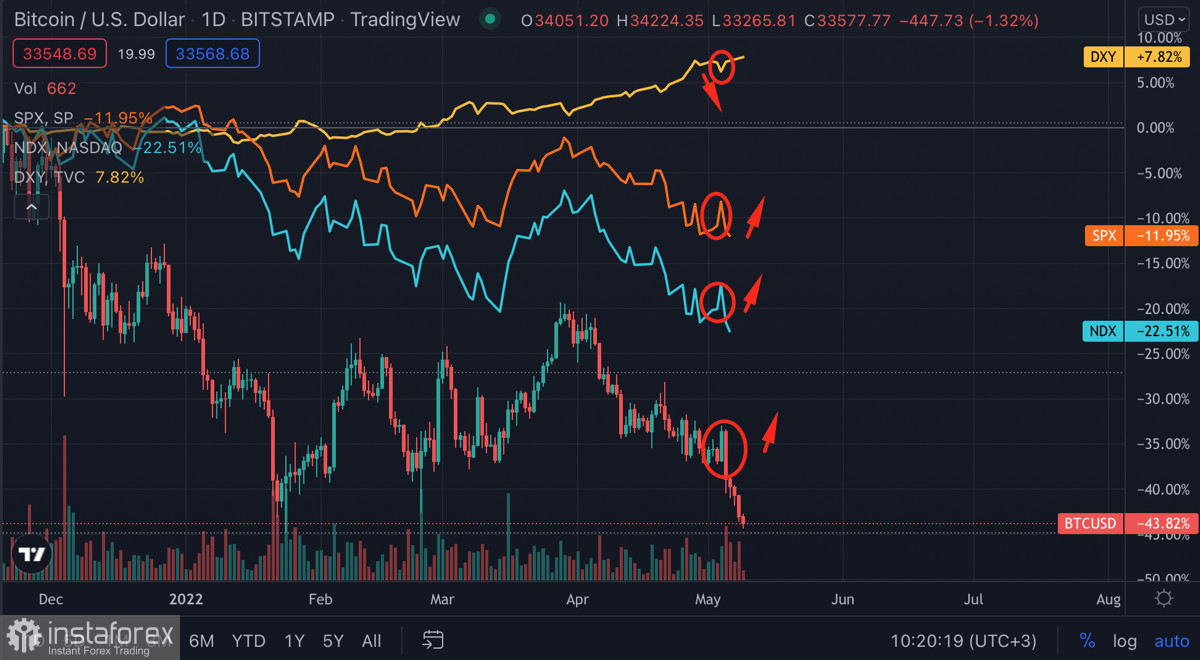

May turned out to be a nightmare for the cryptocurrency market. Liquidity is pouring out of the digital asset market and coins are trying to stabilize in local support areas. However, while Bitcoin continues to decline, we can expect the rest of the market to fall as well. At the same time, an index emerged in the market, which may become a trendsetter soon. This is the US dollar and the DXY.

For the first time, the influence of DXY on the movement of assets in other markets has been seen right before the Fed meeting. It was due to the fact that because of the US dollar index high-risk financial instruments showed a sharp increase. After the Fed announced it would curb inflation, investors began to pay much more attention to the US dollar index. The index has been moving toward the resistance area at 102-103. In tandem with the DXY's rise, high-risk assets attempted to stabilize at safe-haven levels.

However, we have witnessed unprecedented circumstances. Cryptocurrency and stock market investors refrained from any actions and waited for the results of the Fed meeting, which proved disappointing for high-risk assets. Instead of stumbling into key support areas, the markets showed unexpected gains. That sharp upward momentum coincided with a local correction in the US dollar index, which settled in the area of 102-103.

As a result, we see that Bitcoin and other high-risk assets have not been correlating with the DXY. This points to several fundamental things. The first and foremost is the US dollar index becoming the main financial instrument, which should always be taken into account when trading in any market. In the current environment, the DXY is fundamentally important to the movement of any financial instrument. This is due to the policy of the Fed, which aims to strengthen the US dollar by stimulating the demand and value of Treasuries and mortgage-backed securities.

The second fundamental factor is that Bitcoin is not perceived as a hedge against inflation or a reserve asset. Bitcoin is a cryptocurrency and a high-risk asset. The asset may lose liquidity soon and it will take some time before the market rebalances. Meanwhile, BTC continues to be an important diversification tool, but at the current stage, the asset cannot count on much more.

As of May 9, Bitcoin is trading near a key support area. In the short term, we should expect it to reach a local bottom near $33,000-$35,000 and a gradual transition to the accumulation stage. If the asset breaks through $33,000, we can expect sell-offs and the formation of a new local bottom in the area of $30,000-$33,000. We can assume that the period of consolidation and accumulation will not last long because the QE program will start in June. The reduction of liquidity is expected to lead to an even bigger fall in price. Considering all the above, there is every reason to believe that the market is preparing to see Bitcoin's price below $30,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română