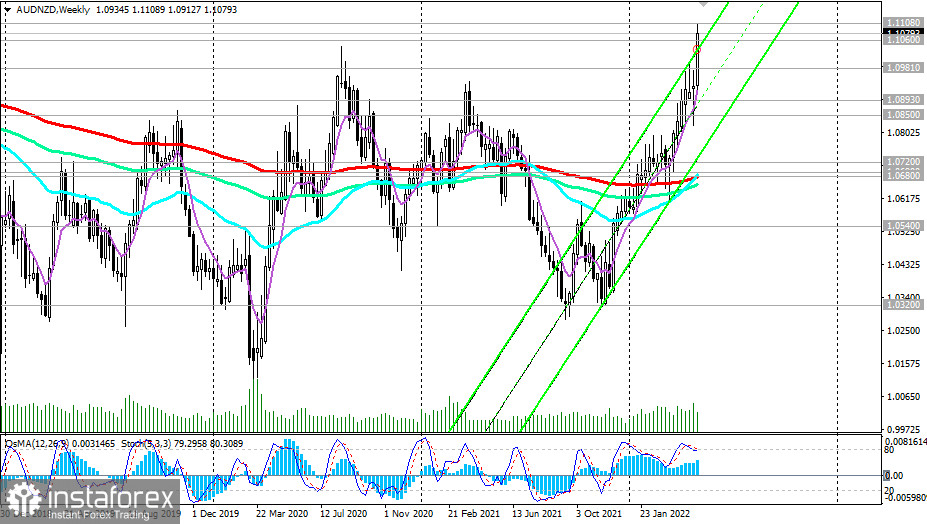

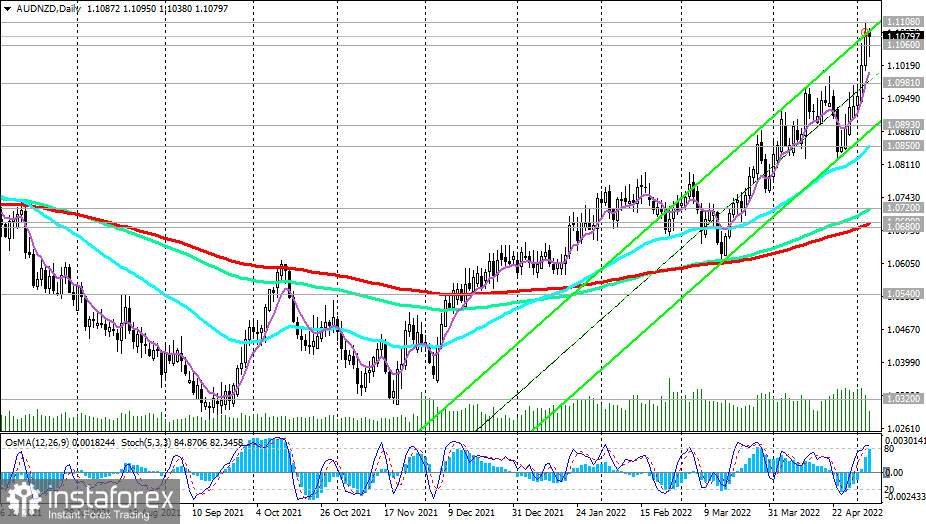

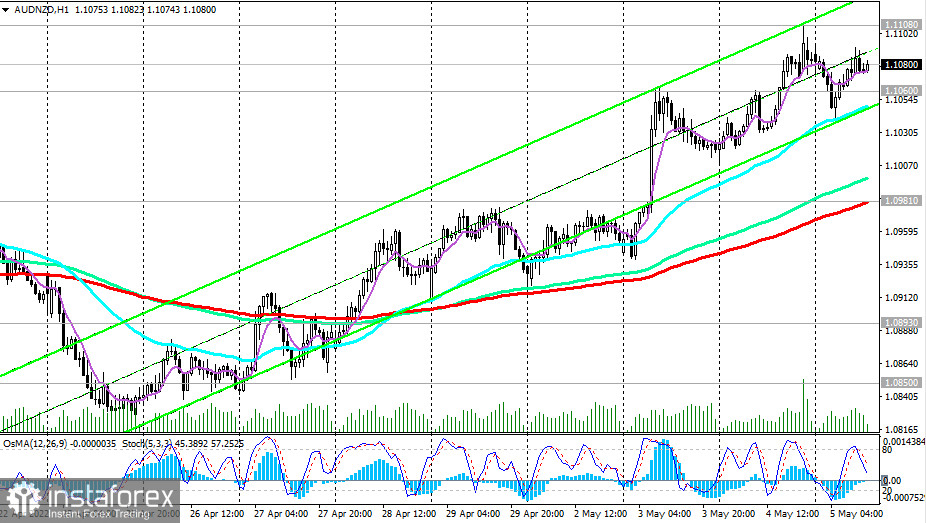

AUD/NZD has been trading in an upward trend since December 2021. After rising from 1.0430, the pair broke through an important resistance level near 1.0540 in mid-December and continued to grow strongly, reaching a local 3.5-year high of 1.1108 this week.

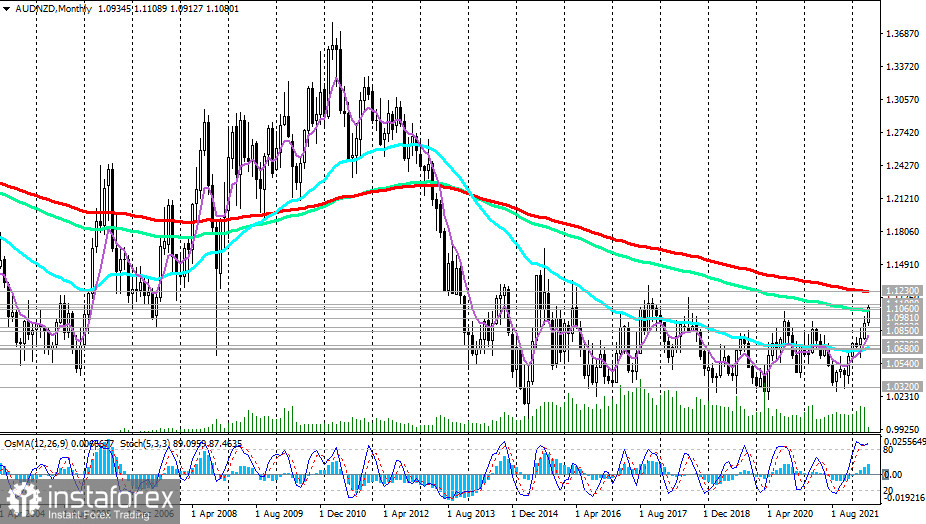

Since December, AUD/NZD has already grown by 6.1% and its positive dynamics continues. Having broken the upper limit of the ascending channel on the weekly chart this week (at 1.1030), AUD/NZD is now testing the important resistance level 1.1060 (144 EMA on the monthly chart) for a breakdown. Consolidation in the area above the resistance level of 1.1230 (200 EMA on the monthly chart) will create prerequisites for this pair to enter the global bull market zone.

In our previous review of this pair, we have noted that long positions are considered preferable, and the growth targets are the resistance levels of 1.0950 and 1.1040. As you can see, our forecast was completely justified. In case of breakdown of the local resistance level passing through 1.1108, we are waiting for testing of the resistance level near 1.1200, 1.1230.

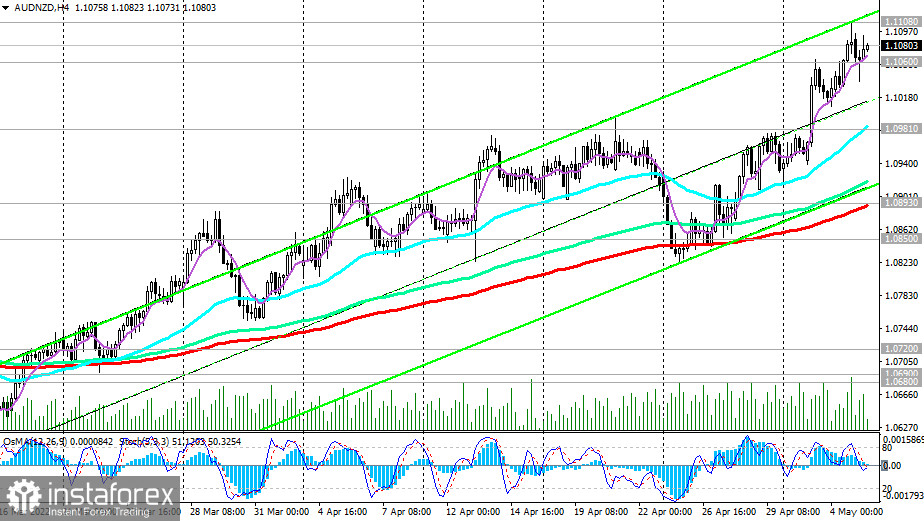

Alternatively, there will be a reversal from the current levels, and the first signal to open short positions will be a breakdown of the support levels of 1.1060 and 1.1050 (200 EMA on a 15-minute chart). A breakdown of the support level 1.0981 (200 EMA on the 1-hour chart) will be a confirming signal. In this case, the targets of the downward correction will be the support levels of 1.0893 (200 EMA on the 4-hour chart and the lower line of the ascending channel on the daily chart),1.0850 (50 EMA on daily chart).

Support levels: 1.1060, 1.1050, 1.1000, 1.0981, 1.0893, 1.0850, 1.0720, 1.0690, 1.0680, 1.0540

Resistance levels: 1.1108, 1.1200, 1.1230

Trading tips

Sell Stop 1.1030. Stop-Loss 1.1095. Take-Profit 1.1000, 1.0981, 1.0893, 1.0850, 1.0720, 1.0690, 1.0680, 1.0540

Buy Stop 1.1095. Stop-Loss 1.1030. Take-Profit 1.1108, 1.1200, 1.1230

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română