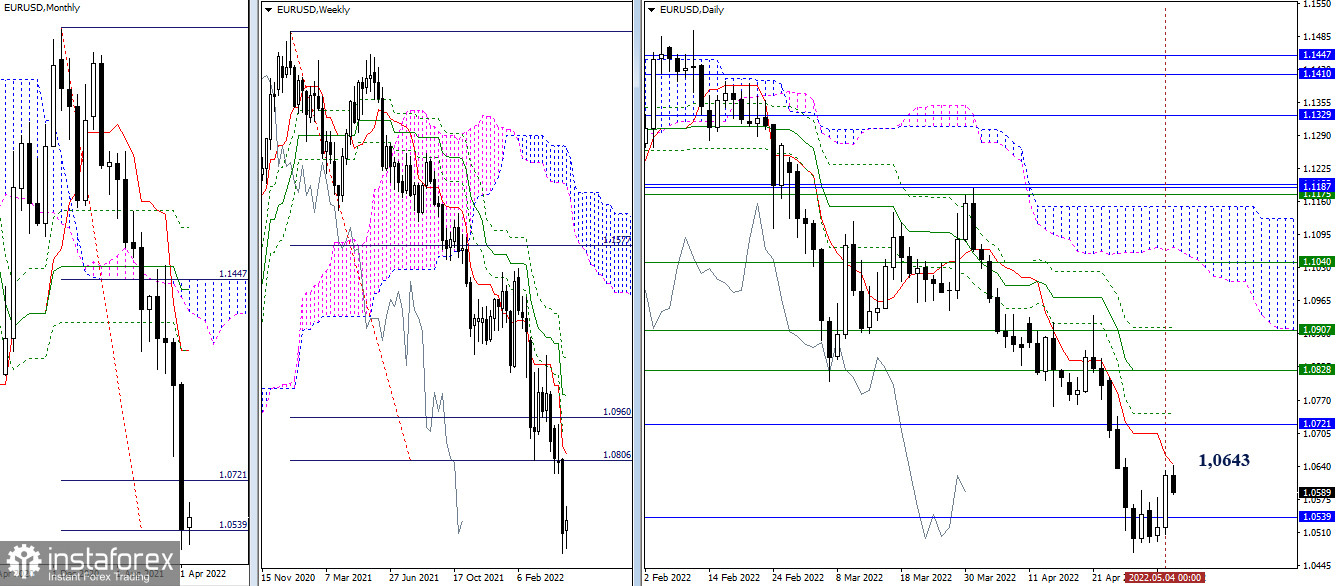

Higher timeframes

Bulls managed to take the initiative and advantage during yesterday's trading. They made an attempt to mark the end of the current decline and executed a corrective rise to the daily short-term trend, which today is at the turn of 1.0643. Consolidation above will lead to an increase in the corrective movement and the emergence of new prospects.

The reference points for the continuation of the upward move can now be noted at the area of 1.0721–44 (monthly level + daily Fibo Kijun). In case of the formation of a rebound from the encountered resistance, as well as a return to the zone of attraction and the influence of the level of 100% of the monthly target (1.0539), the main attention will again return to the restoration of the downward trend (1.0471).

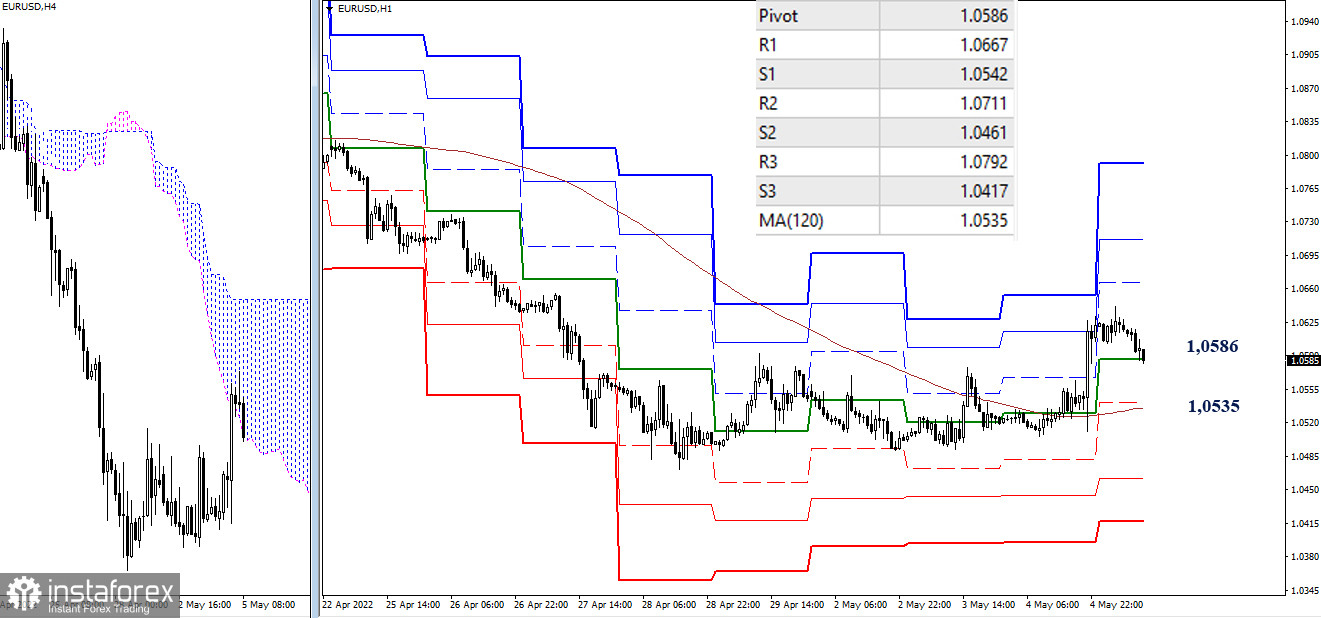

H4 - H1

In order to gain the edge needed to develop a daily corrective upward trend, bulls broke through key levels of the lower timeframes, turning them into support. As a result, the bulls are now using these supports (1.0586 central pivot point + 1.0535 weekly long-term trend) to maintain their interests. The reference points for the continuation of the upward movement within the day are the resistance of the classic pivot points (1.0667 – 1.0711 – 1.0792). The loss of key levels (1.0586 – 1.0535) and the recovery of the downward trend (1.0471) will direct interest towards the support of the classic pivot points (1.0461 – 1.0417).

***

GBP/USD

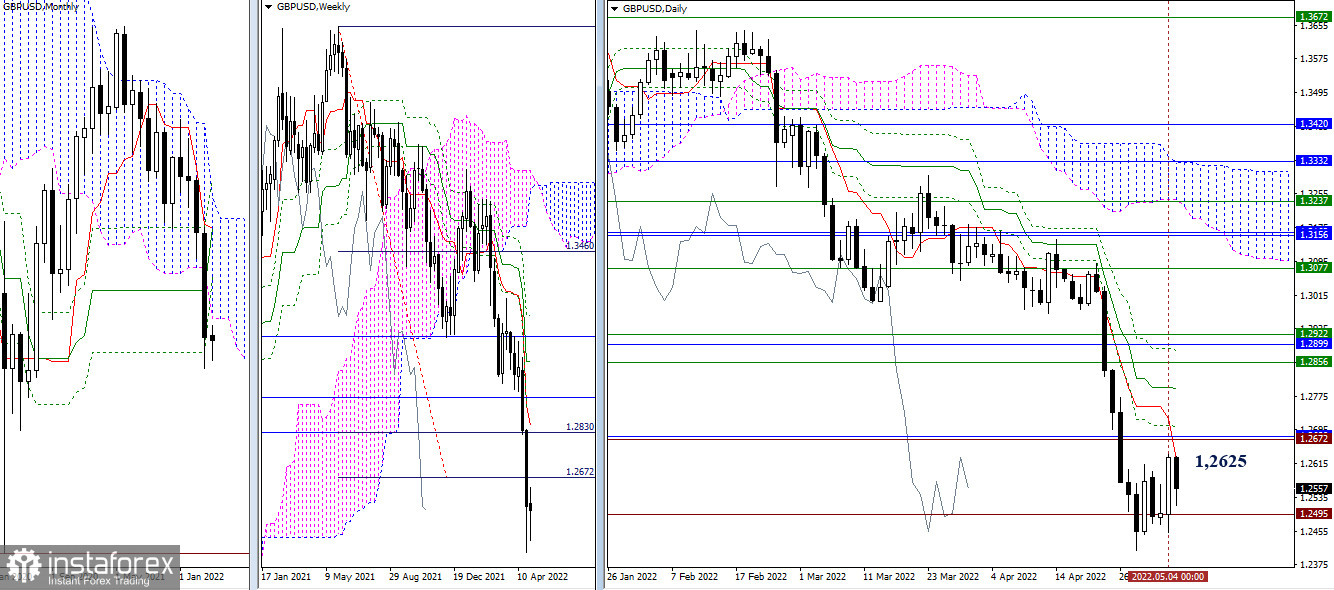

Higher timeframes

The pair remains in the consolidation zone, which has some corrective rise. Today, the daily short-term trend (1.2625) is being tested. Next are resistances 1.2672 – 1.2702 (the lower boundary of the monthly cloud + daily Fibo Kijun). Consolidation above will open new prospects for bulls. The bearish option will return to the trading agenda only after the recovery of the downward trend (1.2410).

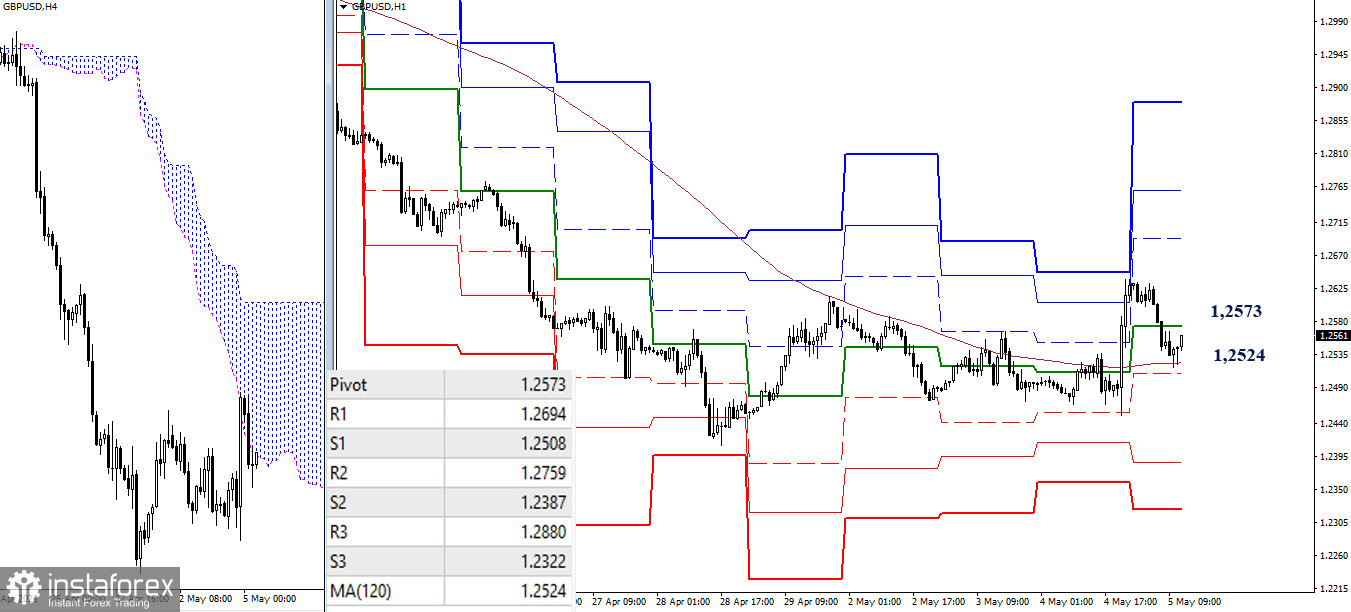

H4 - H1

Bulls have made an attempt to change the situation, but so far they remain in the zone of attraction and influence of key levels (1.2573 central pivot point of the day + 1.2524 weekly long-term trend). The reference points for the development of movements within the day are the classic pivot points – for bulls, this is resistance 1.2694 – 1.2759 – 1.2880, for bears, this is support 1.2508 – 1.2387 – 1.2322.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română