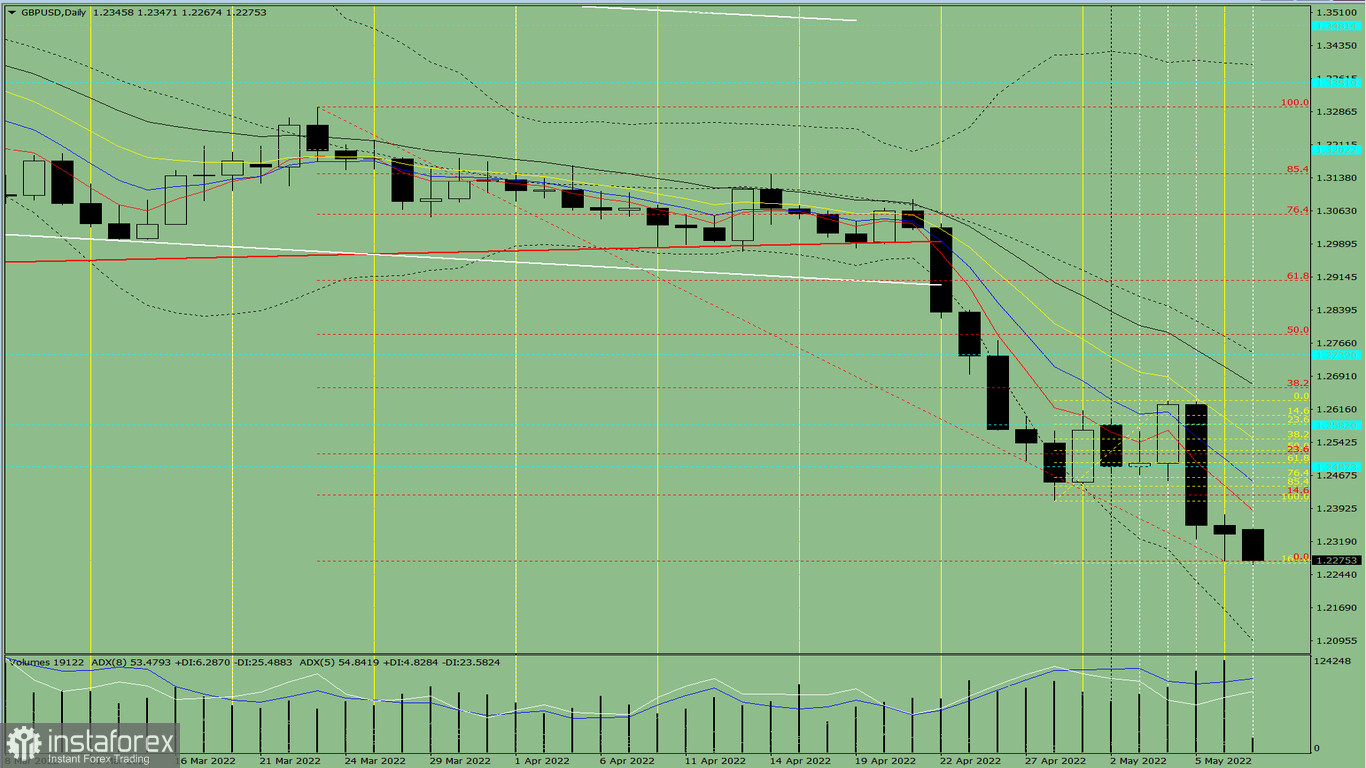

On Monday, from the closing price on Friday at 1.2336, GBP/USD could extend its down move with the target at 1.2097, the lower border of the Bollinger bands plotted by the black dotted line. After this target is hit, the price will aim for another target at 1.2465 that is the 14.6% retracement level plotted by the red line. After this level is tested, the price could aim for 1.2552, the 23.6% Fibonacci level plotted by the red dotted line.

Picture 1: trend analysis

Complex analysis

Indicator analysis – downFibonacci levels – downTrade volume – downCandlestick analysis – downTrend-following analysis – downBollinger bands – downWeekly chart – down

Conclusion

On Monday, from the closing price on Friday at 1.2336, GBP/USD could extend its down move with the target at 1.2097, the lower border of the Bollinger bands plotted by the black dotted line. After this target is hit, the price will aim for another target at 1.2465 that is the 14.6% retracement level plotted by the red line. After this level is tested, the price could aim for 1.2552, the 23.6% Fibonacci level plotted by the red dotted line.

Alternative scenario. From the closing price of the Friday's candlestick at 1.2336, the currency pair could extend its down move with the target at 1.2275, the lower fractal plotted by the red dotted line. From that level, GBP/USD could move upwards with the target at 1.2465 that matches the 14.6% retracement level plotted by the red plotted line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română